(Bloomberg) — The Bank of Russia held its key interest rate at a record-high 21%, surprising most analysts who’d expected policymakers to opt for another big hike to try to tame persistent inflation.

Most Read from Bloomberg

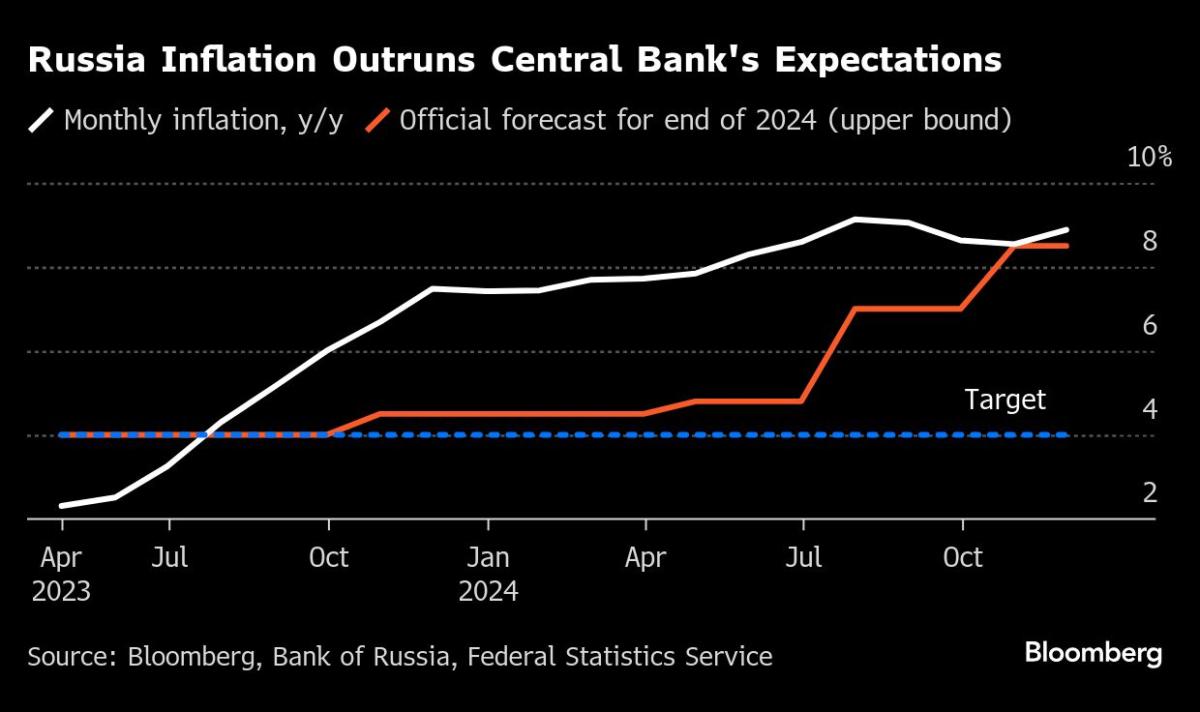

Six of 12 economists had expected a two percentage-point hike, while two foresaw a hike to 24% and only two saw a hold. Price growth continues to run at more than twice the central bank’s 4% target.

The regulator decided to hold the rate because “monetary conditions tightened more significantly than envisaged” after October’s 200-basis point increase, the bank said Friday in a statement.

“The achieved tightness of monetary conditions creates the necessary prerequisites for resuming disinflation processes and returning inflation to the target, despite the elevated current price growth and high domestic demand,” it said.

The bank said it would assess the need for another rate increase at its next meeting in February.

Governor Elvira Nabiullina will hold a news conference at 3 p.m. in Moscow.

Russia’s annual inflation accelerated again in November to 8.9% from 8.5% in the previous month, even after the central bank increased the key rate in October. Inflation expectations, a closely watched metric for monetary policymakers, reached 13.9% in December, the highest level in a year.

The central bank began the year signaling it would consider monetary easing in the second half. Instead, it has sharply raised the benchmark from 16% since July as its bet on a slowdown in price growth failed to materialize. The central bank sees inflation returning to its target in 2026.

Massive budget spending on the war in Ukraine and social programs have kept the economy overheated, while acute labor shortages have led to stiff competition for workers that’s driving up wages. Production, meanwhile, hasn’t been able to expand quickly enough to keep pace with rapidly increasing demand.

The central bank’s plan to cool demand by making credit prohibitively expensive has so far acted as a brake on economic growth, but not on rising prices.

Annual price growth as of Dec. 16 reached 9.52% while food inflation accelerated to 10.93%, weekly data published by the Economy Ministry showed. Vegetables were 24% more expensive than in the previous year.

The central bank said a “cooling of credit activity has already encompassed all segments of the credit market,” and warned that would continue into next year amid the tight monetary conditions. Nonetheless, the bank said that the balance of inflation risks in the medium-term “is still tilted to the upside.”

The central bank’s decision offers some respite for businesses and lenders that had complained the extremely high lending rates could lead to bankruptcies and a freeze in the economy.

Russian President Vladimir Putin appeared to acknowledge these worries at his annual televised news conference and call-in show on Thursday when he said the bank should aim for a “balanced” decision and take into account current “demands.”

The central bank will hold its next rate-setting meeting on Feb. 14.

(Updates with additional details from the bank’s statement starting in the fifth paragraph.)

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.

EMEA Tribune is not involved in this news article, it is taken from our partners and or from the News Agencies. Copyright and Credit go to the News Agencies, email news@emeatribune.com Follow our WhatsApp verified Channel