(Bloomberg) — Stocks in Asia are set to decline after a rally on Wall Street halted within striking distance of its all-time highs.

Most Read from Bloomberg

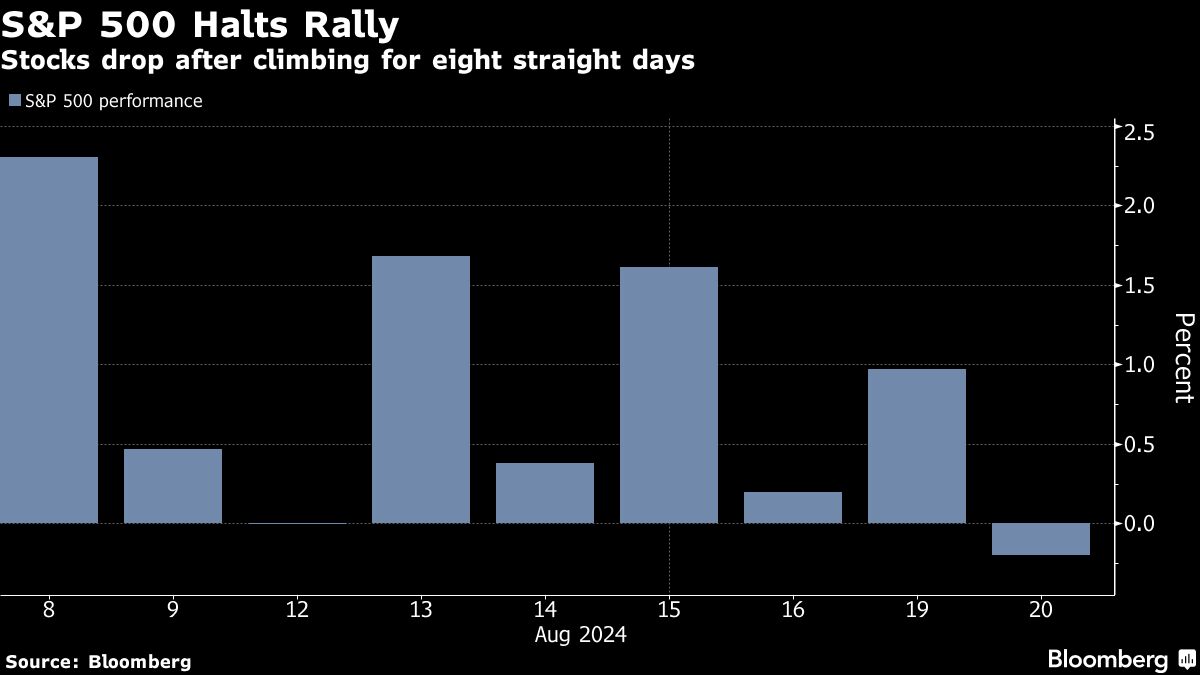

Futures pointed to drops of at least 0.5% in Tokyo, Hong Kong and Sydney after the US benchmark edged lower to end an eight-day winning streak. In stark contrast to the panic selling of early August, bullishness has been in overdrive on Wall Street, with nearly $16 billion in new long bets added to S&P 500 futures just last week, according to Citigroup Inc.

“The momentum guys are driving the bus,” said Kenny Polcari at SlateStone Wealth. “Now the volumes have been trending lower as we move into the end of the month. Moves will be and are exaggerated as a result. And I think the recent rally is proof of that exaggeration.”

At Miller Tabak, Matt Maley said it would be “healthy” if the equity market took a breather for a day or two.

“No market moves in a straight line,” he noted.

Aside from flows and positioning, the recent rally was also fueled by bets the Federal Reserve will signal it’s getting closer to cutting rates, leading bond traders to take on record amounts of risk as they anticipate a Treasury market rally. In the countdown to Jerome Powell’s speech Friday in Jackson Hole, Wednesday’s US payrolls revisions are poised to capture Wall Street’s attention.

In Asia, policymakers in Indonesia and Thailand are tipped to keep interest rates unchanged on Wednesday as they weigh uncertainties over political transitions while awaiting the Fed’s imminent easing.

The S&P 500 fell below 5,600 Tuesday as Nvidia Corp. — which had rallied almost 25% in six days — led losses in megacaps. Treasury 10-year yields declined six basis points, while a Bloomberg gauge of the dollar fell for a third session, helping push the euro and pound to fresh highs for the year. Brent crude declined a third day on the back of a potential cease-fire in Gaza and mounting concern about the global demand outlook, while gold hit a fresh record high.

Dan Wantrobski at Janney Montgomery Scott says he continues to anticipate ongoing stock-market strength on a near-term basis, but remains on “high alert” for another, potentially bigger corrective wave moving through the August-October time frame.

“So what happens when everything and everyone is teed up to be bullish,” Wantrobski said. “From a timing perspective, we are headed into a window where there may be high probability for a liquidity event to occur — and the charts, trader positioning, and sentiment are all very vulnerable right now in our view. We smell a ‘bull trap’ ahead. But hope we’re wrong.”

Momentum traders and a surge in corporate buybacks promise to drive a US stocks rally over the next four weeks, Goldman Sachs Group Inc.’s Scott Rubner said in a note dated Monday.

Rubner, who correctly predicted a late summer correction and advised in late June to trim exposure in US stocks after July 4, has turned tactically bullish saying current positioning and flows “will act as a tailwind as sellers are out of ammo.”

“Strong price momentum and sharp rapid reversals as witnessed over the past month are a feature of modern financial markets, not a bug,” said Jason Draho at UBS Global Wealth Management. “This stems from the outsized market influence of the Fed, macroeconomic uncertainty, investor herd behavior, and the growing use of index-linked products to manage positioning.”

To Anthony Saglimbene at Ameriprise, continued progress on inflation, moderating but still healthy labor conditions, and economic updates that point to firm consumer trends likely allow the Fed to comfortably begin cutting its policy rate in September.

“This is how a soft landing starts,” he said. “Of course, there is no guarantee the Fed will ultimately pull it off, but you need the conditions in place to start, and it looks like we finally have those conditions in place today.”

Key events this week:

-

US Fed minutes, BLS preliminary annual payrolls revision, Wednesday

-

Eurozone HCOB PMI, consumer confidence, Thursday

-

ECB publishes account of July rate decision, Thursday

-

US initial jobless claims, existing home sales, S&P Global PMI, Thursday

-

Japan CPI, Friday

-

Bank of Japan Governor Kazuo Ueda to attend special session at Japan’s parliament to discuss July 31 rate hike, Friday

-

US new home sales, Friday

-

Fed Chair Jerome Powell speaks at Jackson Hole symposium in Wyoming, Friday

Some of the main moves in markets:

Stocks

-

Nikkei futures fell 1.2% as of 7:21 a.m. Tokyo time

-

Hang Seng futures fell 1%

-

S&P/ASX 200 futures fell 0.6%

-

S&P 500 futures were little changed; the S&P 500 fell 0.2%

-

Nasdaq 100 futures were little changed; the Nasdaq 100 fell 0.2%

Currencies

Cryptocurrencies

-

Bitcoin was little changed at $59,334.17

-

Ether was little changed at $2,588.5

Bonds

Commodities

This story was produced with the assistance of Bloomberg Automation.

–With assistance from Rita Nazareth.

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.

EMEA Tribune is not involved in this news article, it is taken from our partners and or from the News Agencies. Copyright and Credit go to the News Agencies, email news@emeatribune.com Follow our WhatsApp verified Channel