-

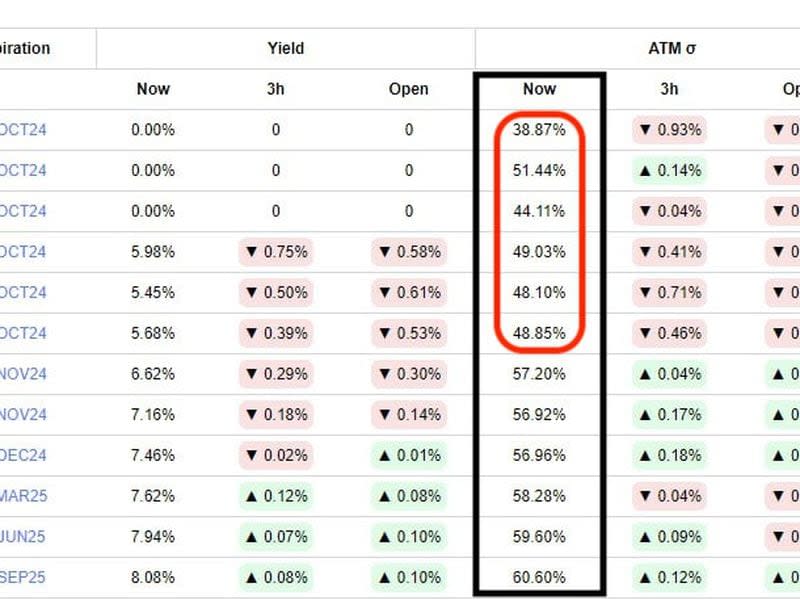

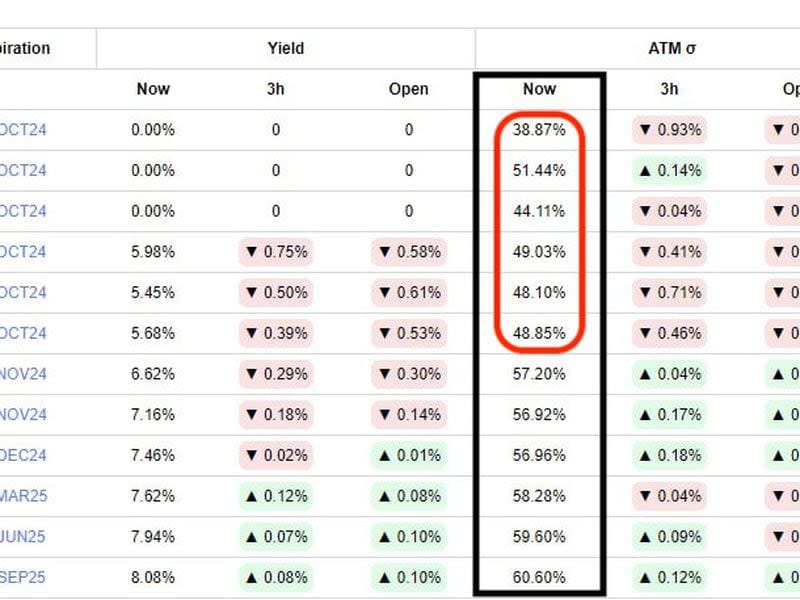

BTC’s options expiring on Oct 5 trade at higher implied volatility (IV) compared to Oct. 25 options.

-

The so-called IV kink points to a unusually volatile weekend.

-

Traders seem to bracing for price turbulence post Friday’s NFP and potential retaliatory strikes by Israel.

The bitcoin {{BTC}} bull run since October last year has seen mostly quiet weekends, but that’s about to change, according to a key metric.

At press time, bitcoin’s “implied volatility term structure” indicates bigger price swings on Saturday (Oct. 5) than on days leading up to Oct. 25, according to Deribit options data tracked by Arbelos Markets.

The term structure is a graphical representation of options-determined implied or expected volatilities (IV) at different expiration dates. It is usually upward sloping, with longer duration options trading pricer in terms of implied volatility relative to short duration ones.

However, as of writing, the curve exhibited a kink, with options expiring on Oct. 5 trading at an annualized IV of 51.44%, notably higher than options expiring on Oct. 6, Oct. 11, Oct. 18, and Oct. 25.

In other words, traders are pricing more significant price swings for Saturday, possibly anticipating increased volatility following Friday’s nonfarm payrolls (NFP) release and amid geopolitical tensions, according to Joshua Lim, co-founder of Arbelos Markets.

“There’s a very noticeable kink in the vol curve – Friday (Oct. 4) is trading around 39 vol and Saturday (Oct. 5) is trading 51 vol. The market is pricing in a risk premium from nonfarm payrolls data, but more importantly, some probability of an Israeli retaliation post-Rosh Hashanah,” Lim told CoinDesk.

Focus on payrolls

The U.S. Bureau of Labor Statistics will release the NFP on Friday at 12:30 UTC. Per FXStreet, the data is expected to show that the economy added 140,000 jobs in September, following August’s weaker-than-expected increase of 142,000. The jobless rate is forecast to hold steady at 4.2%, with the year-on-year growth rate of average hourly earnings matching August’s pace of 3.8%.

According to ING, risks are skewed in favor of hawkish repricing of 25 basis points Fed rate cuts in November and December and dollar strength unless the data misses expectations big margin.

The Fed cut rates by 50 basis points (bps) last month, torching a rally in risk assets, including BTC. Currently, markets expect at least another 50 bps cut by the year-end.

“The pricing for year-end Fed funds continues to largely embed a 50 bps cut in either November or December, meaning room for further re-alignment with the Fed’s less dovish rhetoric and consequently upside risks for the dollar. We sense that the bar for a dollar-negative reaction to U.S. data today and tomorrow is probably higher after Fed Chair Jerome Powell’s recent pushback against 50 bps reductions,” ING said in a note to clients.

A stronger dollar often weighs over risk assets, including BTC and traditional safe havens like gold.

Volatile middle east situation

On Oct 1, Iran fired at least 180 ballistic missiles at Israel, ratcheting up tensions and risk of a full-blown war and leading to a broad-based risk aversion. BTC dropped over 4% on the same, eventually testing the $60,000 support.

Per ING, investors are now on high alert, awaiting Israel’s retaliation against Iran, leading to a rally in crude prices and a stronger dollar index.

A potential action over the weekend, when traditional markets are closed, could see both traditional and crypto traders express their views in the digital assets market, leading to an unusually volatile weekend.

EMEA Tribune is not involved in this news article, it is taken from our partners and or from the News Agencies. Copyright and Credit go to the News Agencies, email news@emeatribune.com Follow our WhatsApp verified Channel