(Bloomberg) — Stocks in Asia rose after economic data supported the case for Federal Reserve interest-rate cuts, and the yen bounced off its lowest level against the dollar since 1986.

Most Read from Bloomberg

The MSCI Asia-Pacific gauge hit its highest point in over two years, with technology shares contributing the most to the rally. Japan’s Topix hit a record intraday high and equities in South Korea, Taiwan, and Australia also advanced. US futures contracts were little changed after the S&P 500 and Nasdaq 100 scaled records in a shortened session ahead of a US holiday.

The yen strengthened after once again touching its lowest level since 1986 against the greenback in the previous session. Speculation persists that the Bank of Japan will tighten policy only gradually. A gauge of dollar weakened for the third successive session.

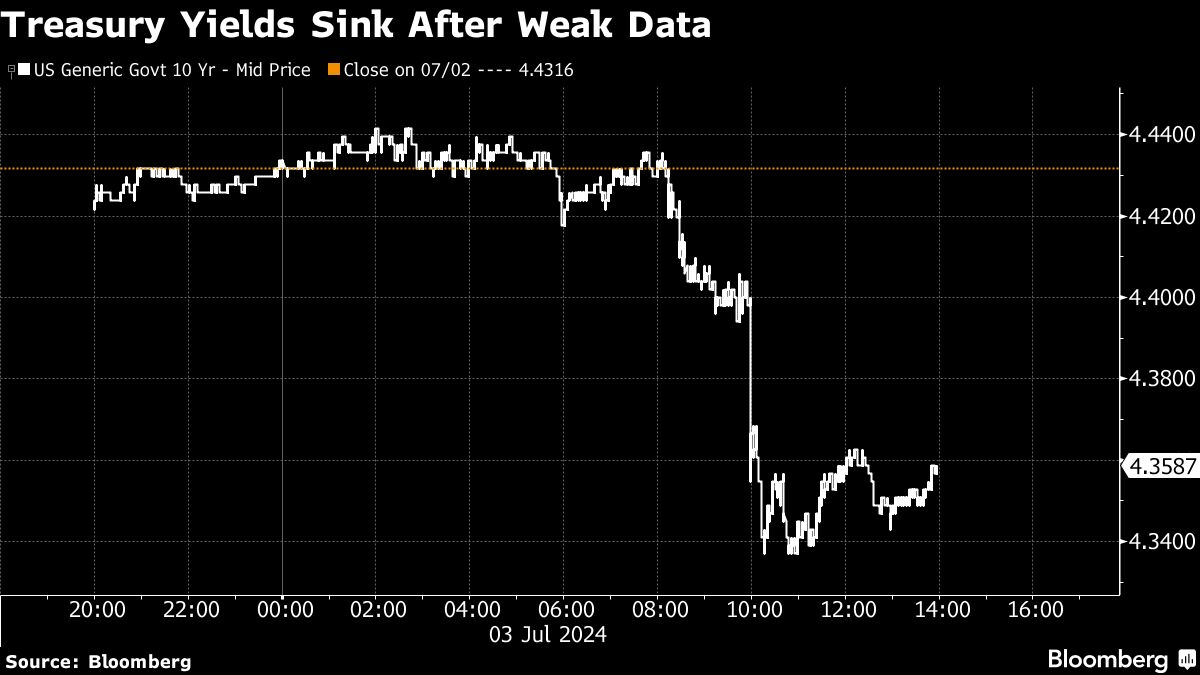

Global stocks are on course for their longest stretch of weekly gains since March on the back of a string of soft economic data in the US, which has brought the idea of September rate cuts back on table. On Wednesday, reports showed the American services sector contracted at the fastest pace in four years, while the labor market saw further signs of softening.

“Weaker Treasury yields and a dip in the US dollar on dovish rate bets may be supportive of risk sentiments across the region,” said Jun Rong Yeap, market strategist at IG Asia Pte. The “slowing US growth prospects” are making a September rate cut “more likely than not,” he said.

Minutes from the Fed’s June policy meeting showed officials were awaiting evidence that inflation is cooling and were divided on how long to keep rates elevated. Swap traders projected almost two rate cuts in 2024, with the first in November — though bets on a September reduction increased.

“Bad news is good news,” said Fawad Razaqzada at City Index and Forex.com. “That’s how risk assets reacted in the aftermath” of Wednesday’s US data.

Treasury 10-year yields were steady after dropping seven basis points to 4.36% in the prior session, which weighed on an index of dollar strength. Most Asian currencies gained against the greenback led by Thailand’s Baht and Taiwanese dollar.

Elsewhere in Asia, Chinese electric-car brands held on to their share of the slumping European EV market in May. Automakers like BYD Co. made up 8.7% of total EV sales, roughly on par with a year ago, as Chinese firms pressure European counterparts with new, inexpensive models.

Meanwhile, Britons prepared to head to the polls in a general election Thursday. The pound was little changed in early Asian trading. Separately, traders are watching for indications if President Joe Biden will drop out of the US presidential race. Wall Street has started shifting money to and from the dollar, Treasuries and other assets that would be impacted if his rival Donald Trump returns to office.

“The UK and French elections will be more of a temporary concern for the markets,” Adrian Zuercher, chief investment officer at UBS AG Private Banking told Bloomberg Radio. But “Trump is a different story, particularly, the trade war situation, we will have to see how aggressive he will be on tariffs and that might resonate a little bit longer” with the markets, he said.

Investors will now keep an close eye on Friday’s US jobs report. Economists anticipate a 190,000 gain in June non-farm payrolls — less than the previous month — with the unemployment rate holding at 4%.

“Given other evidence of a cooling economic backdrop, the payroll report could be increasingly decisive for the Fed as it seeks a rationale to signal an easing of rates,” said Quincy Krosby at LPL Financial.

Chicago Fed President Austan Goolsbee said there’s still a lot of data the US central bank needs to see before gaining the confidence to cut interest rates.

In commodities, gold gained for a second day after breaking out of a days-long tight trading range. Iron futures climbed to the highest level in nearly a month on optimism for improvement in demand from China.

Key events this week:

-

UK general election, Thursday

-

US Independence Day holiday, Thursday

-

Eurozone retail sales, Friday

-

US jobs report, Friday

-

Fed’s John Williams speaks, Friday

Some of the main moves in markets:

Stocks

-

S&P 500 futures were little changed as of 1:03 p.m. Tokyo time

-

Nasdaq 100 futures were little changed

-

Japan’s Topix rose 0.7%

-

Australia’s S&P/ASX 200 rose 1.1%

-

Hong Kong’s Hang Seng was little changed

-

The Shanghai Composite fell 0.4%

-

Euro Stoxx 50 futures were little changed

Currencies

-

The Bloomberg Dollar Spot Index was little changed

-

The euro was unchanged at $1.0786

-

The Japanese yen rose 0.1% to 161.52 per dollar

-

The offshore yuan was little changed at 7.2994 per dollar

Cryptocurrencies

-

Bitcoin fell 0.8% to $59,047.63

-

Ether fell 0.5% to $3,239.31

Bonds

Commodities

This story was produced with the assistance of Bloomberg Automation.

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.

EMEA Tribune is not involved in this news article, it is taken from our partners and or from the News Agencies. Copyright and Credit go to the News Agencies, email news@emeatribune.com Follow our WhatsApp verified Channel