(Bloomberg) — Bank of Japan Governor Kazuo Ueda will size up the need to raise interest rates on Friday amid heightened expectations of a hike — and barring a market shock triggered by Donald Trump’s first few days in the White House.

While the rest of the central banking world has been focusing on the pace of cuts, especially those at the Federal Reserve, Ueda and his board are still heading in the other direction as they look to gradually pull Japan back in the direction of conventional policy settings.

After decades of weak prices and feeble economic growth, Japan appears close to achieving stable inflation with solid wage growth, enabling the BOJ to push borrowing costs up toward levels seen in other major economies.

Some 90% of economists surveyed by Bloomberg this month said prices and economic conditions warrant an increase in rates from 0.25%. Of the surveyed economists, about three-quarters expect the central bank to move this week. Overnight swaps on Friday briefly showed a January rate hike almost fully priced in among traders.

BOJ officials also see a good chance of a rate increase as long as Trump doesn’t trigger too many immediate negative surprises, Bloomberg reported on Thursday, citing people familiar with the matter. A likely upward revision of price forecasts and robust wage growth expectations are among the factors favoring a move, the people said.

The report further fueled expectations of a looming hike after both Ueda and his deputy, Ryozo Himino, flagged that they would consider the need to raise borrowing costs at the upcoming meeting.

Some BOJ watchers interpreted the comments as a hint that action was in the pipeline, as the central bank’s top brass tries to improve the clarity of communications. A lack of messaging ahead of its July rate hike was blamed by some analysts for helping spark a global market meltdown in the summer.

Economists point to the yen as another factor. The currency has been hovering close to the 160 level against the dollar that prompted billions of dollars of market intervention to support the yen last year. A rate hike would narrow the gap between US and Japanese rates, giving the currency a lift.

“The most recent signal of rate hikes from BOJ officials is propping up the yen. In the longer run, a rise in Japan’s interest rates and stronger growth may also squash the yen-selling narrative.”

—Taro Kimura, senior Japan economist. For full analysis, click here

So what might stop Ueda? Economists flagged the possibility that potential market turbulence sparked by Trump might give the BOJ a reason to wait a little longer. Wide-ranging tariffs are among the key concerns for all major trading partners of the US, including Japan, with the president-elect likely to deliver a barrage of executive orders on day one of his second administration.

Among potential delaying factors closer to home, more information on annual wage deals will be available in March should Ueda seek more clarity on pay trends that support stable price growth. Prime Minister Shigeru Ishiba, meanwhile, has no guarantee that he can pass the annual budget without support from at least one opposition party wary of a rate hike before March.

Still, after the apparent signals from Ueda and Himino and with huge expectations of a hike, the BOJ will face more questions about its communications strategy if it doesn’t follow through this time.

Elsewhere, Trump’s inauguration will set the tone for financial markets, overshadowing the World Economic Forum in Davos, where he’s expected to speak via video on Thursday. Purchasing manager indexes around the global for January will also draw attention.

Click here for what happened in the past week, and below is our wrap of what’s coming up in the global economy.

US and Canada

Trump will be sworn into office and give his inaugural address indoors on Monday as the nation’s capital braces for a high temperature of just 22F (-6C). Soon thereafter, he’s expected to release a number of executive orders that may include a rollback of the Biden administration’s immigration policies, according to Bloomberg Economics.

The US economic calendar is light, with December existing-home sales and University of Michigan consumer sentiment data among the highlights. Those reports are slated for Friday, along with S&P Global manufacturing and services surveys. Fed policymakers are in a blackout period ahead of their Jan. 28-29 meeting.

Meanwhile, Canadian Prime Minister Justin Trudeau will huddle with his cabinet at a retreat in Quebec during the first two days of Trump’s presidency, allowing them to swiftly respond if Trump carries out his threat of steep tariffs on the country’s goods.

