(Bloomberg) — Stocks in Asia were primed to fall after Wall Street notched up its worst session of the year on lackluster US economic data. The euro strengthened following an election in Germany.

Most Read from Bloomberg

Shares in Australia opened lower and equity index futures for Hong Kong fell, indicating a gauge of the region’s shares will decline from the four-month closing high struck Friday. Japanese markets are closed Monday for a holiday.

The drop in equity futures echoed the downbeat mood in New York trading on Friday. The S&P 500 fell 1.7% while the Nasdaq 100 dropped 2.1% as traders balanced signs of a cooling economy against the prospect the Federal Reserve is in no rush to trim interest rates.

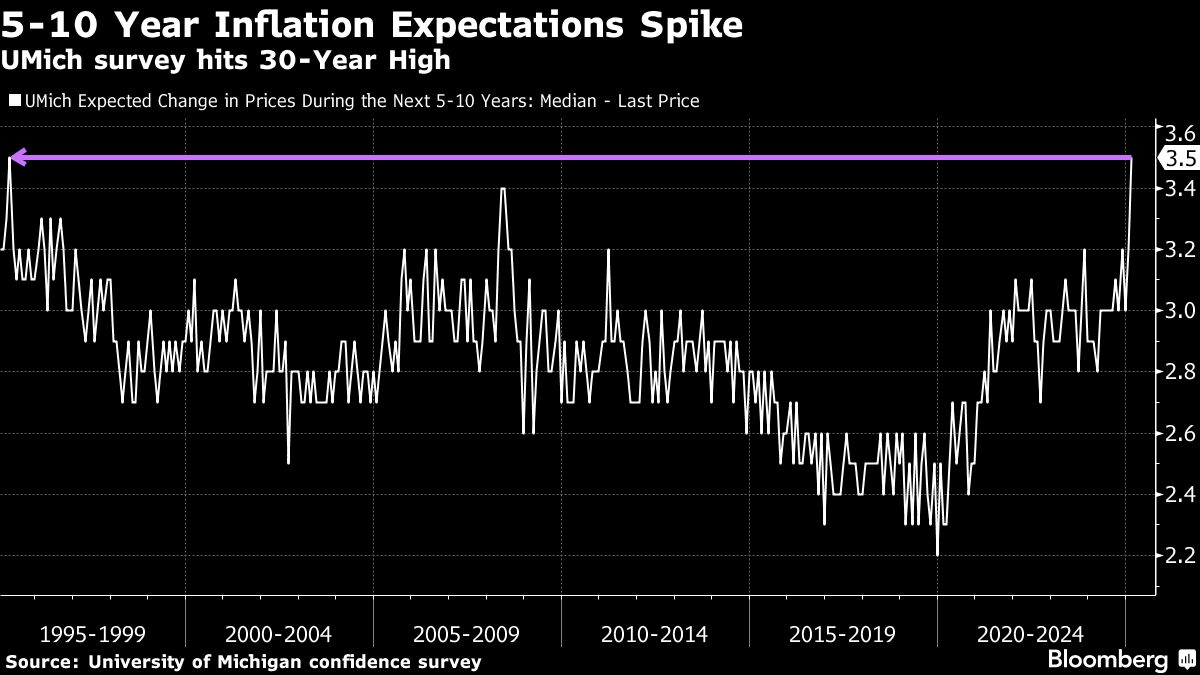

Data released Friday showed US consumers’ long-term inflation expectations rising to the highest level in almost three decades. Fed’s Chicago President Austan Goolsbee downplayed the report, telling News Nation on Sunday that the figure “wasn’t a great number, but it’s only one month of data. You need at least two or three months for that to count.”

Elsewhere US business activity expanded at the slowest pace since September 2023 while existing home sales fell for the first time since September.

Australian and New Zealand yields fell early Monday after a rally in US government debt on Friday. The US 10-year yield dropped 7 basis points on the day to 4.43%, a level not seen in more than two weeks. Treasuries trading in Asia is closed due to the holiday in Japan.

