(Bloomberg Markets) — Scott Dyksterhuis was convinced. Or as convinced as you can be when predicting what lies more than 3 miles beneath the seabed. The then 32-year-old geoscientist for Exxon Mobil Corp. (XOM) figured there was a good chance a vast trove of oil lay buried off the coast of Guyana, near where the Atlantic Ocean meets the Caribbean Sea. Now came the hard part. He had to persuade his bosses to drill a well that would prove it. “It was high-risk,” Dyksterhuis says. “But Guyana was a casino you wanted to play in because when you win, the profits are so high.”

Most Read from Bloomberg

In late 2013 hunting for oil in Guyana was among Exxon’s lowest priorities. Companies had drilled more than 40 dry holes in the region. The target formation—named Liza, after a local fish—was under a mile of water, and drilling it would cost at least $175 million. Even Dyksterhuis estimated there was only a 1 in 5 chance of success. But if he was right, it would open an oil frontier, proving a theory that the same geology behind Venezuela’s reserves, the world’s largest, extended across the north coast of South America. Many at Exxon had no interest in making that bet. Neither did much of the rest of the oil industry.

Today, Liza is the world’s biggest oil discovery in a generation. Exxon controls a block that holds 11 billion barrels of recoverable oil, worth nearly $1 trillion at current prices. The find has transformed Guyana from one of South America’s poorest countries into one that will pump more crude per person than Saudi Arabia or Kuwait by 2027. Guyana is on track to overtake Venezuela as South America’s second-largest oil producer, after Brazil.

Guyana has become the bedrock of Exxon’s post-Covid corporate revival. The Texas oil giant has a 45% share of a field that costs less than $35 a barrel to produce, making it one of the most profitable outside of OPEC. With crude currently trading at $85 a barrel, the oil field would make money even if the transition from fossil fuels caused demand to collapse and prices dropped by half.

