(Bloomberg) — Asian equities were primed for selling Friday following declines on Wall Street that reflected unease on the health of the US economy and sent Treasuries higher.

Most Read from Bloomberg

Equity futures for Japan, Australia and Hong Kong all fell, with contracts for Tokyo’s Nikkei 225 benchmark down by more than 3% early Friday. The yen clung to its rally from earlier in the week, keeping pressure on Japanese stocks, which can be vulnerable to swings in the currency. Both the S&P 500 index and Nasdaq 100 index fell Thursday, erasing gains from the prior session. Contracts for US stocks slipped in Asian trading.

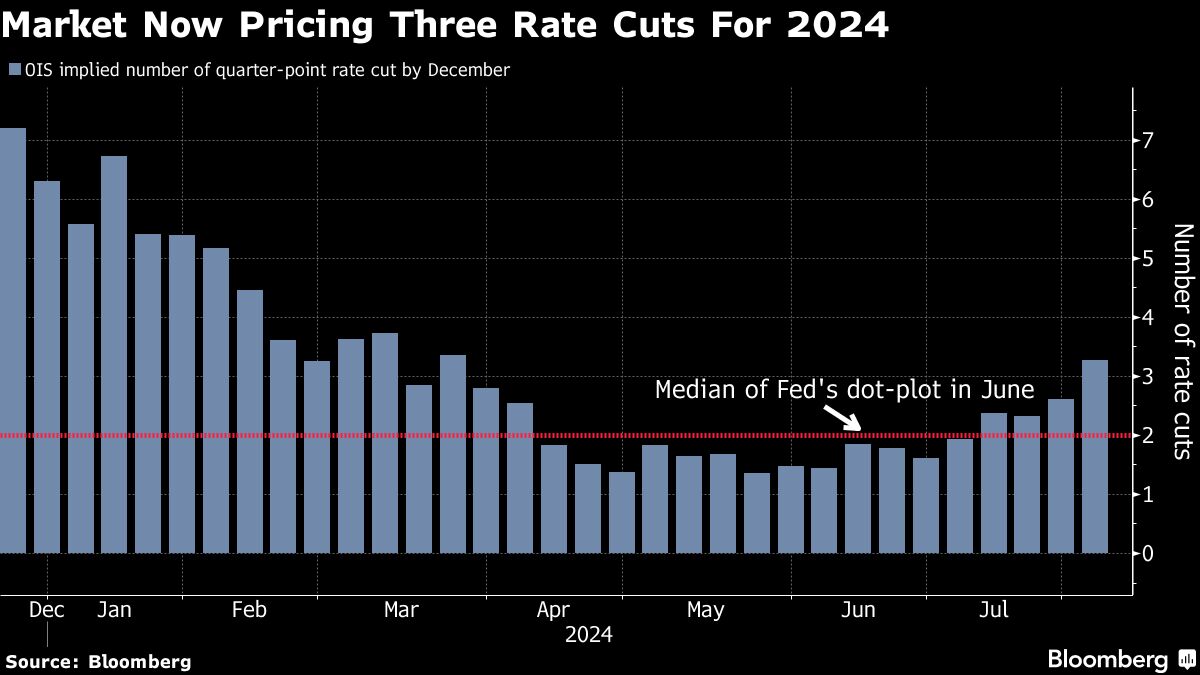

Declines for equities partly echoed signs of strain in the US economy and the likely timing of Federal Reserve interest rate cuts. Thursday data showed US unemployment claims hit an almost one-year high while manufacturing shrank. The unease prompted swaps traders to increase the number of anticipated Fed cuts this year to three from two.

Jobs data due later Friday will provide further clarity and is expected to a show a slowing in new roles added to the economy.

“Markets are approaching panic mode as many economic factors converge, supporting a drift away from risk assets,” said Jose Torres at Interactive Brokers. “The headwinds for this market are just too stormy, especially considering that equities are priced for perfection.”

Earnings from some of the largest US companies provided a further headwind for equities. Intel Corp. said its third-quarter revenue will disappoint and announced more than 15,000 job cuts. Amazon.com Inc projected profits that missed analysts’ estimates as it ramped up spending to meet demand for artificial intelligence services. Shares in both fell in after hours trading Thursday.

The rally in Treasuries dragged 10-year yields five basis points lower to below 4% for the first time since February. The US two-year yield, which is more sensitive to monetary policy, fell 11 basis points to levels not seen since January.

An index of dollar strength rallied Thursday to partly unwind losses from the prior session. The yen was little changed, holding on to a rally this week that has pushed the currency to around 149 per dollar. The pound slid Thursday after the Bank of England cut rates and signaled further cautious reductions ahead.

In Asia, data set for release includes inflation in South Korea, producer prices in Australia and Singapore PMI for July.

US Jobs

Economists are expecting moderation in job growth in the government’s July employment report due Friday. Forecasters anticipate the unemployment rate remained steady at 4.1%.

A survey conducted by 22V Research shows 42% of investors think the market reaction to Friday’s jobs data will be “risk-off,” 36% said “negligible/mixed” and only 22% “risk-on.”

“The labor market has been flashing warning signals over the past several months,” said Chris Senyek at Wolfe Research. “History suggests Powell is walking a very fine line on potentially waiting too long to start cutting rates before it’s too late.”

In commodities, oil pulled back after its biggest gain in more than nine months as signs of a slowing US economy countered concerns that the conflict in the Middle East may endanger supplies. Elsewhere, gold wavered near record levels.

Key events this week:

Some of the main moves in markets:

Stocks

-

S&P 500 futures fell 0.3% as of 7:30 a.m. Tokyo time

-

Hang Seng futures fell 1.5%

-

S&P/ASX 200 futures fell 1.8%

Currencies

-

The Bloomberg Dollar Spot Index was little changed

-

The euro was unchanged at $1.0791

-

The Japanese yen was little changed at 149.33 per dollar

-

The offshore yuan was little changed at 7.2503 per dollar

-

The Australian dollar was little changed at $0.6496

Cryptocurrencies

-

Bitcoin rose 1.3% to $65,555.99

-

Ether rose 1.2% to $3,205.02

Commodities

This story was produced with the assistance of Bloomberg Automation.

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.

EMEA Tribune is not involved in this news article, it is taken from our partners and or from the News Agencies. Copyright and Credit go to the News Agencies, email news@emeatribune.com Follow our WhatsApp verified Channel