Apple (NASDAQ: AAPL) has a long history of providing consistent stock gains. Its shares are up 346% in the last five years alone, outperforming many of its peers and the S&P 500‘s 86% rise. The company is the king of consumer tech, profiting from the immense brand loyalty it has built.

However, Apple has hit many hurdles over the past year. The company got a late start in artificial intelligence (AI), which left it out of much of the rally the market has seen since the beginning of 2023.

Meanwhile, repeated declines in sales have forced the company to rethink its product strategy. It has the cash and brand dominance to turn things around over the long term, but it might be worth investing in more reliable stocks for now.

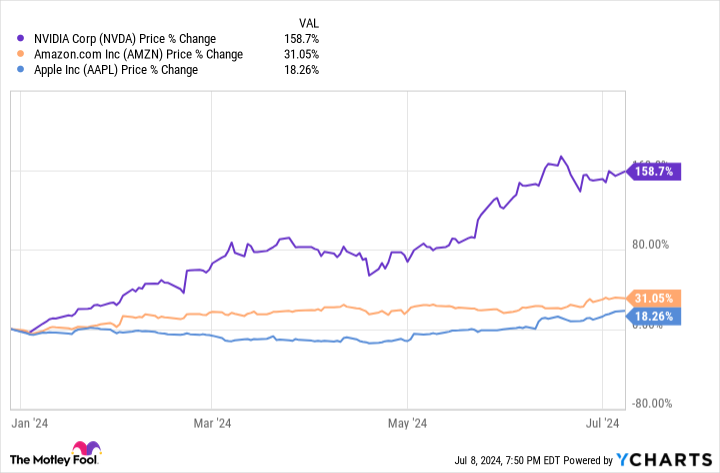

This table shows Nvidia (NASDAQ: NVDA) and Amazon (NASDAQ: AMZN) have delivered significantly more returns than Apple since the start of 2024. They have rallied investors with dominating roles in crucial areas of AI: chip design and cloud computing. The two leaders in their respective industries are unlikely to be dethroned anytime soon.

Their more established positions in tech indicate they could offer more share increases over the next decade than the iPhone maker. So, forget Apple and consider buying these two millionaire-maker stocks instead.

1. Nvidia

Few stocks have been watched as closely as Nvidia has over the last year. The company has achieved rock-star status in the tech industry as its chips have become the gold standard for AI developers worldwide. Nvidia is responsible for an estimated 90% of the AI chip market thanks to the success of its graphics processing units (GPUs).

Much as Apple has attracted loyal users with its easy-to-use design language, Nvidia’s Computer Unified Device Architecture (CUDA) is a leading reason for its AI dominance. CUDA is the software platform that complements the company’s AI GPUs. Millions of developers have grown so accustomed to Nvidia’s chip architecture that switching to similar offerings from competitors like AMD makes little sense.

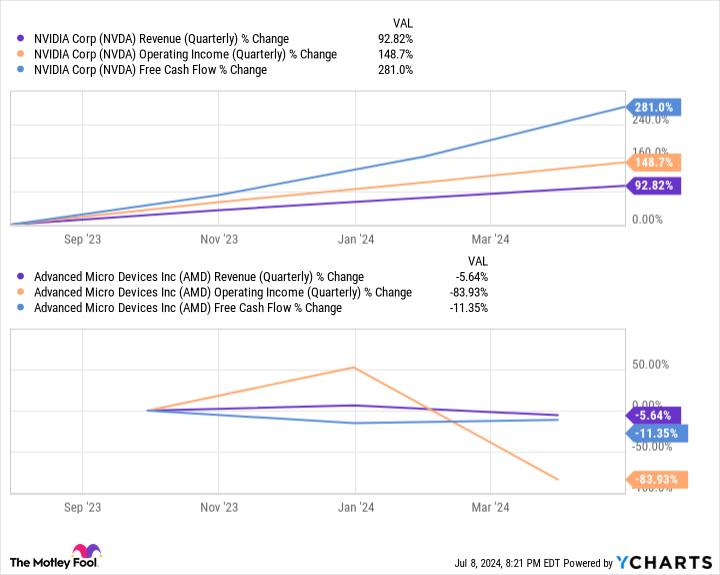

As demand for AI services has soared, so has Nvidia’s sales. The chart above shows the significant difference in financial growth that Nvidia has seen over AMD since last July. As a result, Nvidia hit $39 billion in free cash flow this year, while AMD hovered around $1 billion in free cash flow.

Nvidia’s higher figure suggests it’s only widening the gap between the companies, with it potentially being better equipped to keep investing in its technology and maintain its lead.

According to Grand View Research, the AI market reached $196 billion in spending last year and is growing at a rate that would see it hit close to $2 trillion by 2030. So, despite its meteoric rise since last year, the AI market still has plenty of room to run, with Nvidia well-positioned to keep seeing major gains and creating millionaires.

2. Amazon

Amazon has made more than a few millionaires over the years. Since its initial public offering in 1997, the company’s stock has soared over 200,000%.

It has gone from an online book retailer to the biggest name in e-commerce in multiple countries. And as its earnings have grown, Amazon has reinvested in its business, diversifying its revenue streams to include income from cloud computing, digital advertising, streaming, and more.

The company posted its first-quarter earnings on April 30, delivering revenue growth of 13% year over year and beating Wall Street estimates by $750 million. Amazon proved its e-commerce business remains lucrative, with revenue rising 10% and 12% in its two retail segments. Meanwhile, retail operating income reached a collective $6 billion after reporting losses of $349 million the year before.

But it’s outside of e-commerce where the company’s greatest promise can be found. Its cloud platform, Amazon Web Services (AWS), dominates the market, reporting revenue growth of 17% year over year and operating income that nearly doubled. The quarter also highlighted the company’s budding digital ad business, with revenue in its advertising services segment rising 24% after introducing ads on Prime Video.

While Apple has suffered several quarters of sales declines, Amazon has seen an impressive boost to revenue in its retail segments. Meanwhile, it has become an imposing figure in AI thanks to AWS. With growth catalysts in multiple markets, its stock is too good to ignore right now.

Should you invest $1,000 in Nvidia right now?

Before you buy stock in Nvidia, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Nvidia wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $780,654!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of July 8, 2024

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Dani Cook has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Advanced Micro Devices, Amazon, Apple, and Nvidia. The Motley Fool has a disclosure policy.

Forget Apple: Consider These 2 Millionaire-Maker Stocks Instead was originally published by The Motley Fool

EMEA Tribune is not involved in this news article, it is taken from our partners and or from the News Agencies. Copyright and Credit go to the News Agencies, email news@emeatribune.com Follow our WhatsApp verified Channel