Semiconductors are among the most essential technologies on the planet. They enable everything from thermostats to smartphones to autonomous vehicles. Now, artificial intelligence (AI) demands even higher performance. These high-performance products are so important that there is geopolitical tension between the U.S. and China related to import and export bans and Taiwan, where most of the world’s semiconductors are manufactured.

Because of the high demand and healthy tailwinds, many industry stocks, including Arm Holdings (NASDAQ: ARM), took off in 2024. The enthusiasm pushed Arm’s valuation to nosebleed levels, but the recent market sell-off has pulled Arm down nearly 40% from its recent highs, as shown below.

Arm is a different kind of semiconductor company, and this is a big advantage. Let’s examine what it does and whether the downturn is a golden opportunity.

Why is Arm’s business model so desirable?

Arm Holdings is a semiconductor company that doesn’t actually produce semiconductors. Instead, Arm designs the “infrastructure” for central processing unit (CPU) chips that its customers, like Apple, Samsung, Alphabet, Nvidia, and Taiwan Semiconductor Manufacturing (NYSE: TSM), use as a blueprint for building. Arm then receives payments for licensing and royalties based on the number of products sold. The cumulative number of Arm-enabled chips is 287 billion, and they capture 99% of the global smartphone market.

Because Arm is not a manufacturer, its financial results resemble those of a software company because of three traits:

Arm doesn’t need to invest a lot of capital in factories and equipment (known as capital expenditures) like other semiconductor companies do. Arm spends less than 5% of its revenue on capex, while Taiwan Semiconductor, for example, routinely spends more than 30%. Because of the tiny spend on capex, Arm translated 20% of revenue, or $709 million, into free cash flow over the past 12 months.

On the gross margin front, Arm compares favorably to software companies like Palantir Technologies (NYSE: PLTR) and is well ahead of other semiconductor stocks, as depicted below.

A high gross margin generally means a company can convert more incremental sales growth into net profits.

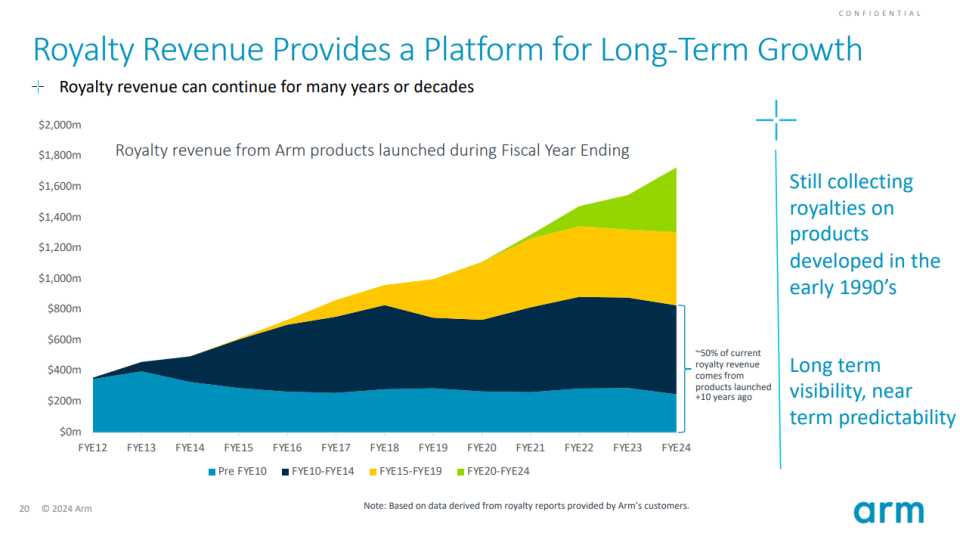

Finally, Arm’s revenue isn’t just recurring; it also takes advantage of legacy products. When Arm creates a new product for a new use case, its older designs still sell. As shown below, this allows the company to “stack” new sales on top of old.

Royalties from older products are outstanding for the bottom line since the research and development costs were paid for years ago. This business model is terrific for profitability.

Is Arm Holdings stock a buy now?

With its desirable business model and brisk tailwinds, it’s no wonder investors bid the stock up from its September 2023 IPO price of $51 to over $180 per share. However, valuation is still important. At its peak, Arm stock traded for more than 50 times sales. The recent sell-off reduced this to 34 and the share price to under $115; however, this is still pricy.

Many investors and analysts consider Palantir richly valued. As shown below, Arm’s price-to-sales (P/S) ratio is still 25% higher than Palantir’s after the recent correction.

Arm is a terrific company that will probably make investors hefty profits over the long haul, but shares could continue to fall in the short term due to the valuation. There are tools investors can use to manage short-term risk, like dollar-cost averaging, buying on dips, or simply waiting patiently for the valuation to fall. When it does, I’ll be ready to pounce.

Should you invest $1,000 in Arm Holdings right now?

Before you buy stock in Arm Holdings, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Arm Holdings wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $641,864!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of August 6, 2024

Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. Bradley Guichard has positions in Alphabet, Arm Holdings, and Nvidia. The Motley Fool has positions in and recommends Advanced Micro Devices, Alphabet, Apple, Nvidia, Palantir Technologies, and Taiwan Semiconductor Manufacturing. The Motley Fool has a disclosure policy.

Arm Holdings Plummets 40% Amid the Sell-Off, Is It a Strong Buy Now? was originally published by The Motley Fool

EMEA Tribune is not involved in this news article, it is taken from our partners and or from the News Agencies. Copyright and Credit go to the News Agencies, email news@emeatribune.com Follow our WhatsApp verified Channel