Despite price volatility, the energy sector brings one big advantage to the table for investors: there is always a market for the products.

Keeping that in mind, Wolfe Research has taken the measure of the US oil and gas industry, looking into the details of the energy stocks, and reinstated coverage of the North American gas companies. The firm is predicting high upsides here, and recommends investors pick up shares in gas stocks.

Doug Leggate, laying out Wolfe’s reasons for recommending natural gas producers, writes, “We see the US gas equities as collectively the best value opportunity in our coverage, paced obviously by expectations of higher forward prices – but acknowledging this will likely come with extraordinary volatility that has already seen gas prices swing from below $2 to above $9 over the past two years… Our top gas picks are EQT and CHK for the reset in break-even price that we believe can drive relative out-performance vs peers.”

We can follow Wolfe’s recommendations, and take a closer look at both EQT and CHK. These are important players on the North American gas scene, and according to the TipRanks data, both stocks have ‘Buy’ ratings – and for Wolfe, the upside here is at least 35%. So, let’s look into the latest stats and find out why the research firm is predicting such strong gains.

Chesapeake Energy (CHK)

We’ll start with Chesapeake Energy, a hydrocarbon extraction company working in some of the richest gas field regions in the US. Chesapeake’s main operations are in the Haynesville area of Louisiana and in the Marcellus shale of northeast Pennsylvania. The company’s Haynesville holdings total some 370,000 acres and generates 46% of the company’s production, while the Marcellus holding has approximately 465,000 acres and generates 56% of Chesapeake’s gas output.

In addition to its natural gas drilling and extraction activities, Chesapeake is preparing to open operations in the liquified natural gas (LNG) sector. The company has several sale and purchasing agreements (SPAs), under which Chesapeake will purchase set quantities of LNG for delivery to customers.

As of the end of Q1 this year, Chesapeake reported that it was operating eight gas rigs and two completion crews on its holdings. The company’s Q1 production came to 3.20 bcf/d, of which 100% was natural gas. The company drilled 28 wells and put 29 wells into production during the quarter, and set up an inventory of 24 drilled-but-uncompleted wells and 22 deferred turn-in lines, and backlog that bodes well for future production.

On the financial side, Chesapeake generated a non-GAAP net income of $80 million in 1Q24, or 56 cents per share. The EPS figure missed the forecast by 7 cents. Also of note, Chesapeake’s free cash flow came to $131 million.

For Wolfe’s Doug Leggate, CHK has earned a ‘top pick’ spot, based on its combination of a sound balance sheet, strong production, and leading position in its niche. He writes, “CHK is our higher beta gas pick with a stand-alone valuation already supported by a best in class balance sheet that mitigates downside risk to recent gas price weakness, but with the planned acquisition of SWN lifting the combined company to the largest US gas producer in the US and potential operating synergies that already account for >20% of the deals value.”

These comments support the analyst’s Outperform (Buy) rating on the shares, and his $110 price target suggests a one-year gain of 36%. (To watch Leggate’s track record, click here)

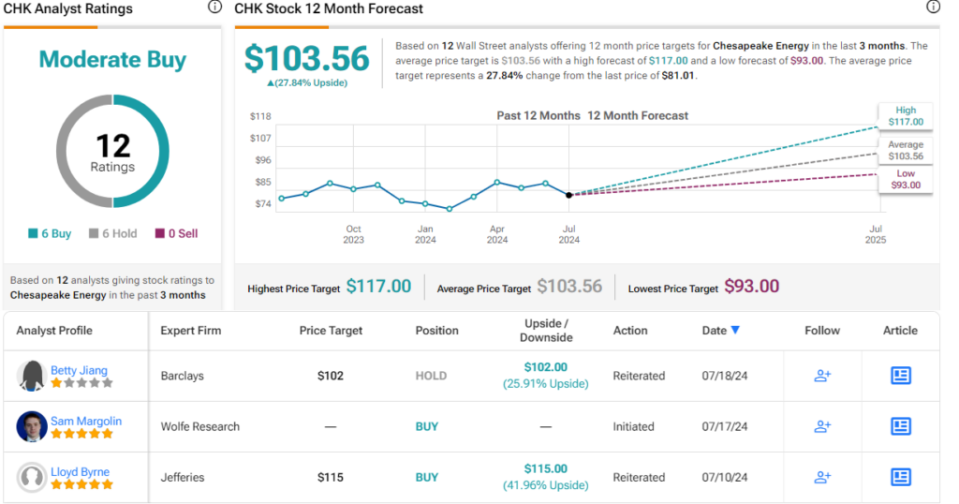

The Moderate Buy consensus rating on Chesapeake’s stock is based on an even split among the 12 recent analyst reviews – 6 Buy and 6 Holds. The shares are priced at $81.01 and their $103.56 average target price points toward a share appreciation of 28% in the coming year. (See Chesapeake’s stock forecast)

EQT Corporation (EQT)

Earlier in this century, the technologies of horizontal drilling and hydraulic fracturing revolutionized the energy extraction industry, especially in its natural gas segment. The techniques made it possible for energy companies to reduce overall costs while increasing production, by using one well to tap multiple underground reservoirs and by opening up known energy reserves that previously could not be tapped.

EQT has long been a leader in both of these technologies, and uses them to conduct operations in the rich Appalachian gas fields. Specifically, the company operates in the Marcellus and Utica shale formations, and has active gas production ongoing in Pennsylvania, West Virginia, and Ohio. These areas are among the richest natural gas production regions in North America, and EQT has more than 1 million net acres in these three states. The company’s holdings include 610,000 net acres in Pennsylvania, mainly in the southwest of the state, as well as 405,000 net acres in West Virginia, in the northwestern part of the state – adjacent to the Pennsylvania holdings. Finally, EQT has 65,000 net acres in eastern Ohio.

Earlier this year, EQT and the midstream company Equitrans announced a merger agreement, under which EQT will acquire Equitrans and its asset network. The deal will be conducted in stock, with each share of Equitrans being exchanged for 0.3504 shares of EQT common shares. The transaction will create a combined company enterprise value of more than $34 billion, and is expected to be completed today (July 22).

We can get an idea of EQT’s operational capabilities and results, pre-merger, from the last released quarterly report. That report, covering 1Q24, showed a top line of $1.72 billion, down 9% from the prior year period but some $130 million better than had been expected. At the bottom line, EQT had a non-GAAP EPS figure of 82 cents per share. While down from the $1.70 per share reported in 1Q23, this earnings figure was 17 cents above the forecast.

Checking in again with the Wolfe view, we find the research firm taking an upbeat view here, based mainly on the potentialities of the Equitrans deal. Leggate writes, “EQT is separated from peers by its pending midstream acquisition (ETRN) that we estimate will pull its portfolio b/even under $2.00 / mcf to one of the lowest in the sector. This is helped by non-core asset sales post-deal that we expect to be faster than the street expects: ETRN was premeditated enough to not underestimate the pace of integration, ahead of better gas pricing in 2025.”

Put into quantifiable terms, this adds up to an Outperform (Buy) rating on EQT, with a $51 price target that suggests the shares will gain 42% over the next 12 months.

Overall, EQT’s Moderate Buy consensus rating is based on 15 analyst reviews that are split fairly even – 8 Buys and 7 Holds. The shares are selling for $35.88 and the $45.92 average target price implies a potential one-year upside of 28%. (See EQT’s stock forecast.)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.

EMEA Tribune is not involved in this news article, it is taken from our partners and or from the News Agencies. Copyright and Credit go to the News Agencies, email news@emeatribune.com Follow our WhatsApp verified Channel