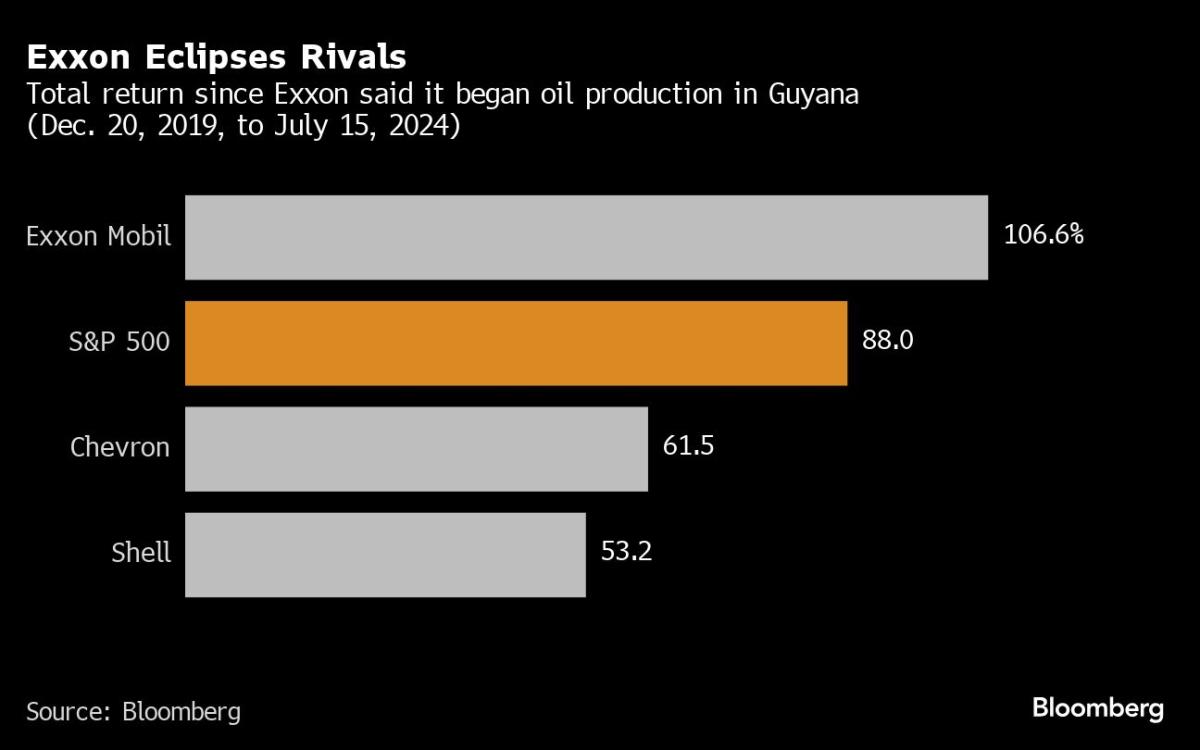

The untold story of the Guyana find’s origins—based on interviews with more than a dozen people involved in the Liza well, most of whom have since left Exxon—reveals some surprising truths about oil’s past and future. It shows how others in the business overestimated the shift from oil to renewables. Only three years ago, Exxon lost a battle over board seats with activist investors who argued it wasn’t doing enough to prepare for the transition. Exxon stuck to its core business. “When everyone else was pulling back, we were leaning in,” says Liam Mallon, president of Exxon’s production division. Since Guyana production began at the end of 2019, the company’s shares have more than doubled, the highest return among its supermajor peers.

This history suggests the difficulty of relying on market forces to usher in the end of fossil fuels. The Green movement had hoped that improved technology would help solar, wind and other renewables supplant increasingly hard-to-find oil. Environmentalists now worry that Exxon will earn a windfall from a slower energy transition, while others bear the cost of drilling’s harm to the climate and Guyana’s ecology. “Exxon is polluting the ocean and atmosphere without having to pay for the damage,” says Melinda Janki, a Guyanese lawyer who’s worked on international environmental protection. (Exxon says it invests in technology to protect the environment and meets or exceeds regulatory requirements.)

Exxon’s rivals no doubt have aching regret. Almost 30 other companies, including Chevron Corp., passed up the chance to buy into the Guyana discovery. Shell Plc, previously a 50% partner, walked away. Chevron is now paying $53 billion for Hess Corp., one of Exxon’s two partners in Guyana, which has a 30% stake in the project. Exxon this year filed an arbitration case against Hess, claiming it has a right of first refusal over the stake. (Hess says that right doesn’t apply in a merger.)

But the tale of the Guyana discovery isn’t about taking swashbuckling risks for a huge payoff. Exxon, it turns out, is as much a financial engineering company as an oil explorer. It hedged its bets, reduced its exposure and bought itself an option to make a fortune on an unlikely outcome.

That strategy dates to a key moment in 2013. Exxon’s top geoscientists concluded that Dyksterhuis and his colleagues hadn’t made the case that drilling Liza was worth the risk. Dyksterhuis was downbeat. If it didn’t drill, Exxon would have to hand the Stabroek block, or concession—its license to explore and drill the territory—back to Guyana’s government within months. (Stabroek was the former name of Guyana’s capital, Georgetown.)

In the hallway after a meeting, Rudy Dismuke, a commercial adviser, pulled one of the geoscientists aside. “Would you support Liza if we could drill it for free?” he asked. “Of course,” the geoscientist replied.

And so a small group of lower- and midlevel employees figured out a way to drill for nothing. Or close to it.

Like many geoscientists Rod Limbert knew that the source rock for Venezuela’s oil—the La Luna formation—extended under the Atlantic into maritime territory held by Guyana, Suriname and French Guiana. The straight-talking Australian became fascinated with an onshore discovery in Suriname in the 1960s, when villagers accidentally found what became a billion-barrel oil field while drilling for water in a schoolyard.

Limbert thought the schoolyard’s oil had originated off Guyana’s continental shelf and migrated more than 100 miles onshore over millions of years. He took the idea to the Exxon team responsible for entering new basins in mid-1997. “They had a picture of a downward-pointing thumb at the end of their presentation,” Limbert says. He contacted Guyana’s government about acquiring drilling rights anyway. “I just didn’t tell anyone,” he says.

In 1997, Guyana was one of the poorest countries in South America, still suffering from the socialist and isolationist policies of strongman Forbes Burnham, who rose to power soon after independence from the UK in 1966. Limbert and two colleagues flew from Houston to Georgetown, to acquire old well logs and discuss the potential for drilling rights with the Guyana Geology and Mines Commission. “The ground floor was literally the ground floor,” Limbert says. “By that I mean the desks and chairs were on the dirt.”

The Exxon team also met Samuel Hinds, Guyana’s president, who talked mostly about cricket, Guyana’s national pastime. “I wasn’t in any particular hurry to talk about business, because I had no authority to do anything,” Limbert says. On returning to Texas and armed with fresh data, Limbert won permission to begin contract negotiations for exploration rights.

