Costco Wholesale (COST), popularly referred to as just Costco, is a well-known big-box retail store chain that sells items in bulk and offers household products and groceries at a discount.

When consumers anticipate unfavorable world events that might hinder supply-chain activity, such as the COVID-19 pandemic, they’ll frequently panic-shop at Costco. The company has evidently benefited from some unfortunate recent developments in the world, and that will likely limit future upside potential. Costco has a high valuation and a low dividend yield. I’m neutral on COST, and it doesn’t look like a good month for investors to go shopping on Costco stock.

Costco and the Dock Workers’ Strike

Dock workers on America’s East and Gulf Coasts officially walked off their jobs and began striking on October 1. However, their contracts with employers ended in late September, and consumers used this as an opportunity to stock up on essential goods. Many people remember what occurred near the onset of the COVID-19 pandemic, when citizens rushed to purchase large supplies of products like toilet paper out of fear they might encounter empty shelves later on.

While the dock workers’ strike has already been resolved, and will undoubtedly take a toll on the U.S. economy, it certainly gave a boost to Costco sales in September. The early part of October likely featured much of the same. Investors should keep this in mind as they assess Costco’s results.

Costco Acknowledges “Abnormal” Shopping Activity

Amidst the panic shopping that likely occurred in anticipation of the dock workers’ strike, Costco management acknowledged a shopping activity boost in September due to the onset of Hurricane Helene. Specifically, Costco’s management cited “abnormal consumer activity associated with Hurricane Helene and port strikes.” Hurricane Milton might “make it rain” again for Costco’s top line in October, but this is also another one-time event. Investors probably shouldn’t count on such events providing a boost to Costco indefinitely.

Breaking down Costco’s sales numbers for the ‘retail’ month of September (the five weeks ended October 6, 2024), the company’s net sales jumped 9% year-over-year to $24.62 billion. Moreover, during that same timeframe, Costco’s U.S. comparable-store sales increased 6.5% and the company’s e-commerce sales surged 22.9%.

The spike in e-commerce sales is eye-catching, but it’s easy to imagine shoppers ordering essential household goods online as soon as they heard about the port strike and hurricane developments. I can’t expect that Costco will maintain a ~23% growth rate in e-commerce sales for much longer.

Costco’s High Valuation and Low Dividend Yield

Costco investors may have already gotten ahead of themselves, in my view, as COST stock’s valuation is quite high. Alarmingly, Costco’s trailing 12-month adjusted (non-GAAP) P/E ratio is 55.1x. In contrast, the sector median P/E ratio is 17.8x and Costco’s five-year average P/E ratio is 41.2x. It’s entirely possible that all current and anticipated benefits of the aforementioned events have been priced into COST stock.

Income-focused investors also aren’t served very well by Costco stock at the current market price. The average forward annual dividend yield for the Consumer Cyclical Sector is around 1%, versus about 0.5% for COST. Investors won’t be getting rich from Costco’s quarterly dividend distributions. Regardless of whether you’re a value-focused investor or a high yield seeker, Costco stock probably doesn’t look attractive right now.

Digging Deeper into Costco’s Sales Performance

Drilling down into Costco’s recent sales performance, we can observe that the company reported fourth-quarter Fiscal Year net sales of $78.2 billion. That’s only a 1% increase when compared to the $77.4 billion in net sales that Costco generated in the year-ago quarter.

As we’ll discuss below, analysts are generally only lukewarm about COST stock. This assessment, despite Costco’s impressive-looking September performance, makes logical sense to me. In light of the company’s lackluster fourth-quarter net sales growth, one could suspect that September was just an outlier.

Yellow Flags in Costco’s Financials

Moreover, after checking the TipRanks’ Financials page for Costco, we will discover some potential cautionary signals. Costco’s cash and cash equivalents position dwindled from $15.23 billion in the year-earlier period to $11.14 billion in the quarter ended August 2024. During that time frame, Costco’s free cash flow decreased from $2.17 billion to $1.38 billion, which is a notable decline. The deteriorating cash picture further supports my neutral position on COST stock.

