(Bloomberg) — Most Asian stocks traded in narrow ranges following losses on Wall Street after an unimpressive start to the earnings reports from the “Magnificent Seven” megacap technology companies.

Most Read from Bloomberg

Equity benchmarks in Japan edged lower while those in China opened with small gains. US shares dropped Tuesday as traders assessed earnings after the closing bell from corporate America’s largest businesses including Tesla Inc. and Alphabet Inc. Taipei’s bourse is shut for a typhoon, meaning Taiwan Semiconductor Manufacturing Co, is not trading.

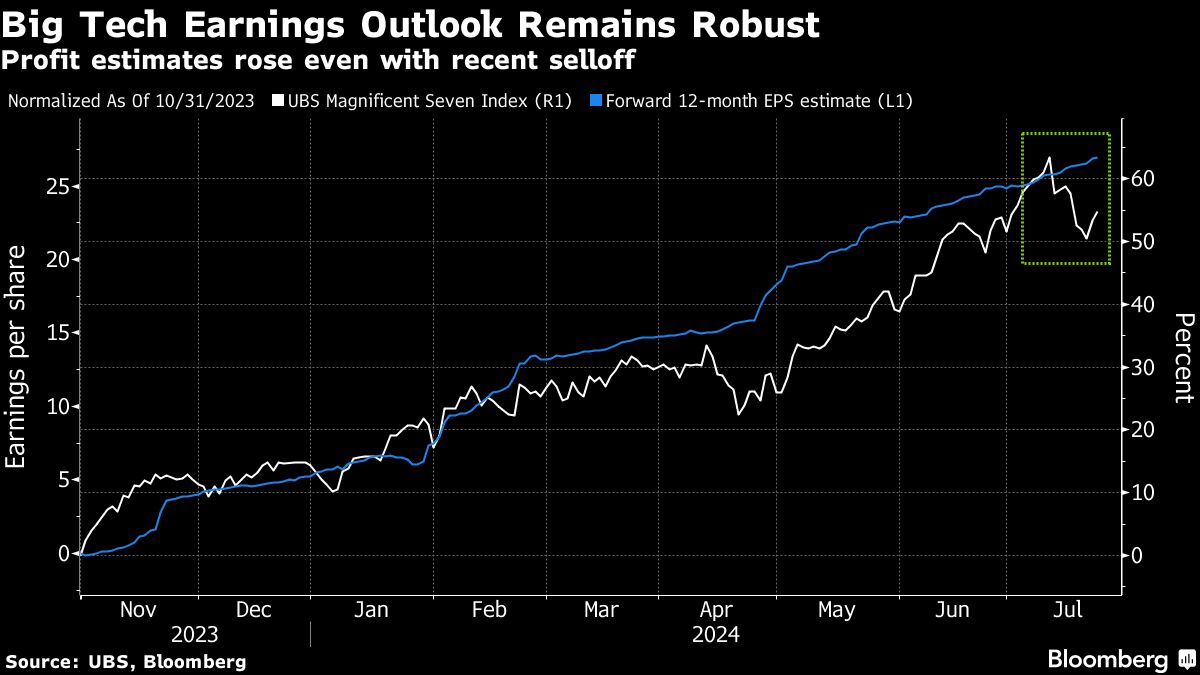

Investors were looking to tech earnings to maintain a rally that drove US and global stocks to records. That failed to materialize as Alphabet retreated as the company’s chief signaled patience will be needed to see concrete results from artificial-intelligence investments. Tesla slid as much as 7% after profit missed estimates and the electric-vehicle giant delayed its Robotaxi event to October.

“Given that profit expectations are high for the ‘Magnificent Seven,’ these companies will have a lot to prove,” said Anthony Saglimbene at Ameriprise. “At the same time, their outlooks will likely be heavily scrutinized in comparison to elevated valuations.”

Bloomberg’s gauge of the dollar touched its highest level in nearly two weeks before erasing gains.

The yen strengthened for a third day as traders looked ahead to a Bank of Japan policy meeting next week. While only about 30% of BOJ watchers predict the authorities will hike interest rates on July 31, more than 90% say there is a risk of such a move, according to a Bloomberg survey.

Investors will also be watching China, where the market that has lost momentum amid economic troubles and geopolitical risks. The outstanding balance of short trades on China’s stock exchanges fell to 27.9 billion yuan (3.8 billion), the lowest in more than four years, on July 22, when China’s new measures to curb short-selling went into effect, China Securities Journal reported Wednesday.

Typhoon Gaemi is approaching Taiwan with strong winds and heavy rain, compelling Taipei to suspend its $2.4 trillion stock market. Trading in securities, currencies and fixed income will be suspended Wednesday, according to statements from its exchange. The Philippines will also close its financial markets, schools and offices after the typhoon lashed Manila.

Upbeat earnings on Wall Street would be a much-needed driver for equities after a bumper first half of the year. The market is facing pressure heading into a seasonally weak period, with volatility likely to be heightened by the US presidential election. In addition to the woes for Big Tech, United Parcel Service Inc. suffered its worst plunge ever on a profit miss.

The five biggest US technology companies are facing tough comparisons with stellar earnings cycles of the past year. Profits for the group are projected to rise 29% in the second quarter from the same period a year earlier, data compiled by Bloomberg Intelligence show.

Treasury 10-year notes were little changed as investors awaited debt auctions and US manufacturing PMI data due Wednesday. Oil slipped amid algorithmic selling and low summer liquidity. Gold held an advance before key US economic data this week, that is forecast to support the case for interest-rate cuts.

Key events this week:

-

Canada rate decision, Wednesday

-

US new home sales, S&P Global PMI, Wednesday

-

IBM, Deutsche Bank earnings, Wednesday

-

Germany IFO business climate, Thursday

-

US GDP, initial jobless claims, durable goods, Thursday

-

US personal income, PCE, consumer sentiment, Friday

Some of the main moves in markets:

Stocks

-

S&P 500 futures fell 0.3% as of 10:47 a.m. Tokyo time

-

Nikkei 225 futures fell 0.2%

-

Japan’s Topix fell 0.4%

-

Australia’s S&P/ASX 200 fell 0.1%

-

Hong Kong’s Hang Seng fell 0.3%

-

The Shanghai Composite was little changed

-

Euro Stoxx 50 futures fell 0.4%

Currencies

-

The Bloomberg Dollar Spot Index was little changed

-

The euro was little changed at $1.0848

-

The Japanese yen rose 0.2% to 155.29 per dollar

-

The offshore yuan was little changed at 7.2874 per dollar

Cryptocurrencies

-

Bitcoin fell 0.1% to $65,755.51

-

Ether fell 1% to $3,447.08

Bonds

-

The yield on 10-year Treasuries was little changed at 4.25%

-

Japan’s 10-year yield advanced one basis point to 1.070%

-

Australia’s 10-year yield advanced two basis points to 4.36%

Commodities

This story was produced with the assistance of Bloomberg Automation.

–With assistance from Jason Scott.

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.

EMEA Tribune is not involved in this news article, it is taken from our partners and or from the News Agencies. Copyright and Credit go to the News Agencies, email news@emeatribune.com Follow our WhatsApp verified Channel