(Bloomberg) — Chinese investors’ demand for better returns overseas is so strong that even an expanded purchase quota for some funds is selling out fast.

Most Read from Bloomberg

Five global bond funds in the so-called Mainland-Hong Kong Mutual Recognition of Funds (MRF) scheme had to suspend new subscriptions this week as mainland inflows neared a limit. The products in the pool, which allows investors to trade without currency controls, had reopened their doors after the Chinese regulator raised the cap on mainlanders’ ownership to 80% from 50% starting Jan. 1.

The demand surge sheds a light on onshore investors scouring for assets abroad as a recent domestic stock rally deflates and sovereign bond yields fall to historic lows on a dimming economic outlook. The MRF funds’ popularity also shows that China’s financial opening, repeatedly pledged by Beijing, may not come without a price if such strong pent-up demand leads to a stream of outflows.

“Investing in Chinese stocks has been a painful experience for investors,” said Li Changmin, managing director at Snowball Wealth in Guangzhou. These MRFs “likely attracted risk-averse capital seeking to diversify amid the low bond yields in China and investors’ losing patience with stock volatility.”

Hong Kong-based JPMorgan Global Bond Fund, an MRF participant that has $2.3 billion in assets, said it’s suspending Chinese investors’ purchases after new subscriptions on Jan. 6 took the mainland ownership to near a limit, according to its filing.

Market Volatility

It’s not just the MRF funds that are in hot demand. Exchange-traded funds that track overseas stocks enjoyed a year in the limelight as US equities powered ahead, and the trend is continuing.

The Invesco Great Wall S and P Consumer Select ETF, which tracks an S&P 500 consumer index, spiked by the 10% daily limit on Monday in China and has continued to rise through the week. That’s even as investors have to pay a hefty premium of nearly 40% for the underlying assets.

China’s market performance explains why investors are looking offshore. The equity benchmark CSI 300 rose more than 14% last year, its first annual gain since 2020 thanks to a stimulus blitz, but has lost nearly 5% in the new year already. It has fallen in all but one session.

Yields on 10- and 30-year government bonds have hit record lows, as investors worry about a looming tariff hike that may further slow economic growth and spur monetary easing. China’s yield discount to the US has expanded to an unprecedented 300 basis points, underscoring the interest-rate appeal of the latter.

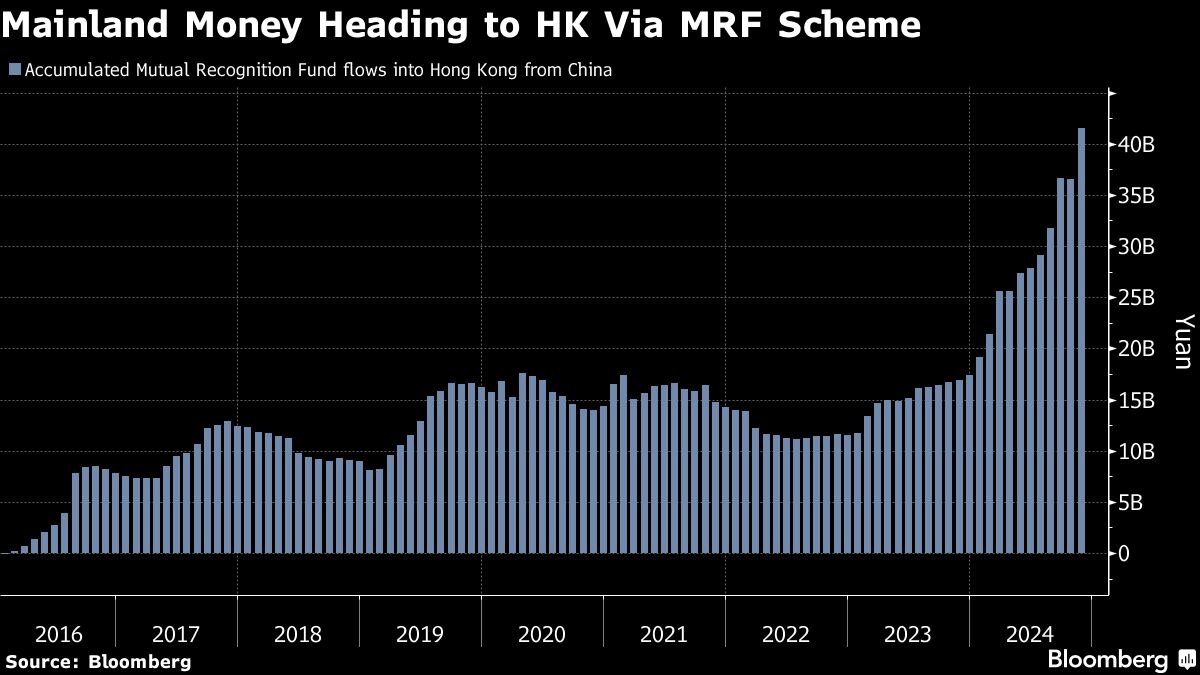

Started in 2015, the MRF scheme allows eligible mainland and Hong Kong funds to market their products in each other’s jurisdiction. The program has grown since as domestic investors are drawn to trading in Hong Kong-incorporated, globally-investing mutual funds without having to convert from the yuan.

There are currently 44 such funds in the scheme. Assets for Hong Kong funds sold to mainland investors amounted to about 41.5 billion yuan ($5.7 billion) as of the end of November, according to the State Administration of Foreign Exchange. There’s plenty of room for the investments to expand, as the amount represents only a fraction of the 300 billion yuan forex quota allocated for such southbound flows.

“With the volatility in China stocks, US bonds are appearing more attractive,” said Yang Ruyi, a fund manager at Shanghai Prospect Investment Management Co.

–With assistance from Jack Wang.

Most Read from Bloomberg Businessweek

©2025 Bloomberg L.P.

EMEA Tribune is not involved in this news article, it is taken from our partners and or from the News Agencies. Copyright and Credit go to the News Agencies, email news@emeatribune.com Follow our WhatsApp verified Channel