Amid the uncertainty, the race to become Canada’s next premier has kicked off, with ex-central banker Mark Carney and former finance minister Chrystia Freeland entering the Liberal leadership contest. Bank of Canada surveys for the fourth quarter and inflation data for December will also be released.

Asia

Ahead of the BOJ rate decision on Friday, the nation will release inflation figures likely to show an uptick that further supports the case for a hike.

The Monetary Authority of Singapore holds its first meeting of the year the same day, with some economists seeing a risk of an easing move.

Earlier, on Wednesday, Malaysia’s central bank is likely to extend its long policy pause and leave its benchmark rate at 3% — a level unchanged since May 2023 — as price pressures remain manageable.

New Zealand publishes an all-important inflation report for the December quarter earlier in the day that will feed into its central bank’s decision-making when it meets in February for the first time this year.

Also on Wednesday, investors will get insight into the mood of South Korean households after consumer confidence tumbled last month in the wake of the political turmoil triggered by the brief imposition of martial law that led to President Yoon Suk Yeol’s impeachment.

On Thursday, advanced gross domestic product estimates may show South Korea’s economy picked up a tad in the final three months of 2024.

The week will also see trade data from the Philippines, Malaysia and Japan, while India and Australia report purchasing manager indexes. Taiwan will release estimates of gross domestic product on Friday.

Europe, Middle East, Africa

The Davos gathering will be in the limelight as global leaders and financial officials mingle with business executives in the Swiss mountain resort.

European Central Bank President Christine Lagarde and other Governing Council colleagues will be there, as will Swiss National Bank chief Martin Schlegel.

Embattled UK Chancellor Rachel Reeves is another scheduled attendee. Her comments will be closely scrutinized given the market focus on the country’s fiscal challenges.

Back in Britain, wage data will be watched in earnest given persistent worries about inflation. An uptick in pay pressures is widely anticipated by economists, though the Bank of England should still be able to proceed with a rate cut next month.

In both the UK and euro zone, PMI numbers on Friday will be key, giving the first signal of manufacturing and services at the start of the year, before Trump reveals how far he wants to go through with his threats of tariffs.

Away from Europe, South African data on Wednesday will likely show inflation in December quickened to 3.2% because of higher gasoline prices and a weaker rand. Forward-rate agreements used to speculate on borrowing costs are now pricing in just a single 25-basis-point rate cut in 2025, likely coming on Jan. 30.

Three monetary decisions are scheduled around the region:

-

On Tuesday, Angola’s central bank will likely leave its rate unchanged at 19.5% for a fourth straight meeting to contain Africa’s highest inflation, at 27.5%.

-

Norwegian officials on Thursday are widely tipped to keep borrowing costs at a 16-year high. They may reiterate that their first post-pandemic cut from the current level of 4.5% could arrive in March, along with uncertainty regarding further easing beyond that. Most economists see a total of four quarter-point reductions this year.

-

Turkey’s central bank has cautioned that the 250 basis-point rate cut it delivered in December doesn’t necessarily mean an easing cycle has started. But many economists and traders reckon it has, and expect another move of the same size on Thursday, taking the base rate to 45%.

-

The same day, policymakers in Ukraine are expected to raise the benchmark rate for a second straight month, to 14%, as they seek to tame accelerating inflation and as the country faces uncertainty over continued US support in its efforts to repel Russia’s invasion.

Latin America

The region’s two biggest economies report mid-month inflation and both are likely to print lower — but the similarities end there.

Analysts see January’s slowdown in Brazil as a one-off that will be followed by a sharp jump in February. Economists surveyed by the central bank expect January’s monthly inflation rate near zero before it jumps above 1.3% in February.

