(Bloomberg) — Equities in Japan and China advanced following gains on Wall Street as investors cheered a string of encouraging economic data points from the world’s three largest economies.

Most Read from Bloomberg

Japan’s Topix index and China’s CSI 300 benchmark both rallied more than 1%, while futures contracts for the S&P 500 and Nasdaq 100 both rose in Asian trading. The gains followed data showing Japan’s economy grew faster than analysts forecast in the second quarter, and signs of stabilization in China that included slowing declines in home prices and better-than-expected retail sales.

The data in China may mark “early signs of stabilization in retail sales and home prices, which have been the weak spots in recent months,” said Marvin Chen, an equity strategist at Bloomberg Intelligence in Hong Kong.

The economic reports added further support for sentiment after US inflation data Wednesday showed year-on-year core consumer prices in July rose at the slowest pace since 2021, paving the way for anticipated Federal Reserve interest-rate cuts next month.

Traders are currently fully pricing in one 25 basis-point reduction in September and 100 basis points of easing through year-end, indicating a degree of confidence the central bank will deliver one half-point cut in the remaining three meetings of 2024.

Australian shares also advanced, while those in Taiwan were little changed. Financial markets in South Korea and India are shut for holidays.

Treasuries, Dollar

Treasuries fell in Asia with the 10-year yield climbing one basis point to 3.84%. The dollar strengthened versus most of its major peers. The yen was little changed near 147 to the greenback after weakening 0.3% Wednesday.

Australian 10-year bond yields slipped to a 13-month low before trimming those declines after jobs growth surpassed expectations, underscoring the resilience of the labor market to elevated interest rates.

Evercore’s Krishna Guha said the US CPI wasn’t perfect but was good enough as it was consistent with a tame read on the Fed’s preferred inflation measure. In addition, the Fed has disavowed data-point dependence, and is looking at the wider outlook and balance of risks.

“This is now a labor data-first Fed, not an inflation data-first Fed, and the incoming labor data will determine how aggressively the Fed pulls forward rate cuts,” Guha said.

‘Weak Sentiment’

In addition to China’s data, the central bank announced it would inject one-year liquidity to domestic lenders on Aug. 26, instead of Aug. 15, a rare delay that comes amid a broad overhaul of its policy toolkit.

Tencent Holdings Ltd. dropped in Hong Kong despite posting an 82% increase in net income in results released late Wednesday, helped along by demand for its mobile games. The company’s US-listed shares fell Wednesday, weighed down by concerns about the Chinese economy.

Hedge fund manager Michael Burry, who bet against the US housing market in 2008, further increased his stake in Alibaba Group Holding Ltd. despite cutting his equity portfolio in half in the second quarter.

Investors will also be focused on further reaction to the decision by Japanese Prime Minister Fumio Kishida to bow out of the ruling Liberal Democratic Party’s leadership election next month. The move will trigger “a period of modest political uncertainty,” said Taro Kimura, senior Japan economist for Bloomberg Economics. “That’s hardly a welcome prospect for markets in light of the recent turmoil in stocks and the yen.”

