(Bloomberg) — Investors searching for ways to navigate the artificial intelligence story are turning their sights away from Taiwan and toward South Korea.

Most Read from Bloomberg

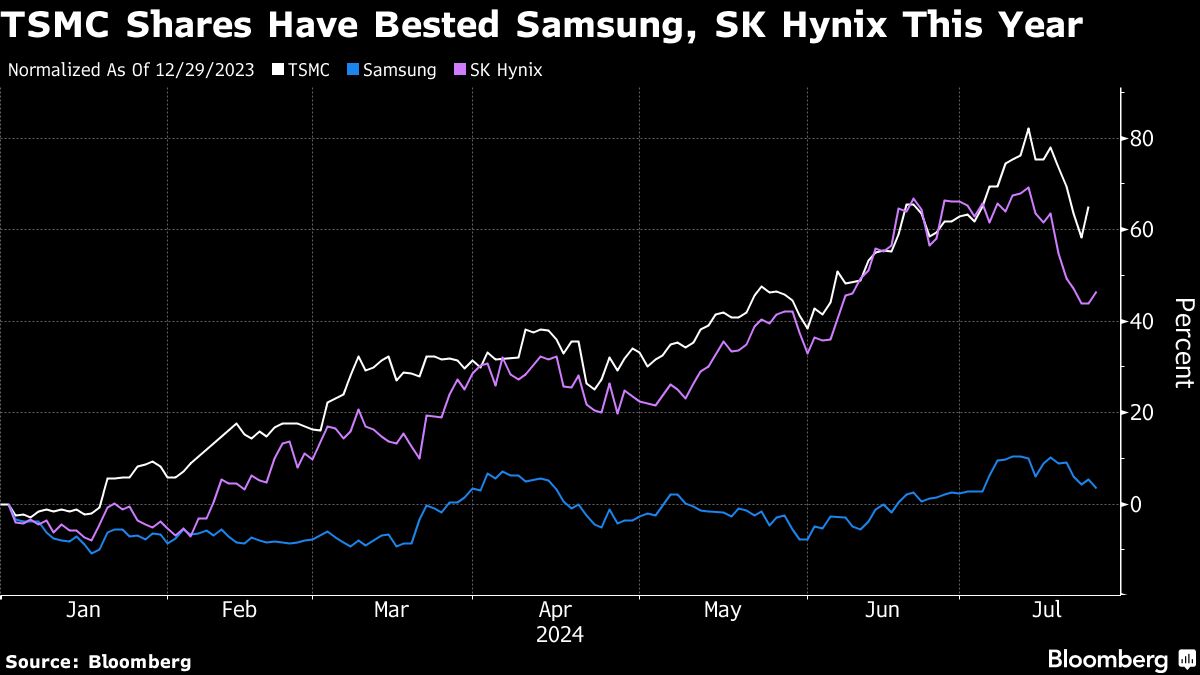

Federated Hermes, M&G Investments and Invesco Asset Management are underweight Taiwanese stocks and overweight Korean shares, saying positioning in the former has become crowded after a record-breaking rally. A push from Samsung Electronics Co. and SK Hynix Inc. into high-bandwidth memory, cheaper valuations and outsized gains from Taiwan Semiconductor Manufacturing Co. are making Korean shares a more appealing bet.

“We have an underweight allocation to Taiwan given more attractive opportunities in Korea,” said James Cook, head of investment specialists at Federated Hermes. The asset manager’s biggest stock position is in Samsung as it’s “priced only on its non-AI business which is mid-to-low cycle, and at a record discount to TSMC.”

Taiwan offers more direct exposure to the AI theme with index heavyweight TSMC, a key supplier for advanced chips used by Nvidia Corp., but Korea isn’t far behind. SK Hynix provides most of the HBM chips for Nvidia’s AI processors, while Samsung — which has been lagging rivals this year — recently started ramping up HBM production.

Valuations also suggest a more alluring risk-reward for Korea at a time when investors are becoming more skeptical of stock prices for AI tech darlings.

Read: AI Fever Cools, Sending Nasdaq 100 Into $1 Trillion Tailspin

The Taiex Index trades at almost 18 times forward earnings, nearly twice as expensive as the Kospi Index. After a 65% year-to-date run, TSMC is trading at 20 times forward earnings versus 11.4 times for Samsung and 6.8 times for SK Hynix.

Read: Janus Henderson Trims China Stock Holdings to Add Samsung Shares

Recent fund flows are telling. Foreign funds have net sold $7.2 billion worth of Taiwanese stocks so far this month amid a global chip selloff, set for the most in two years. Meanwhile, Korean shares have seen $1.6 billion of net inflows during the period.

For some fund managers’ mandates or index-tracking funds, the weighting of TSMC is already reaching a ceiling, meaning they will have to find smaller peers to get equivalent exposure.

Long-only funds have reduced TSMC positions in recent months, according to Morgan Stanley, causing the stock’s foreign ownership to drop to the lowest level since February.

The memory chip recovery is particularly positive for Korean stocks. The supply glut in previous years has sowed “the seeds for shortages, price recovery and renewed profitability,” said John Pellegry, product director for Asian and emerging market equities at Invesco. “This dynamic was boosted by AI demand and supplemented the strong earnings growth prospects.”

Korea is also getting a boost from the “Corporate Value-up Program,” with companies striving to increase shareholder returns and improve corporate governance.

To be sure, the rotation from Taiwan to Korea may be just tactical, as Taiwanese tech stocks have robust long-term growth prospects given the island’s critical role in the global AI supply chain.

And Korea isn’t immune to broader tech selloffs. On Thursday, a global rout sent SK Hynix shares tumbling the most since November 2022 despite solid earnings. Samsung also fell.

“When you buy Taiwan, you can’t avoid having a lot of TSMC,” said Keiko Kondo, head of multi-asset investments for Asia at Schroder Investment Management. But “AI is not just about Nvidia, and Taiwan is not just about TSMC either. So if that theme is real, there are other names also in Taiwan that are benefiting from that.”

Still, some see Korea as a better place to play the AI story for now.

The country offers “exposure to similar themes at much more appetizing valuations,” said Fabiana Fedeli, chief investment officer for equities, multi asset and sustainability at M&G. While Taiwan is home to some AI winners, “it has become a crowded position. And so you obviously want to make sure that you don’t have all your eggs in one basket.”

(Updates with Thursday’s share moves.)

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.

EMEA Tribune is not involved in this news article, it is taken from our partners and or from the News Agencies. Copyright and Credit go to the News Agencies, email news@emeatribune.com Follow our WhatsApp verified Channel