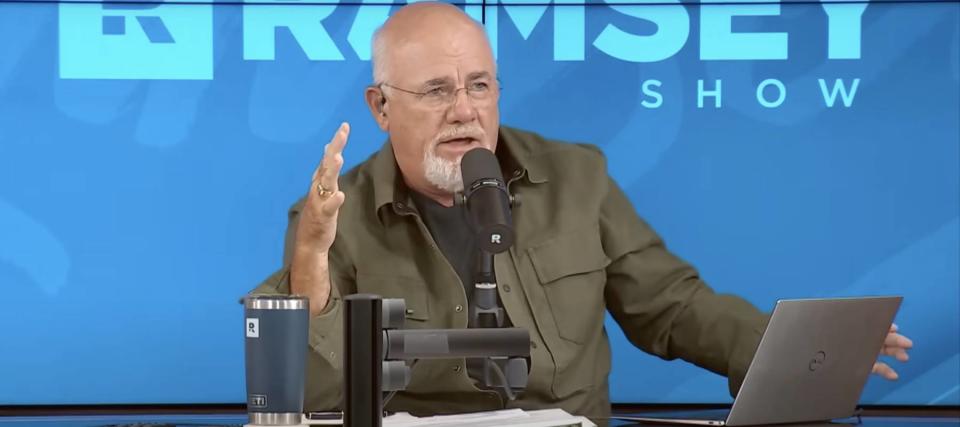

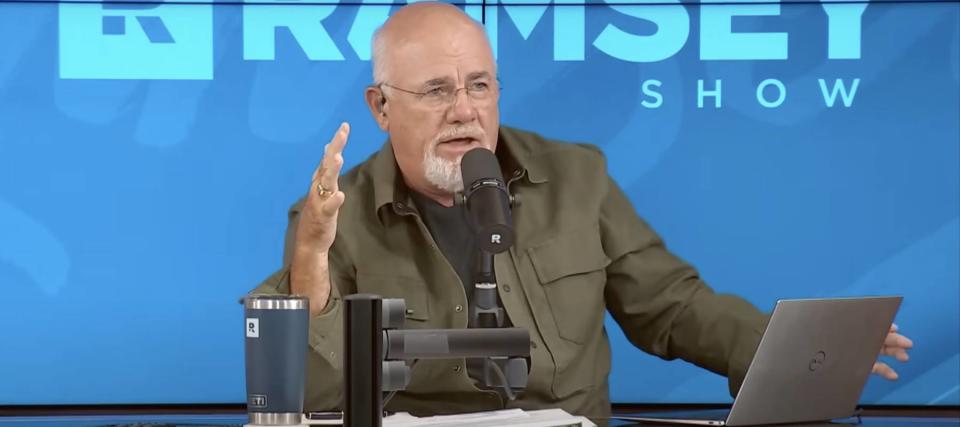

Dave Ramsey, the renowned financial adviser and radio show host, has built a reputation for advocating straightforward and simple investment strategies.

His philosophy is rooted in the belief that investors don’t need complicated maneuvers and sophisticated assets to perform well.

“I don’t play single stocks, I don’t screw around with gold, I don’t mess with Bitcoin and I don’t need your stock tip from your broke golfing buddy with an opinion,” he said in an off-the-cuff rant during an episode of The Ramsey Show.

Don’t miss

-

Commercial real estate has beaten the stock market for 25 years — but only the super rich could buy in. Here’s how even ordinary investors can become the landlord of Walmart, Whole Foods or Kroger

-

Car insurance premiums in America are through the roof — and only getting worse. But 5 minutes could have you paying as little as $29/month

-

These 5 magic money moves will boost you up America’s net worth ladder in 2024 — and you can complete each step within minutes. Here’s how

For those who insist he “missed out” on better opportunities, Ramsey had a clear message: “Didn’t miss a thing! I’ll set my net worth down beside yours while you mouth off!”

Instead of chasing “cool” asset classes, the financial guru says his net worth, which is estimated at $200 million, is concentrated in only three investments. Here’s a closer look at his streamlined portfolio.

His business

Like many ultra-wealthy individuals, Ramsey’s business ventures are a major contributor to his immense net worth. In 2024, he estimates the business will generate roughly $300 million in revenue. Since it’s a private company, it’s difficult to confirm its valuation and how much Ramsey’s personal stake in the business is worth.

Business interests account for 41% of total wealth for those in the top 1%, according to the Federal Reserve’s Survey of Consumer Finances. In other words, starting or buying a successful business can be a great way to build a fortune.

Fortunately, Americans are highly entrepreneurial. According to the U.S. Chamber of Commerce, 5.5 million new businesses were registered in 2023 alone. Meanwhile, 93% of working Americans have a side hustle, and 44% rely on income from their side hustle to cover bills and make ends meet, according to a recent Insuranks.com survey.

Getting involved in this entrepreneurial wave could be beneficial for your personal finances.

Debt-free real estate

Ramsey is more passionate about real estate than any other asset class. He acquired his real estate license when he turned 18 and was already a millionaire by the time he was 26. However, a brush with bankruptcy left him permanently wary of leverage.

Ramsey now insists his vast real estate portfolio is owned outright with no mortgages attached.

Ramsey’s approach isn’t common but his fascination with real estate is understandable. The U.S. residential real estate market is worth $52 trillion in aggregate, according to Zillow. That makes it a larger asset class than equities since the combined value of all public companies is roughly $50 trillion.

For most ordinary American families, their primary residence is their largest asset, according to analysis by the Pew Research Centre. Like Ramsey, a whopping 39.3% of homeowners own their property without a mortgage, according to the U.S. Census data.

However, with rising interest rates and home prices, it’s become increasingly difficult for first-time home buyers to buy real estate without taking on a large and expensive mortgage. If you’re looking for exposure to this asset class without purchasing physical property, consider a real estate investment trust such as Equity Residential Properties Trust (EQR), which owns 299 properties consisting of 79,688 apartment units across America’s largest cities.

Read more: Car insurance rates have spiked in the US to a stunning $2,150/year — but you can be smarter than that. Here’s how you can save yourself as much as $820 annually in minutes (it’s 100% free)

Mutual funds

Ramsey has often mentioned his preference for mutual funds that track the broader stock market. Instead of stock picking, he believes a passive investing approach is better.

This theory has become increasingly popular. Passive investment strategies now have more assets under management than actively invested funds, according to Morningstar. The Vanguard S&P 500 ETF, a low-cost fund that simply tracks the S&P 500 index, has delivered a compounded annual growth rate of 14.51% since 2010.

Adding some exposure to the stock market through index funds could be another way to accelerate your wealth-creation journey.

What to read next

This article provides information only and should not be construed as advice. It is provided without warranty of any kind.

EMEA Tribune is not involved in this news article, it is taken from our partners and or from the News Agencies. Copyright and Credit go to the News Agencies, email news@emeatribune.com Follow our WhatsApp verified Channel