The dollar was mixed against major currencies in early Monday trading in Sydney. The euro rose 0.2% against the dollar after Germany’s conservative opposition leader Friedrich Merz said he’ll move quickly to form a new government following Sunday’s federal election victory.

In Asia, data set for release includes inflation for Singapore and retail sales for South Korea. China’s one-year medium-term lending facility may be released any time through February 25.

Tariff Tensions

Chinese Vice Premier He Lifeng expressed “serious concern” over President Donald Trump’s 10% tariff hike on Chinese goods in a call with Treasury Secretary Scott Bessent, China Central Television reported Friday. For his part, Bessent also signaled concerns on a host of issues with China, including “economic imbalances,” the US Treasury said.

The Trump administration told Mexican officials that they should put their own duties on Chinese imports as part of their efforts to avoid tariffs threatened by President Donald Trump, according to people familiar with the matter.

Separately, Trump is directing the Committee on Foreign Investment in the United States to restrict Chinese spending on technology, energy and other strategic US sectors, his administration’s latest salvo against the world’s second-largest economy.

In corporate news, Berkshire Hathaway Inc. is looking to increase ownership in Japan’s five largest trading houses “over time,” Warren Buffett said in an annual letter to shareholders. Saipem SpA and Subsea7 SA agreed in principle to create an oil services company with a combined backlog of €43 billion and expected revenue of about €20 billion. In Australia, WiseTech Global Ltd.’s entire board quit after a disagreement over the founder’s role in the company.

Key events this week:

-

Eurozone CPI, Monday

-

Israel rate decision, Monday

-

Singapore CPI, Monday

-

BOE Deputy Governors Clare Lombardelli and Dave Ramsden speak, Monday

-

Germany GDP, Tuesday

-

South Korea rate decision, Tuesday

-

Taiwan industrial production, Tuesday

-

US consumer confidence, Tuesday

-

ECB Governing Council member Joachim Nagel delivers Bundesbank’s annual report, Tuesday

-

Richmond Fed President Tom Barkin speaks, Tuesday

-

Taiwan GDP, Wednesday

-

Thailand rate decision, Wednesday

-

US new home sales, Wednesday

-

Nvidia earnings, Wednesday

-

G-20 finance ministers and central bank governors meet in Cape Town though Feb. 27, Wednesday

-

Atlanta Fed President Raphael Bostic speaks, Wednesday

-

Brazil unemployment, Thursday

-

Eurozone consumer confidence, Thursday

-

Mexico unemployment, trade balance, Thursday

-

Spain CPI, Thursday

-

US GDP, durable goods, initial jobless claims, Thursday

-

ECB publishes account of Jan. 29-30 policy meeting, Thursday

-

Canada GDP, Friday

-

Chile industrial production, unemployment, Friday

-

France CPI, GDP, Friday

-

Germany CPI, unemployment, Friday

-

India GDP, Friday

-

Japan Tokyo CPI, industrial production, retail sales, Friday

-

Sri Lanka CPI, trade, Friday

-

US PCE inflation, income and spending, Friday

-

Chicago Fed President Austan Goolsbee speaks, Friday

Some of the main moves in markets:

Stocks

-

S&P 500 futures rose 0.3% as of 8:13 a.m. Tokyo time

-

Hang Seng futures fell 0.3%

-

Australia’s S&P/ASX 200 fell 0.8%

Currencies

-

The Bloomberg Dollar Spot Index rose 0.3%

-

The euro rose 0.2% to $1.0483

-

The Japanese yen was little changed at 149.24 per dollar

-

The offshore yuan was little changed at 7.2534 per dollar

Cryptocurrencies

-

Bitcoin rose 0.3% to $96,067.28

-

Ether rose 0.5% to $2,821.97

Bonds

Commodities

-

West Texas Intermediate crude was little changed

-

Spot gold rose 0.1% to $2,940.41 an ounce

This story was produced with the assistance of Bloomberg Automation.

Most Read from Bloomberg Businessweek

©2025 Bloomberg L.P.

EMEA Tribune is not involved in this news article, it is taken from our partners and or from the News Agencies. Copyright and Credit go to the News Agencies, email news@emeatribune.com Follow our WhatsApp verified Channel