Citing the legions of failed wells, Limbert pushed for and won a highly favorable deal. The Stabroek block offered to Exxon was more than 1,000 times bigger than the average oil block in the Gulf of Mexico. It required no upfront payment, and if Exxon struck oil, the company would keep 50% of the profit after deducting costs. It would pay the government a royalty of only 1%. Guyana later received heavy criticism for the contract. “I have examined my conscience about it over a period of time, but I don’t feel bad about it,” Limbert says. “It was a complete fit for what we knew and what we didn’t know.”

The deal helped the government in another way. Guyana faced serious border disputes both with Suriname to the east and Venezuela to the west. Aligning with Exxon would mean anyone picking a fight with Guyana would also be picking a fight with the world’s most powerful oil company.

Guyana’s concerns proved valid. Suriname gunboats forced a different oil explorer out of disputed waters between the two countries. Exxon couldn’t work on the block for eight years. When the Suriname conflict was nearing resolution in 2007, Exxon executives realized they’d need to spend money on seismic studies to meet work requirements under the contract. They suggested giving up the block to free up cash for higher-priority explorations in Brazil, the Gulf of Mexico and emerging US shale basins.

Dismuke, a Texas-schooled engineer who was Exxon’s Western Hemisphere commercial adviser at the time, took one look at the contract with Guyana and couldn’t believe his eyes. The deal Limbert negotiated had a huge upside. Dismuke and a colleague suggested a farm-out deal that would hand a portion of the block to a company willing to pay for the seismic study. Exxon’s management approved the idea and sold 25% of Stabroek to Shell in 2008. Exxon and Shell spent the next three years interpreting the seismic waves bounced off underground rock layers to understand the region’s geology. The early data was promising, showing indications of fossil fuels.

But this data also confirmed many geoscientists’ worst fear: a complete absence of structural traps. These formations are geological faults or impenetrable bands of rock that act like dams, capturing oil as it seeps through layers of sediment over millions of years. Without a solid trap, oil can’t accumulate in large enough quantities to be commercially viable. Guyana instead had stratigraphic traps, the most risky of all geological formations for an oil explorer. Although they can be secure, stratigraphic traps are subtle and very difficult to analyze on seismic charts. They often contain what’s known as a “thief zone” from which oil can escape.

By the late 2000s, however, the oil industry was warming to such formations. Crude was trading for more than $100 a barrel, so big discoveries meant big profits. Technology was improving. Shell decided to raise its stake in the Stabroek block to 50%. Around the same time, two geoscientists at APA Corp., a small explorer in Houston then called Apache, were watching closely. Tim Chisholm studied Venezuela for Exxon in the 1990s, and Pablo Eisner had worked the region for Repsol SA. The pair wanted a slice of Stabroek, but when that wasn’t an option, they led Apache into Suriname instead.

Before they could drill a well, Apache management had a change of heart and cut its exploration team. Chisholm and Eisner were laid off within a half-hour of each other. Chisholm went to Hess and Eisner joined CNOOC. Each says they believed they had unfinished business.

At Exxon in 2013 one geoscientist in a company of 75,000 people worked full time on Guyana. A trove of data was coming from the Shell-financed seismic studies. Exxon turned to Dyksterhuis, the Australian geoscientist, to help interpret it. He was drawn to the subject in college because it had “every single field of science in it,” including the physics of seismic modeling and the biology of creatures that had died millions of years ago, he says. “And then you go into oil and gas, you’ve got, like, big-dollar decision-making.”

One such decision came soon after Dyksterhuis arrived in Houston from Melbourne. Exxon, which by then had held Stabroek for more than a decade, had a matter of months to decide whether to drill an 8-inch-diameter hole somewhere in an area the size of Massachusetts.

Signs pointed to no. Exxon was more focused on established oil provinces, and Shell was souring on the region after drilling in French Guiana didn’t pan out. Dyksterhuis started analyzing two-dimensional seismic data shot about five years earlier. One prospect, Liza, stood out. The readings showed fluid. But what kind? Water or oil? The uncertainty prompted constant challenges from his bosses.

Using complex computer modeling, Dyksterhuis combined more than 300 3D seismic images to determine it was likely oil sitting on top of water. “The more I worked it, the more I was, like, ‘There’s something going on here,’ ” Dyksterhuis says. Toward the end of 2013, he and two colleagues presented their findings to more than a dozen of Exxon’s top geoscientists.

