If you’re looking to generate passive income from your portfolio, Annaly Capital (NYSE: NLY) and its 13% dividend yield is probably one stock that has come across your screen.

The mortgage real estate investment trust (mREIT) allows investors to invest in the U.S. housing market and could be one way to invest in the higher mortgage rates in today’s environment. However, the stock is acutely sensitive to interest rates, which have weighed on the business over the past several years. If you’re thinking of scooping up Annaly Capital because of its high dividend yield, consider the following first.

How Annaly makes money

Annaly invests in mortgage-backed securities (MBS), pools of residential mortgage loans bundled and sold to investors. Government-sponsored entities, such as the Federal National Mortgage Association (Fannie Mae) and the Federal Home Loan Mortgage Corporation (Freddie Mac), guarantee the principal and interest payments on these mortgage investments, which can help mitigate risk to some degree.

However, the company competes in a commodity-like business, vying for the same MBS as competitors, which makes it hard to stand out. Also, since the mortgage yield isn’t relatively high enough, the mREIT uses leverage to boost the return on its portfolio.

Annaly uses repurchase agreements (repo) and other financial instruments to leverage and boost returns. The company aims to have an economic leverage ratio below 10:1, the ratio of its debt and derivative instruments divided by its total equity.

Using capital and borrowed funds to invest in MBS allows Annaly to earn the spread between the yield on its assets and the cost of its borrowings. Because it borrows on a short-term basis while investing in MBS long-term, it is sensitive to changes in the yield curve, which represents the relationship between interest rates and time to maturity for an asset.

Over the past few years, interest rates have risen across the yield curve. Last year, Annaly’s average yield on its interest-earning assets was 4.33%, reflecting its investments in the higher mortgage rate environment. However, the average cost of its liabilities was 3.01%, up from 0.79% two years earlier. As a result, its net interest spread of 1.32% decreased from 1.89% in 2021.

Another way Annaly feels the impact of higher interest rates is in the book value of its portfolio. The book value of debt-related securities is sensitive to changes in interest rates. When interest rates rise, the value of those securities declines. Over the last two years, Annaly’s book value per share plummeted 39%.

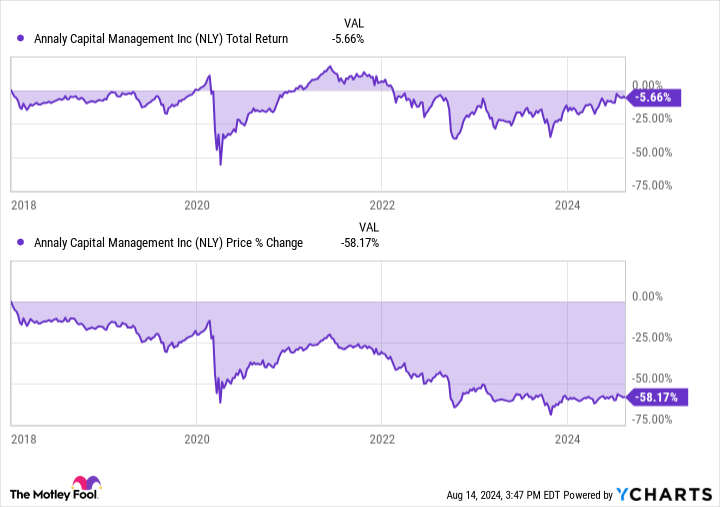

Lackluster returns for investors

Annaly’s sensitivity to interest rates makes it vulnerable to changes in the economic and market cycles. Over the past several years, the stock has failed to deliver for investors. Since 2018, Annaly’s total return (including the effect of reinvesting dividends) is -5.6%. So, despite the investors having “earned” a double-digit dividend yield, the stock has plummeted 58%, making the net return negative.

Longer-term structural factors could result in higher interest rates compared to the decade before the pandemic.

For example, JPMorgan Chase CEO Jamie Dimon cautioned that growing fiscal deficits, a restructuring of world trade, growing government obligations, and geopolitical uncertainty could make this decade more volatile than the previous one. For this reason, higher interest rates make Annaly less appealing to me as a long-term (five years or more) investment.

Is Annaly right for you?

That said, I think Annaly could do well if the Federal Reserve begins cutting interest rates. According to CME Group‘s FedWatch tool, market participants are pricing in as many as six 0.25% interest rate cuts over the next year.

Annaly, which has increased its portfolio yield, would benefit from falling interest rates, which could help reduce its shorter-term funding costs. Falling interest rates would also boost its book value after several years of declines.

While it could do well over the next year or so if interest rates start falling, structural factors could keep interest rates elevated for the next decade. Given Annaly’s sensitivity to interest rates, use of leverage, and lack of a robust competitive advantage, I would prefer to search for yield elsewhere.

Should you invest $1,000 in Annaly Capital Management right now?

Before you buy stock in Annaly Capital Management, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Annaly Capital Management wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $763,374!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of August 12, 2024

JPMorgan Chase is an advertising partner of The Ascent, a Motley Fool company. Courtney Carlsen has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends JPMorgan Chase. The Motley Fool has a disclosure policy.

Annaly Capital: Buy, Sell, or Hold? was originally published by The Motley Fool

EMEA Tribune is not involved in this news article, it is taken from our partners and or from the News Agencies. Copyright and Credit go to the News Agencies, email news@emeatribune.com Follow our WhatsApp verified Channel