Ask any engineer tasked with tracking customer balances, what the experience is like, and you’ll get a deep sigh that says, ledgering is the bane of existence.

Fragment is a startup that offers a ledger API that makes real-time, double-entry accounting accessible to engineers without having to learn a whole new accounting vocabulary. Founders Thomas Neckel, CEO, and Omi Chowdhury, CTO, founded Fragment in 2021. This software is geared towards engineers to build software for tracking customer balances.

It’s the third startup this pair of co-founders have done together. They previously built an identity management company called Scuid that competed with Okta and was acquired by CA Technologies in 2014. They then built a private investment platform called Cove.io. This was the catalyst for identifying the importance of a ledger, with Neckel saying that was “a huge problem we had ourselves.”

“In order for anyone to close their books for the month, the balances have to be right and reconciled with the bank statements,” Neckel told TechCrunch. “Accountants typically perform this function with the help of enterprise resource planning systems.” While the reconciliation happens between the product and the bank, Fragment keeps balances in the fintech product in lockstep with the bank and balance sheets they’re built on. The result is that customers can close their books faster because the transactions are fully reconciled, Neckel said.

Reconciliation issues are what happened with Evolve Bank and Synapse, Neckel pointed out, and those issues led to rounds of finger pointing and allegations between the two.

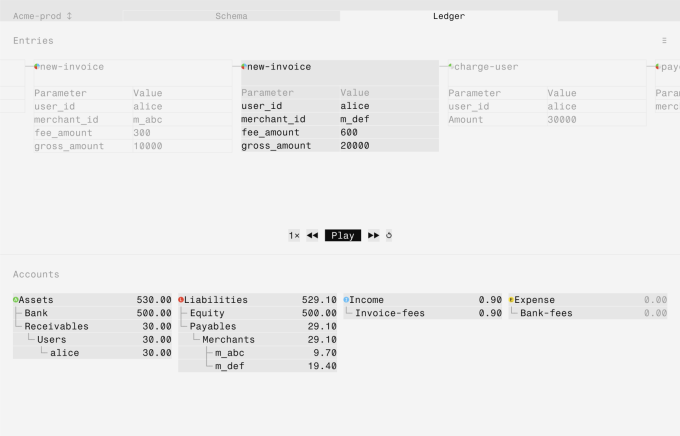

With Fragment, fintech developers can use the API to build financial products. They can compose fund flows, turn it into code and embed the code into their products. Fund flows are the set of steps that are recorded in the database as entries, and each entry updates a set of accounts, Neckel said.

“We give you a designer to model the funds flow, and then basically a database, not unlike Postgres, to implement it, and a dashboard to operate it,” Neckel said. (Postgres, of course, also known as PostgreSQL, is an open source database.)

Although the New York-based startup says it already counts companies like TruckSmarter, Nala and Pleo as early customers, it is officially launching to the public on Monday. TruckSmarter runs its own fuel payments network and finance purchases using Fragment. Nala uses Fragment to help businesses send payments to Africa. Meanwhile, B2B spend management platform Pleo uses it to store and track the historical balances for their 30,000 customers, Fragment says.

The startup is also announcing a seed round of $9 million backed by fintech infrastructure executives from Stripe, BoxGroup, Avid Ventures, Zach Perret (Plaid), Jack Altman (Lattice), Gokul Rajaram (DoorDash), Dara Khosrowshahi (Uber), Emilie Choi (Coinbase), Scott Belsky (Adobe) and Cristina Cordova (Linear). Including this new investment, Fragment raised a total of $10.8 million since June 2021. Gradient Ventures invested in the company’s pre-seed round.

Fragment’s ledgering tech competes most directly with payments company Modern Treasury, according to Neckel. However, Fragment’’s mission is to go beyond balances to solve the more basic problem of exchanging value online.

”Stripe gave two people in a garage the same payments infrastructure as Amazon,” said Neckel, referring “Let’s see what’s possible when we give two people in a garage the same financial infrastructure as Square, Stripe and Uber.”

Fragment plans to use the funding to grow its engineering team and invest in go to market resources.

“We’re excited to see what’s possible when you arm technology companies with programmable versions of the double-entry systems the modern economy runs on,” said Adam Rothenberg, a partner at BoxGroup, in a written statement.

EMEA Tribune is not involved in this news article, it is taken from our partners and or from the News Agencies. Copyright and Credit go to the News Agencies, email news@emeatribune.com Follow our WhatsApp verified Channel