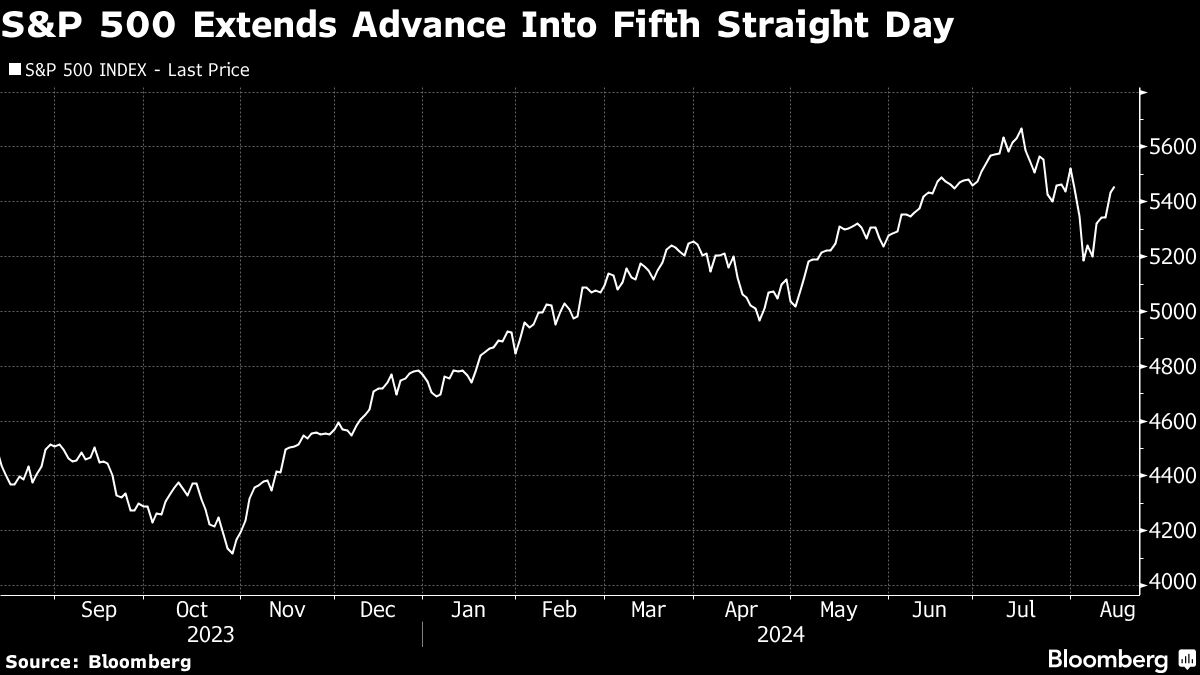

The S&P 500 extended its advance into a fifth straight day on Wednesday, the longest winning streak in more than a month. Most of its major groups gained, with financial, energy and tech shares leading the charge. In late trading, Cisco Systems Inc. climbed on a solid revenue forecast.

Megacaps were mixed, with Nvidia Corp. up and Alphabet Inc. down. Wall Street’s “fear gauge” — the VIX — continued to subside, dropping to around 16. That’s after an unprecedented spike that took the gauge above 65 last week.

In commodities, oil clawed back gains in early trading after falling for a second session on Wednesday. Gold edged higher after two daily declines to trade around $2,450 per ounce.

Key events this week:

-

US initial jobless claims, retail sales, industrial production, Thursday

-

Fed’s Alberto Musalem and Patrick Harker speak, Thursday

-

US housing starts, University of Michigan consumer sentiment, Friday

-

Fed’s Austan Goolsbee speaks, Friday

Some of the main moves in markets:

Stocks

-

S&P 500 futures rose 0.3% as of 11:55 a.m. Tokyo time

-

Japan’s Topix rose 1.2%

-

Australia’s S&P/ASX 200 rose 0.3%

-

Hong Kong’s Hang Seng rose 0.5%

-

The Shanghai Composite rose 0.9%

-

Euro Stoxx 50 futures rose 0.5%

Currencies

-

The Bloomberg Dollar Spot Index was little changed

-

The euro was little changed at $1.1009

-

The Japanese yen was little changed at 147.46 per dollar

-

The offshore yuan fell 0.1% to 7.1570 per dollar

Cryptocurrencies

-

Bitcoin fell 1.2% to $58,465.01

-

Ether fell 0.9% to $2,651.8

Bonds

-

The yield on 10-year Treasuries was little changed at 3.84%

-

Japan’s 10-year yield was unchanged at 0.815%

-

Australia’s 10-year yield declined four basis points to 3.89%

Commodities

-

West Texas Intermediate crude rose 0.4% to $77.28 a barrel

-

Spot gold rose 0.2% to $2,451.86 an ounce

This story was produced with the assistance of Bloomberg Automation.

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.

EMEA Tribune is not involved in this news article, it is taken from our partners and or from the News Agencies. Copyright and Credit go to the News Agencies, email news@emeatribune.com Follow our WhatsApp verified Channel