The company is also up against tough comps, and it will be interesting to see how investors react to substantially lower sequential results. Per TipRanks’ earnings page for Costco, we can see an EPS expectation of only $3.78 for the current quarter. That represents a significant drop from the recent quarter’s $5.29 EPS result. That’s another reason to be cautious on COST stock at the current time, in my opinion.

Is Costco Stock a Buy, According to Analysts?

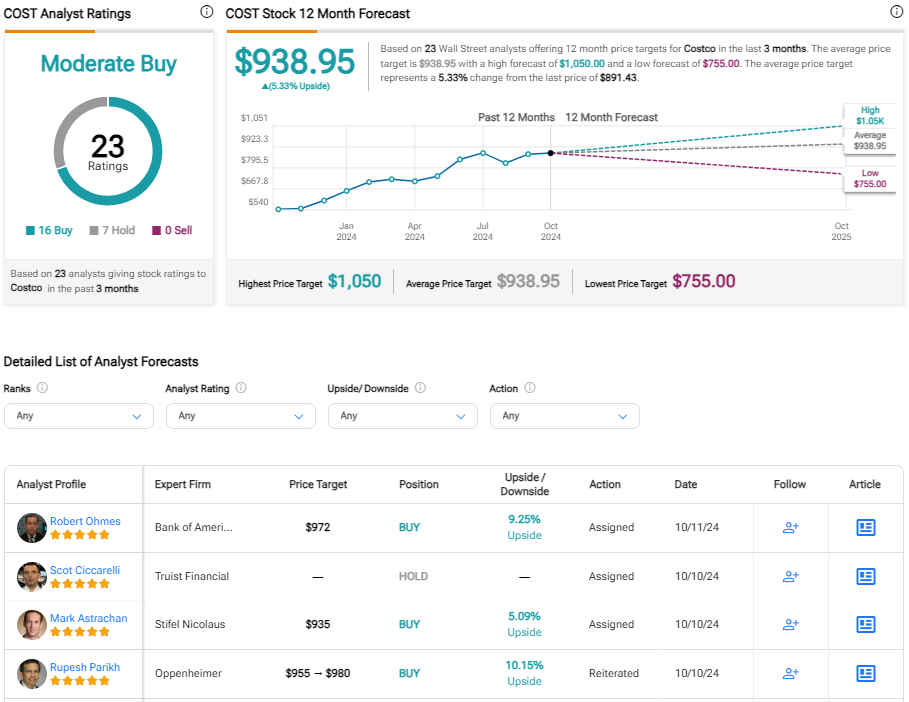

On TipRanks, COST comes in as a Moderate Buy based on 16 Buys and seven Hold ratings assigned by analysts in the past three months. There are no current Sell ratings. The average COST stock price target is $938.95, implying about 5% potential upside.

If you’re wondering which analyst you should follow on COST stock, the most profitable analyst covering the stock (on a one-year timeframe) is Laura Champine of Loop Capital Markets, with an average return of 30.09% per rating and a 96% success rate.

Conclusion: Should Investors Consider Costco Stock?

Currently, COST stock doesn’t seem very appealing based on value or dividend yield measures. The company’s September retail revenues were very impressive, but it’s hard to imagine that the market hasn’t already factored the positive numbers into the current valuation. Future results are also susceptible to a dearth of one-time events that have boosted Costco’s business lately.

As a consumer, I might shop at Costco to stock up on essential items, but as an investor I don’t feel any draw to investing on COST stock right now. For the time being, I’m staying neutral on shares of Costco.

EMEA Tribune is not involved in this news article, it is taken from our partners and or from the News Agencies. Copyright and Credit go to the News Agencies, email news@emeatribune.com Follow our WhatsApp verified Channel