Summary

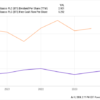

Halfway through 2024, sector breadth has deteriorated somewhat from strong levels earlier in the year — but remains better than that at mid-year 2023. Communication Services and Information Technology at mid-year 2023 were high-teen percentage points higher than the benchmark index; currently, they are, on average, beating the broad market by high-single to low-double-digit percentages. While only these two sectors are ahead of the S&P 500, multiple sectors — including Energy, Financial, Utilities, Consumer Staples, and Healthcare — currently are beating or slightly lagging the index’s average annual appreciation of 10% since 1980. Materials and Consumer Discretionary are up 4%-6% year to date, while Real Estate — deeply negative for much of 2024 — is down less than 2% as of mid-year. The Consumer Discretionary sector, one of the top-three performers in 2023, was ninth among 11 sectors in 2024 to date. Spending by consumers, particularly those in the middle and lower tiers of the economy,

Upgrade to begin using premium research reports and get so much more.

Exclusive reports, detailed company profiles, and best-in-class trade insights to take your portfolio to the next level

EMEA Tribune is not involved in this news article, it is taken from our partners and or from the News Agencies. Copyright and Credit go to the News Agencies, email news@emeatribune.com Follow our WhatsApp verified Channel