Financial analysts in the Philippines have said the central bank’s recent sales of gold is part of a routine strategy to generate profits and manage the country’s foreign asset reserves, contrary to misleading social media posts that claimed the move was a sign of financial instability. The claim was shared by allies of former president Rodrigo Duterte, who has had a public falling out with incumbent President Ferdinand Marcos. The latest figures from August 2024 show the country maintains foreign asset reserves of $107.9 billion, enough to cover 7.8 months of imports.

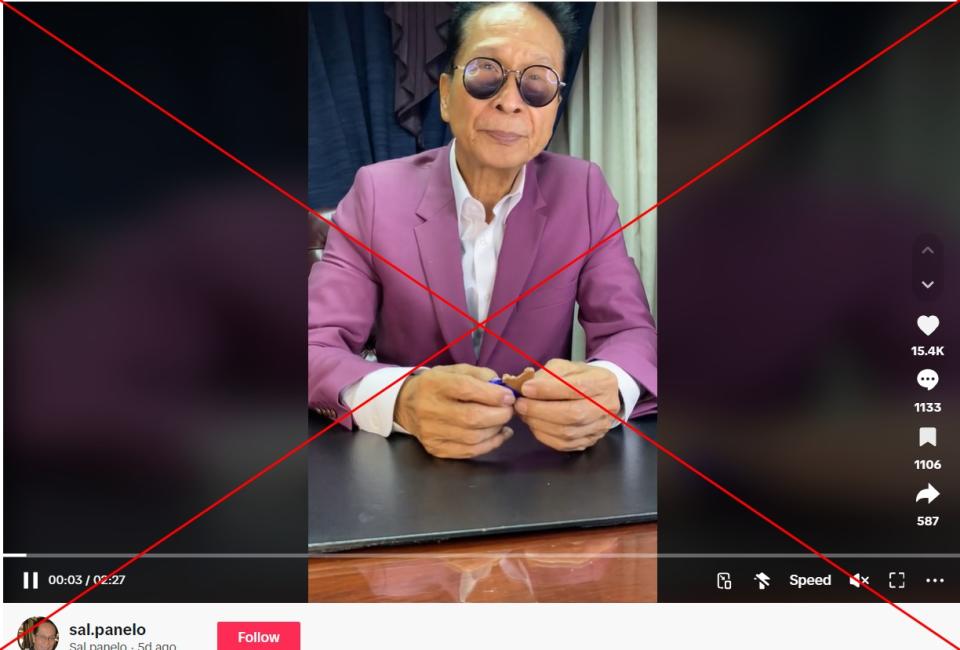

The claim was shared by Salvador Panelo, Duterte’s former spokesperson and chief legal counsel, on September 24, 2024 on TikTok, where it racked up over 350,000 views (archived link).

Panelo was reacting to an Esquire Philippines report on how the country sold the most gold worldwide in the first half of 2024 (archived link).

“Why would we sell gold reserves?” he asked before going on to claim the reserves are “meant to be used only when needed” — when a country runs out of money, to prevent bankruptcy and safeguard the economy.

“So if we’re selling, it means we have a problem — that we’re selling because we’ve run out of money.”

Relations between the Marcos and Duterte families have deteriorated ahead of the 2025 midterm elections, with accusations of drug abuse, threats to split the country and rumours of a coup plot shattering their public facade of unity (archived link).

Panelo’s video was also reposted on Facebook here and here, while other known supporters of Duterte made similar claims questioning the sale of gold reserves here and here.

Social media users left a flurry of comments indicating they believed the central bank’s gold sale was a sign of economic distress, while others alluded to the corrupt rule of Ferdinand Marcos Sr, the current president’s father.

An estimated $10 billion was stolen from state coffers over the course of Marcos Sr’s 20-year rule that left the country impoverished.

“The Philippine is really in serious trouble,” one user said.

“Congress must investigate this,” another commented.

The posts have misrepresented the central bank’s gold sales, multiple experts told AFP.

‘Robust’ reserves

In a September 24 statement, the Bangko Sentral Ng Pilipinas (BSP) explained that it sold gold as part of an “active management strategy” of the country’s gold reserves (archived link).

It said the sales were made to “take advantage of the higher prices of gold in the market” and had generated additional income without compromising the central bank’s objectives of holding gold as a safety net.

“Amid the gold sales, the country’s Gross International Reserves (GIR) has remained robust, with the end-August 2024 figure rising to US$107.9 billion from US$103.8 billion as of end-December 2023.”

Victor Abola, an economist at the University of Asia and the Pacific, told AFP on September 25 that the claim that the BSP’s sale of gold indicated poor economic standing was “erroneous and misleading.”

Gold is only one component of the country’s total GIR alongside other assets such as foreign currencies, he explained.

When the central bank sells gold, it receives payment in the form of US dollars or other reserve currencies. The value of the country’s reserves remains “basically unchanged”, Abola said.

The BSP earlier reported that by the end of August, the country’s reserves could cover 7.8 months of imports and were about six times the amount of short-term external debt (archived link).

These figures are “good” and exceeds the typical threshold for reserve adequacy, according to financial analyst Jonathan Ravelas.

He told AFP on September 25 that the “rule of thumb” suggests countries should hold reserves covering 100 percent of short-term debt, or the equivalent of three months’ worth of imports.

Ravelas also said gold was a volatile asset and “taking profits in an uptrending market is wise,” especially when market prices stood at all-time highs.

“There is no harm in taking profits. This is part of the strategy. The change is minimal and still focuses on building reserves,” he added.

In a follow-up report to its earlier article about the central bank’s gold sales, Esquire Philippines interviewed an economist who said the move was a “prudent investment decision” (archived link).

AFP has previously debunked claims about the Philippine central bank.

EMEA Tribune is not involved in this news article, it is taken from our partners and or from the News Agencies. Copyright and Credit go to the News Agencies, email news@emeatribune.com Follow our WhatsApp verified Channel