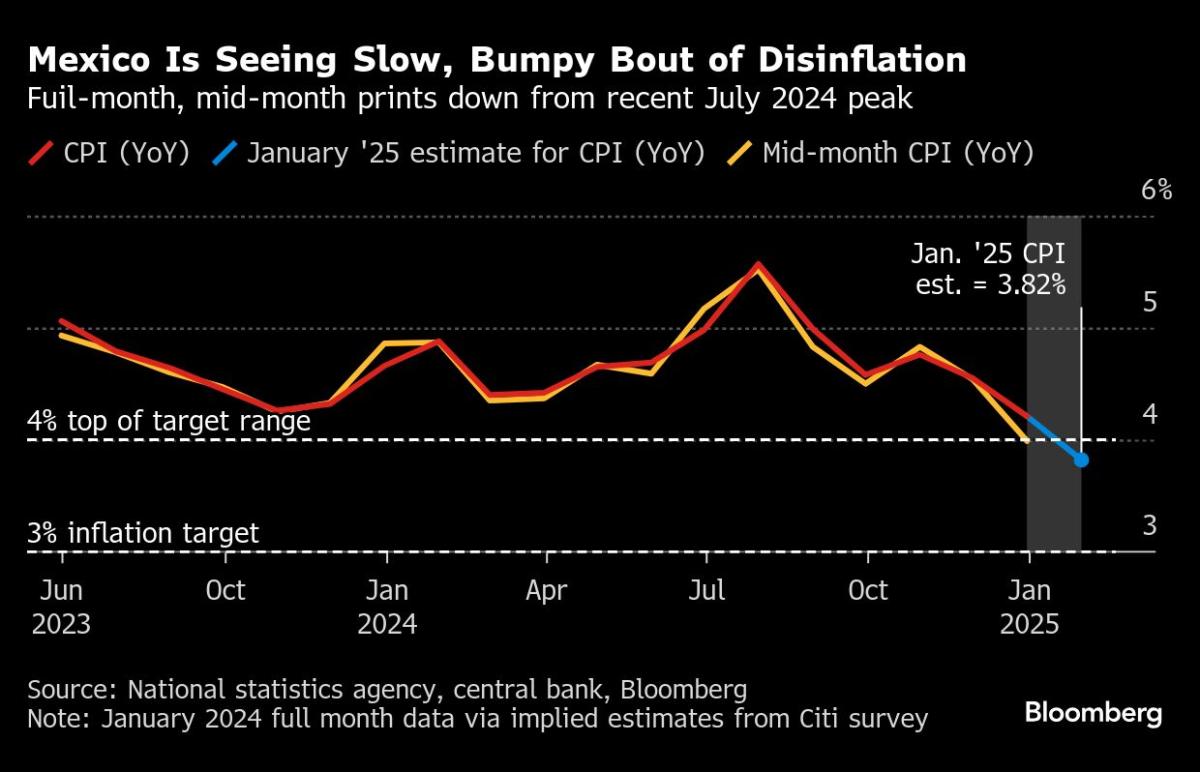

Mexico’s riding a bumpy but unmistakable bout of disinflation on tight monetary policy and slowing growth, with forecasts from analysts surveyed by Citi implying a slowdown to within the bank’s 2%-to-4% target range. The full-month and mid-month readings in each economy often track quite closely.

As usual, Brazil watchers get a new central bank survey of economists, which will be joined by Banco Central de Chile’s poll of traders and Citi’s survey of economists in Mexico.

Argentina posts December trade figures along with its consumer confidence index and monthly wages data. Colombia publishes imports and the trade balance for November.

Mexico, Argentina and Colombia publish economic activity data that will close the books on November for Latin America’s big-six economies.

Of the group come year-end, Brazil’s economy likely led the pack with growth above 3%, but it will give way to Argentina in 2025, which some analysts expect to expand as much as 5%.

–With assistance from Laura Dhillon Kane, Monique Vanek, Piotr Skolimowski, Robert Jameson, Swati Pandey, Ott Ummelas and Vince Golle.

Most Read from Bloomberg Businessweek

©2025 Bloomberg L.P.

EMEA Tribune is not involved in this news article, it is taken from our partners and or from the News Agencies. Copyright and Credit go to the News Agencies, email news@emeatribune.com Follow our WhatsApp verified Channel