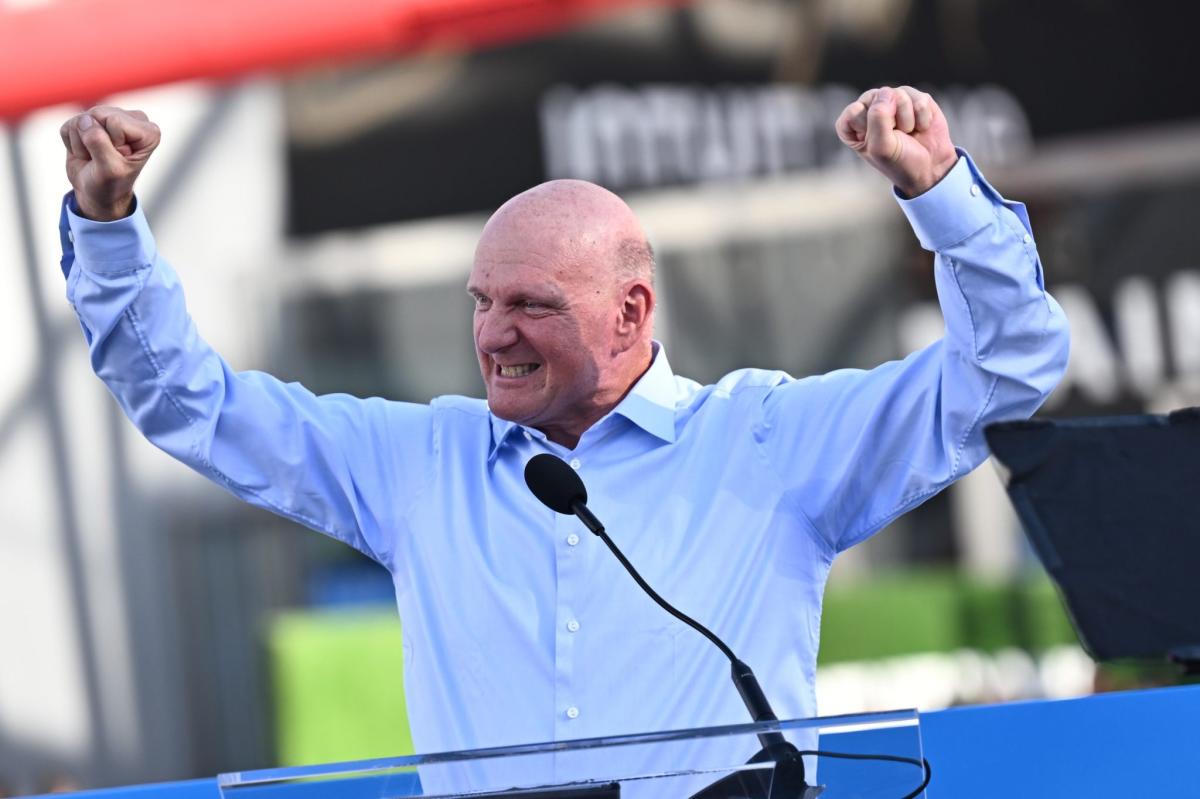

Former Microsoft CEO Steve Ballmer believes most investors should keep things simple, and his own holdings are so simple they depend overwhelmingly on just one stock.

According to the Wall Street Journal, more than 80% of his investment portfolio is in Microsoft stock with the rest in stock index funds.

“Microsoft’s outperformed just about every other asset I could have owned,” he told the Journal in a Q&A that was published on Sunday. “It’s a little hard to say that it hasn’t worked out.”

Including dividends, Microsoft has returned an average of about 29% annually in recent years, while the S&P 500 has returned about 13% on average.

That was helped by the AI boom that was launched by Microsoft-backed OpenAI. Since the release of ChatGPT in November 2022, Microsoft’s stock price has soared, vaulting its market cap above $3 trillion.

Ballmer, who served as Microsoft’s boss from 2000 to 2014, said his philosophy was shaped by Warren Buffett’s advice that retail investors are better off parking their money in an S&P 500 index fund rather than trying to outsmart the market.

Of course, the Berkshire Hathaway CEO doesn’t have 80% of his portfolio in one stock. But Ballmer settled on his unusual investment strategy after having trouble finding money managers who regularly beat the market.

Now worth $151 billion on the Bloomberg Billionaires Index, he told the Journal that he and his wife shifted an index fund to be just the U.S. and Europe while they “maybe” own some Japanese assets too. He’s also getting out of private equity and only really follows top holding Microsoft.

“I like it. It’s simple,” he added. “We’ve been very blessed financially. What I seek in this instance is not to have to spend a lot of time, anxiety, brain power in an area where we’re blessed enough if we make 7% because that’s the standard return on the S&P over the long run.”

As far as which index fund he owns, Ballmer sounded uncertain, saying if it’s not the S&P 500, then it’s the small-cap Russell 2000 or “some broad mirror of the market.”

Meanwhile, his other big investment—the Los Angeles Clippers—also appears to be doing well. He bought the NBA franchise in 2014 for $2 billion, and it’s now worth $5.5 billion, according to Forbes.

When asked if his strategy can apply to everyday investors, he replied, “I would say, ‘Keep it simple’—unless you’re really going to become an expert.”

Studies have shown index funds tracking the S&P 500 consistently beat most actively managed funds, especially as U.S. assets have reigned supreme in global markets lately.

Over the past 10 years, the average share of active funds that beat the S&P 500 was 27%, according to Morningstar data from July. In addition, funds that are diversified across asset classes and geographies also fared worse than the S&P 500. Such portfolios have lagged the index in 13 of the last 15 years, according to data from Cambria Funds in June.

To be sure, the vast majority of the S&P 500’s recent gains have come from just a handful of tech giants, such as Microsoft and Nvidia, leaving index investors vulnerable to a single-stock drop.

Meanwhile, skeptics on Wall Street see the overwhelming dominance of U.S. markets among global investors as a red flag.

“Talk of bubbles in tech or AI, or in investment strategies focused on growth and momentum, obscures the mother of all bubbles in U.S. markets,” Ruchir Sharma, chair of Rockefeller International, wrote in the Financial Times earlier this month. “Thoroughly dominating the mind space of global investors, America is over-owned, overvalued, and overhyped to a degree never seen before.”

This story was originally featured on Fortune.com

EMEA Tribune is not involved in this news article, it is taken from our partners and or from the News Agencies. Copyright and Credit go to the News Agencies, email news@emeatribune.com Follow our WhatsApp verified Channel