Benzinga and Yahoo Finance LLC may earn commission or revenue on some items through the links below.

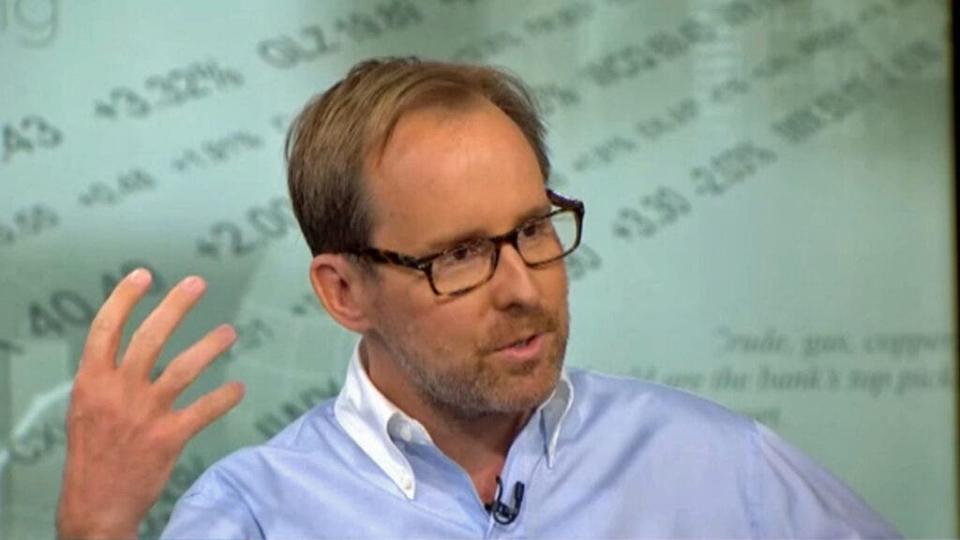

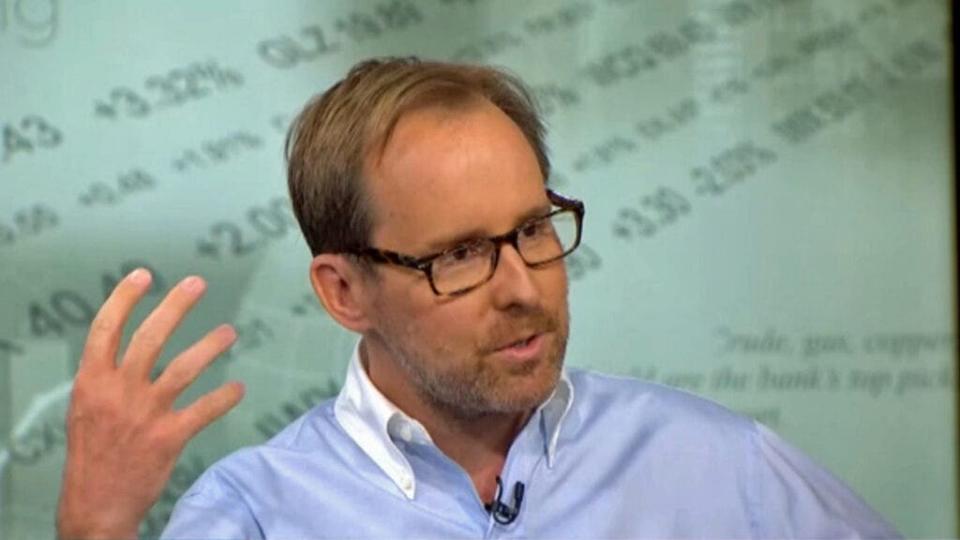

Mark Spitznagel, co-founder of Universa Investments, believes the stock market is in a “Goldilocks phase” following the Federal Reserve’s rate cuts and China’s stimulus measures. After a crash last month, the market surged to new highs, but Spitznagel warns this euphoria won’t last in an interview with Bloomberg.

He predicts a looming recession and believes the current rally is only temporary.

Check It Out:

Spitznagel, known for his focus on “tail-risk” hedging, which protects against extreme, unexpected market events, says the biggest market bubble in history is about to burst. He foresees stagflation in the future, where the Fed will have to act, but it won’t be enough to save the economy.

Spitznagel has had success hedging through large downturns in the market, utilizing out-of-the-money put options as a way to “buy insurance” against market routs. Buying puts on the overall market through the SPDR S&P 500 ETF Trust (NYSE:SPY) or similar broad-exposure ETFs could be a way to protect against market volatility.

Spitznagel said that while the market might continue to soar in the short term, it will soon exit the Goldilocks zone, potentially by the end of the year. With the recent “uninversion” of the yield curve, Spitznagel feels the market is now in “black swan territory.”

Trending: This billion-dollar fund has invested in the next big real estate boom, here’s how you can join for $10.

This is a paid advertisement. Carefully consider the investment objectives, risks, charges and expenses of the Fundrise Flagship Fund before investing. This and other information can be found in the Fund’s prospectus. Read them carefully before investing.

What Is A Black Swan Event: A black swan event is an unpredictable event that leads to market volatility. The COVID-19 market crash is a recent example of a black swan event.

He also criticized traditional investment strategies like diversification, calling them a “big lie.” He argues that modern portfolio theory has distracted investors, often making them poorer in the long run. Instead, he urges investors to focus on how their portfolios will perform in both good and bad markets.

According to Spitznagel, the key is to protect against one’s own tendencies, not just market movements. Rather than fixating on what the market will do next, investors should think about how they’ll react in boom and bust scenarios to avoid emotional mistakes like selling at the low and buying at the high.

Wondering if your investments can get you to a $5,000,000 nest egg? Speak to a financial advisor today. SmartAsset’s free tool matches you up with up to three vetted financial advisors who serve your area, and you can interview your advisor matches at no cost to decide which one is right for you.

Keep Reading:

This article Billionaire Investor Who Predicted 2000, 2008 Crashes Says Market Euphoria Will Top Soon, Warns Of ‘Black Swan Event’ originally appeared on Benzinga.com

EMEA Tribune is not involved in this news article, it is taken from our partners and or from the News Agencies. Copyright and Credit go to the News Agencies, email news@emeatribune.com Follow our WhatsApp verified Channel