The good news was that Liza had a “pay zone” 90 meters (295 feet) thick packed with porous sand that fluids could move through very easily. They estimated it could contain 890 million barrels of recoverable oil, worth almost $1 billion at the time. Their high-side estimate was twice as big. The bad news was there was only a 22% chance of success, mainly because Liza was a stratigraphic trap. It wasn’t enough to win the bosses’ approval, and the trio left discouraged.

Dismuke, who sat at the back of the meeting, saw it differently. “I thought, if this hits and the trap holds, then I’ve got 6 million more acres to explore under a very good contract,” he says. He made a plan similar to the approach in 2008: reduce the financial downside by finding partners who would disproportionately pay for the well, in return for a stake in the block. Of course, Exxon would now be far richer if it hadn’t laid off that risk. Mallon, the Exxon oil production chief, says it would have been inappropriate to bet hundreds of millions of dollars on a single well, given the company’s many other opportunities. “You can’t sit as an armchair quarterback,” he says. “Was it right or wrong? It was the decision based on what we knew at the time.”

Management approved, and Exxon quickly set up a data room at its Greenspoint office in Houston, inviting about 30 oil companies. Only about 20 showed up. Geoscientists from each interested party got a daylong presentation from the Exxon team and a second day to analyze the data. Hess was the last to come through. Chisholm grilled Dyksterhuis for more than two hours. “He did a very good job of, I would say, not overselling it,” Chisholm said in a 2020 lecture. “That was very critical to me believing. He had passion for what it was.”

In mid-2014, as Hess was considering entering the block, Shell dropped a bombshell: After six years of paying for seismic data, the Anglo-Dutch supermajor wanted out. The decision was “part of a broader groupwide review of our frontier exploration portfolio,” the company said in response to questions. Exxon now had 100% of Stabroek and only weeks before it had to inform the Guyana government whether or not it planned to drill.

Within Hess, Guyana was a tough sell, but the company agreed to take a 30% stake. “I bet my career on it,” Chisholm says. “I would have definitely been fired if it had not worked.”

Eisner, who’d coveted Guyana since working with Chisholm at Apache, was now working at CNOOC. “Everybody was offered Stabroek, but you need a maverick, big-headed geologist banging the table, even breaking the table to say, ‘This is good,’ ” he says. “At CNOOC, that was me.” Eisner convinced his bosses, and CNOOC took a 25% stake. Exxon’s share of Stabroek was now 45%, but crucially, the two newcomers agreed to fund most of the well cost. With Exxon’s own money now largely protected, management gave the go-ahead to drill Liza.

The well cost $225 million. Though Exxon will end up investing more than $25 billion in the Guyana project, its initial outlay—the one that secured its control of the epic discovery—was pretty close to the zero that the small group of Guyana believers had mentioned back in 2013: less than $100 million, according to people familiar with the matter. Possibly much less.

Exxon hired Transocean Ltd.’s Deepwater Champion for the job. The high-spec drill rig was as long as two football fields, carried 10 truckloads of cement and mud, and could drill more than 7 miles deep. With helicopter crews and support vessels at the ready, the well was soon costing more than $1 million a day.

Inside Exxon it was dubbed “the well from hell.” A section of pipe got stuck, unable to move up or down, compromising the integrity of the entire well. Drillers sheared off the drill bit and filled the bottom section of the well with cement. They lost equipment worth more than $15 million. But the drillers made a side-track hole that saved the project. The night before Liza reached its target, Dyksterhuis and a colleague slept on the floor in separate meeting rooms at Exxon’s newly built Houston campus.

As soon as the drill bit hit Liza on May 5, 2015, real-time well data being fed back to Houston showed a sudden change in rock density. That meant Liza was stacked with fossil fuels. But it wasn’t immediately clear whether it was oil or gas. To really hit the big time, it had to be oil.

A few hours later, the Deepwater Champion circulated drilling mud on its deck and shook out rock cuttings onto a conveyor belt. Kerry Moreland, a senior geoscientist and Dyksterhuis’ boss, noticed a familiar smell in the salty sea air. “Maybe like a gas station,” she says. She put on gloves and picked up some of the rocks. They were dripping in oil.

Crowley covers the oil industry from Bloomberg’s Houston bureau.

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.

EMEA Tribune is not involved in this news article, it is taken from our partners and or from the News Agencies. Copyright and Credit go to the News Agencies, email news@emeatribune.com Follow our WhatsApp verified Channel