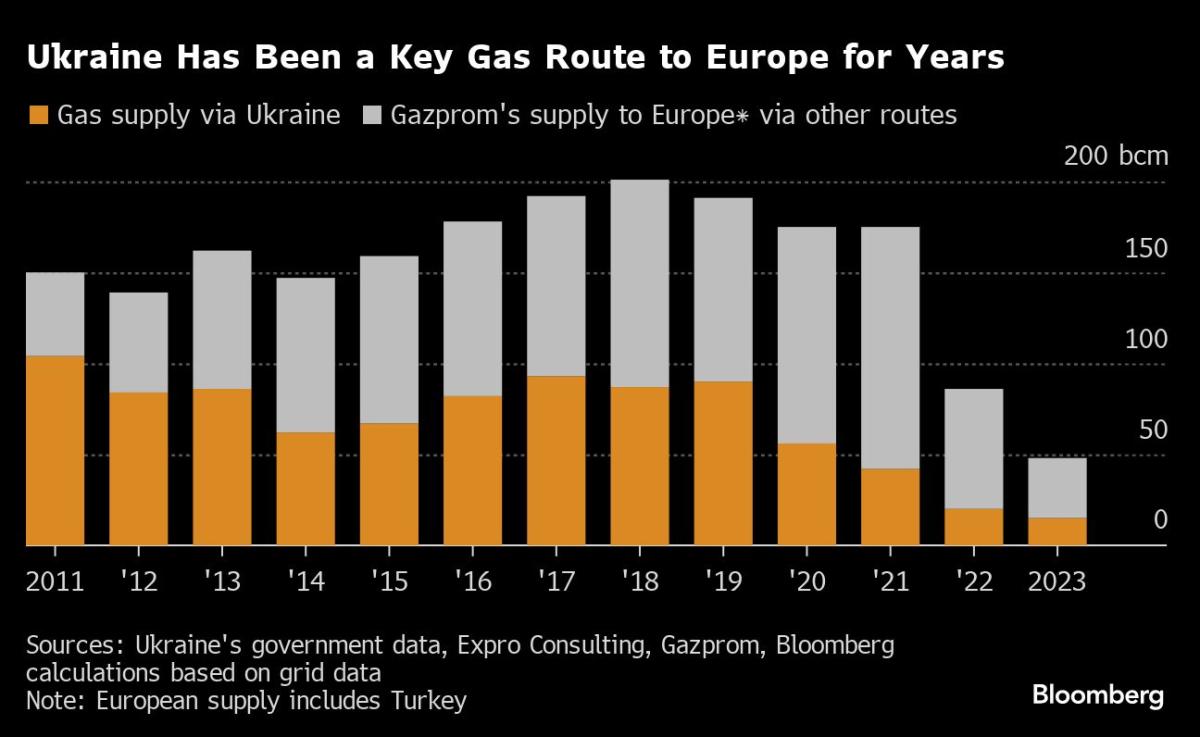

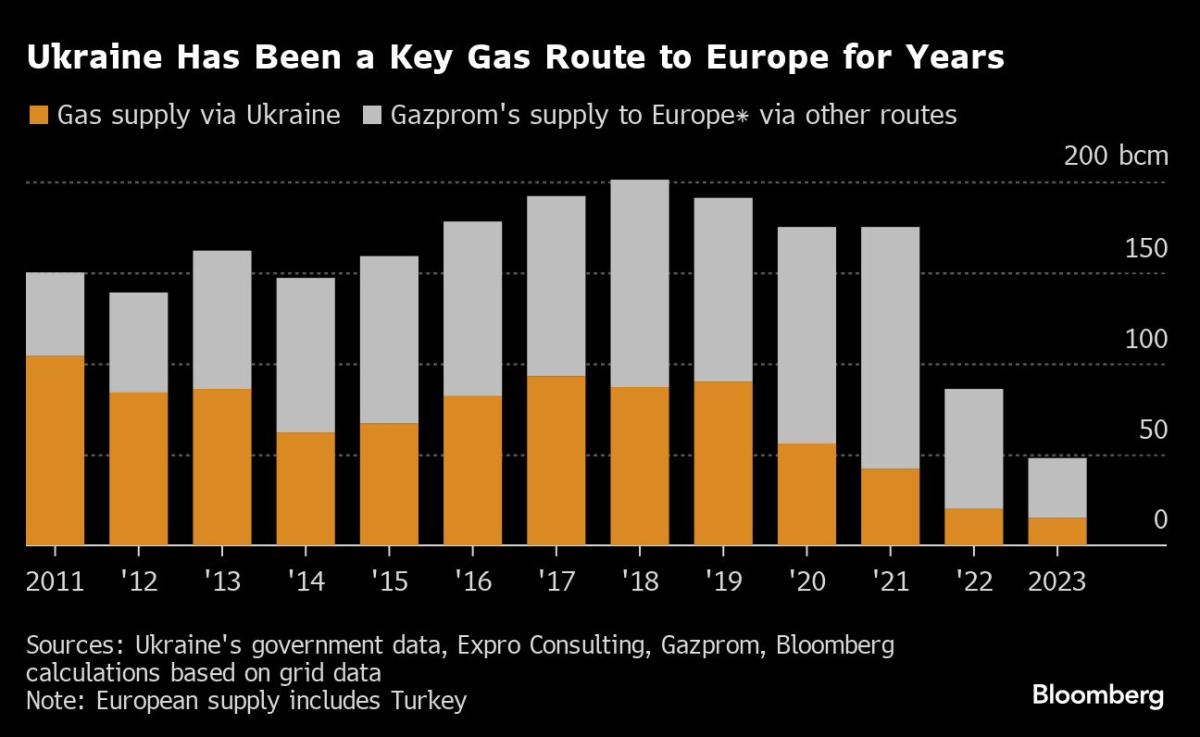

(Bloomberg) — With more than 22,000 kilometers of natural gas pipelines, Ukraine has been a key player in Europe’s energy markets for decades. But by the end of the year, those strategic assets might be stranded.

