(Bloomberg) — Stocks in Asia are set to follow a rally on Wall Street after latest US inflation data reinforced speculation that the Federal Reserve will be able to start its widely anticipated monetary easing in September.

Most Read from Bloomberg

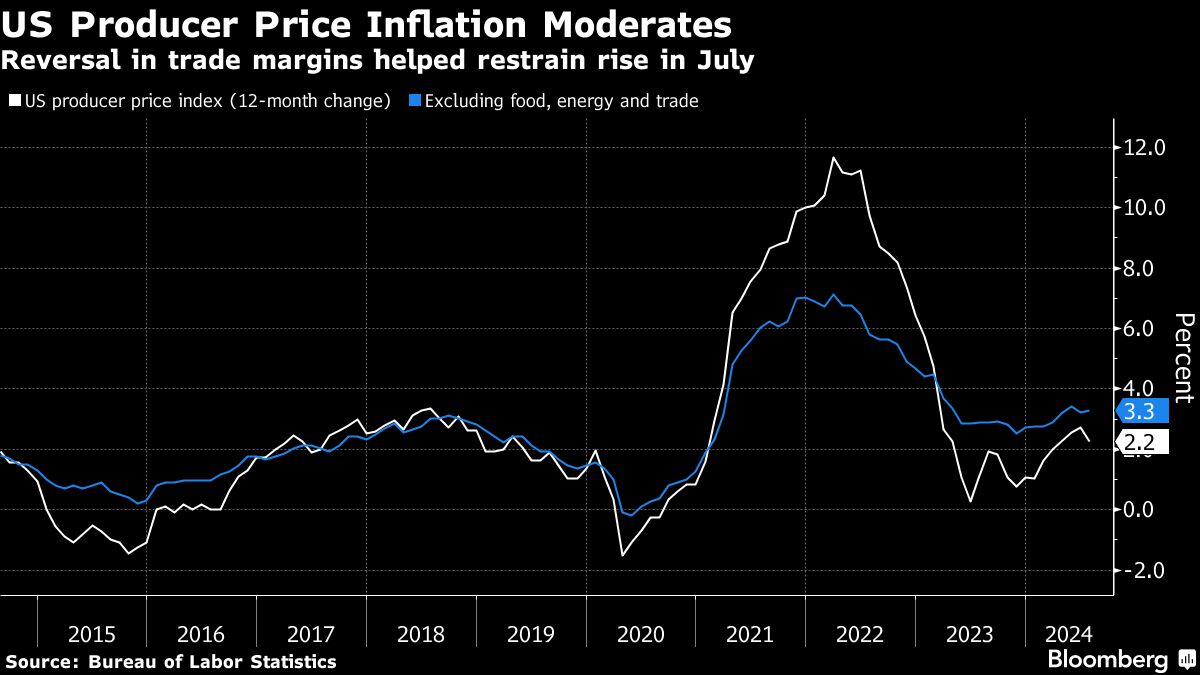

Futures for Tokyo, Hong Kong and Sydney all pointed to further gains after a regional benchmark on Tuesday reclaimed levels seen before the historic Aug. 5 selloff. Ahead of the US consumer inflation report later Wednesday, the producer price index rose less than forecast, helping to fuel a 1.7% rally in the S&P 500 that was led by gains in big tech. Treasuries rose across the curve, with the move driven by shorter maturities, while a Bloomberg gauge of the dollar closed at a four-month low.

“Markets searching for stability got more evidence of cooling inflation,” said Chris Larkin at E*Trade from Morgan Stanley. “The lower-than-expected reading will probably be welcomed by a stock market attempting to bounce from its biggest pullback of the year.”

The easing of price pressures has bolstered confidence US officials can start lowering borrowing costs while refocusing on the labor market, which is showing greater signs of slowing. Fed Bank of Atlanta President Raphael Bostic said he’s looking for “a little more data” before supporting a reduction in rates, while reiterating he’ll likely be ready to cut “by the end of the year.”

To Ian Lyngen at BMO Capital Markets, there isn’t anything in Tuesday’s data suggesting the Fed will have any hesitation cutting rates next month. However, Wednesday’s “consumer inflation update is far more relevant to near-term policy expectations,” he said.

The S&P 500 saw its biggest four-day rally this year. The Nasdaq 100 climbed 2.5%. Starbucks Corp. surged 25% after ousting its chief and picking Chipotle Mexican Grill Inc.’s Brian Niccol as its next leader. In late hours, Bloomberg News reported that a bid to break up Alphabet Inc.’s Google is one of the options being considered by the Justice Department.

Wall Street’s favorite volatility gauge — the VIX — tumbled to around 18. Treasury 10-year yields fell six basis points to 3.85%. Swap traders priced in an about 40 basis-point Fed cut in September and a total rate reduction of over 105 basis points for 2024.

“Disinflationary data is being celebrated by investors — not for its signaling of a slowing economy here in the US — but to solidify improving liquidity conditions ahead via the much anticipated rate cuts starting presumably in September,” according to Dan Wantrobski at Janney Montgomery Scott.

In New Zealand, economists and investors are largely unsure whether the central bank will begin reversing course and cut its key rate by 25 basis points to 5.25% at its meeting on Wednesday.

The US producer price index for final demand increased 0.1% from a month earlier. The median forecast in a Bloomberg survey of economists called for a 0.2% gain. Compared with a year ago, the PPI rose 2.2%. Excluding the volatile food and energy categories, it was unchanged in July from the prior month — the tamest reading in four months.

“The runway is clear for the Fed to cut rates in September,” said Jamie Cox at Harris Financial Group. “If data like this persists, the Fed will have plenty of room to cut rates further this year.”

Oil climbed in early Asia trading, rebounding from losses on Tuesday as the prospect of a potential surplus overshadowed concern about an escalation in the Middle East conflict.

Key events this week:

-

Eurozone GDP, industrial production, Wednesday

-

US CPI, Wednesday

-

China home prices, retail sales, industrial production, Thursday

-

US initial jobless claims, retail sales, industrial production, Thursday

-

Fed’s Alberto Musalem and Patrick Harker speak, Thursday

-

US housing starts, University of Michigan consumer sentiment, Friday

-

Fed’s Austan Goolsbee speaks, Friday

Some of the main moves in markets:

Stocks

-

Hang Seng futures rose 0.7% as of 7:17 a.m. Tokyo time

-

Nikkei 225 futures rose 0.5%

-

S&P/ASX 200 futures rose 0.7%

-

The S&P 500 rose 1.7%

-

The Nasdaq 100 rose 2.5%

Currencies

Cryptocurrencies

-

Bitcoin fell 0.1% to $60,531.51

-

Ether rose 0.5% to $2,713.11

Bonds

Commodities

This story was produced with the assistance of Bloomberg Automation.

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.

EMEA Tribune is not involved in this news article, it is taken from our partners and or from the News Agencies. Copyright and Credit go to the News Agencies, email news@emeatribune.com Follow our WhatsApp verified Channel