(Bloomberg) — The diesel market in India is losing momentum as the economy expands at a slower pace and consumption patterns shift in the world’s third-largest oil importer.

Most Read from Bloomberg

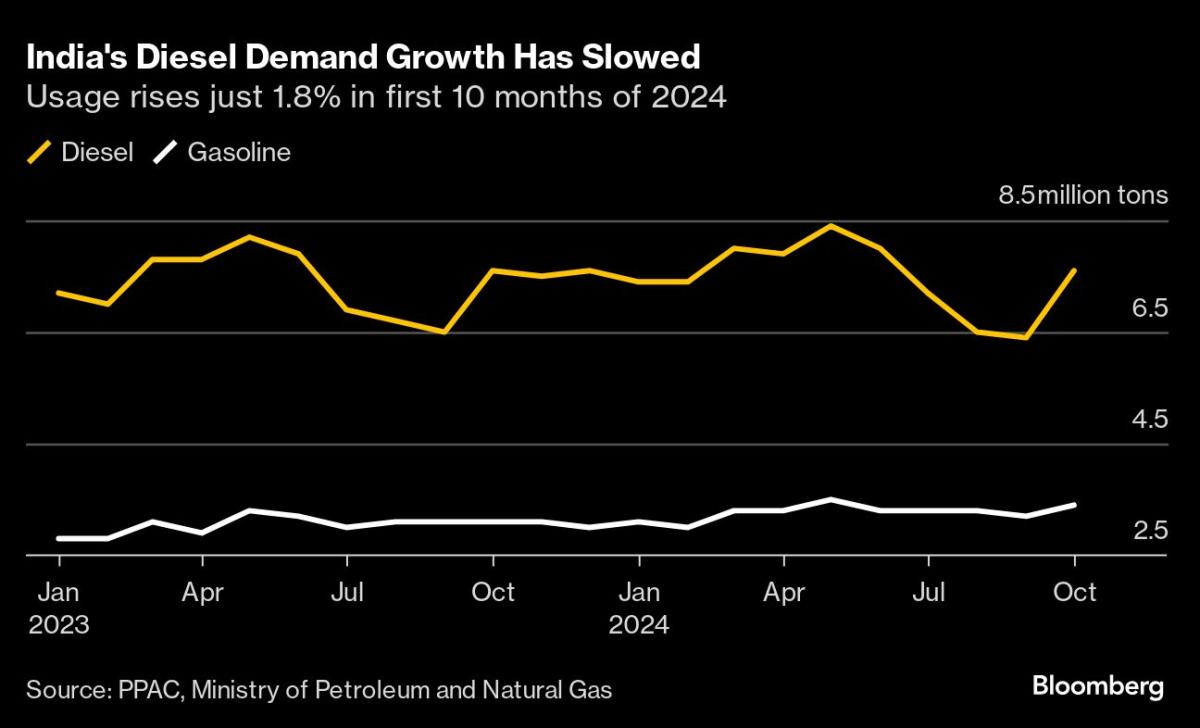

Sales of the fuel used to power trucks and farm machinery were flat at 7.64 million tons in October from a year earlier, according to preliminary oil ministry data. In the first 10 months of 2024, volumes expanded by just 1.8%, the slowest pace since 2020, when pandemic lockdowns hit demand.

Diesel accounts for about four barrels in every 10 of oil used in India, and the softness comes just as signs of weak buying have been seen in China and Europe. That’s potentially a headwind for crude prices, with investors also grappling with market cross-currents thrown up by OPEC+ supply policy, the US presidential election, and prospects for a global oil glut in 2025.

“The consumption of goods in smaller towns and cities of India has not picked up at the pace that was expected,” said R. Ramachandran, former director of refineries at Bharat Petroleum Corp Ltd. “This has in all likelihood impacted the movement of trucks that transport goods, hurting diesel demand. Also, rains this year got extended, further adding to pressure on diesel sales for farm sector.”

The listless demand for diesel last month contrasts with patterns seen in other key petroleum products. Gasoline sales jumped 8.4% in October on-year to 3.4 million tons, while jet-fuel volumes swelled by 8.6% to 751,000 tons.

“India’s oil-demand profile is evolving, with a noticeable shift from diesel to gasoline,” said Esteban Moreno Cots, senior demand analyst at Kpler. “This transition is supported by rising consumer spending, and an expanding middle class.”

For the full year, diesel demand is projected to grow by 2.2%, followed by 2.5% in 2025, according to Kpler. “We observe a moderation in the growth rate compared to the post-pandemic recovery,” he said.

Slowing Growth

While India’s economic growth has slowed, it remains one of the stronger performers in emerging markets, a trend that typically aids diesel consumption. Gross domestic product rose 6.7% in the three months to June, the slowest pace in five quarters, and banks including Goldman Sachs Group Inc. have been lowering GDP forecasts. Among other signals, industrial production contracted for the first time in almost two years in August.

In China, the largest oil importer, diesel demand has been falling because of the spread of trucks powered by liquefied natural gas, and the drawn-out property crisis. In Europe, meanwhile, futures recently flipped into contango, a bearish structure with prompt prices cheaper than those further out.

India’s diesel demand is contingent on the health of the economy, according to Ramachandran. Also, there’s no major threat yet from alternatives such as LNG in trucking, which is in its initial stages locally, he said

(Adds GDP outlook in eighth paragraph)

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.

EMEA Tribune is not involved in this news article, it is taken from our partners and or from the News Agencies. Copyright and Credit go to the News Agencies, email news@emeatribune.com Follow our WhatsApp verified Channel