Most Read from Bloomberg

While talks are intensifying ahead of the heating season, an agreement between Moscow and Kyiv to move Russian gas to Europe is unlikely to be renewed before it expires in December. That would halt flows, which continued through more than two years of the full-scale invasion, hitting the market at a critical period.

“The end of transit through Ukraine really represents the end of an era that has been slowly simmering,” said Margarita Balmaceda, an international relations professor at Seton Hall University, who specializes in energy politics of the post-Soviet states.

For the continent’s taut energy markets, it means more uncertainty, while Russia would lose one of the two remaining pipeline routes to Europe for its gas. But Ukraine may have the most at stake, losing funds to help sustain its energy infrastructure and its long-held strategic position as a conduit of affordable energy for western allies.

For more than five decades, gas flows have been a key feature linking Russia, Ukraine and Europe. Ever since the Soviet Union collapsed, tensions over transit have been part of Russian and Ukrainian relations. Disputes led to supplies getting cut in 2006 and 2009, causing several European customers to get shut off for days during freezing temperatures.

The current transit deal between Ukraine’s state-run energy company Naftogaz JSC and Russia’s Gazprom PJSC was agreed in late 2019, when Europe’s energy map looked completely different. Flows through the route now account for less than 5% of the continent’s supplies, but that’s still enough to have an impact on energy security.

The bitter reality for Ukraine now is that nobody needs a renewal of the gas-transit pact quite as much as Kyiv. Financially, it risks losing as much as $800 million a year in transit fees, according to estimates from Mykhailo Svyshcho, an analyst from Kyiv-based ExPro Consulting. That’s already about a third of what it used to be.

While that’s small change compared to the billions that Russia has lost from European customers since its 2022 invasion, it might take more than a revival of the pact to bring the flows back after the Kremlin sought to weaponize energy links.

Most customers have managed to find alternatives. After relying on Russian gas for more than half of its needs before the invasion of Ukraine, Germany increased pipeline deliveries from Norway and ramped up facilities to import liquefied natural gas from around the world. It’s now independent of imports via Ukraine’s pipelines.

That said, the door isn’t entirely closed. With Germany’s manufacturing sector under pressure, some opposition parties and business leaders call for a return to cheaper pipeline deliveries from Russia. The Ukraine route would be the most viable after the Nord Stream pipeline to Germany was sabotaged in September 2022.

Austria and Slovakia — the main recipients of the fuel that still flows via Ukraine — say they’re ready to move on from Russia-linked pipelines. Slovakia’s largest gas supplier SPP said it’s in a comfortable situation ahead of the winter. Austria is working under the assumption that gas via Ukraine stops in January, and the government in Vienna is hoping that will allow it to break contracts with Gazprom.

Moscow though has other routes available to sell gas, including pipelines via Turkey, expanding links with China and LNG cargoes. But pipeline routes to Europe are limited — given networks shut after the war because of damage or sanctions — and a loss of Ukrainian volumes equates to roughly $6.5 billion on an annual basis at current prices, Bloomberg calculations show.

That’s a strong incentive for the Kremlin to renew the deal. President Vladimir Putin left the door open last week, saying he’s ready to continue gas transit via Ukraine beyond 2024.

Despite being eager to maintain the network’s relevance, Ukraine is trying to stick to red lines. President Volodymyr Zelenskiy has vowed to exclude “Russian molecules” from the country’s transit network to cut off a flow of funds to the Kremlin. Instead, Kyiv is looking for other suppliers to help it leverage the assets, but a lack of Russian gas in the system could make the network even more of a military target than it was already.

Ukraine has held transit talks with Azerbaijan, which already supplies gas to eight countries in Europe. Ilham Aliyev, the president of the Caspian Sea nation, said last week that discussions are under way on delivering the fuel to at least three more markets in Europe.

The reality is that Azerbaijan’s gas production is insufficient as full substitute in the short term and any replacement deal would likely include redirected Russian gas, according to Anne-Sophie Corbeau, a researcher at the Center on Global Energy Policy at Columbia University.

“Flows at the same levels labeled as Azeri would be pure whitewashing of Russian gas,” she said.

Deals with Kazakhstan and other central Asian suppliers could also be an option, but time is tight to pull a plan together before the deal runs out.

With energy supply and demand still tightly balanced, the almost certain loss of the route via Ukraine risks triggering volatility in European markets. Disruptions in Norway or shipping issues with LNG could combine with a cold snap to send prices soaring.

“There still could be a shortage during this heating season,” said Frank van Doorn, head of trading at Vattenfall Energy Trading GmbH. “Realistically, we haven’t been been tested yet given that the last two winters were mild.”

–With assistance from Daniel Hornak, Jonathan Tirone, Dave Merrill and Olga Tanas.

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.

EMEA Tribune is not involved in this news article, it is taken from our partners and or from the News Agencies. Copyright and Credit go to the News Agencies, email news@emeatribune.com Follow our WhatsApp verified Channel