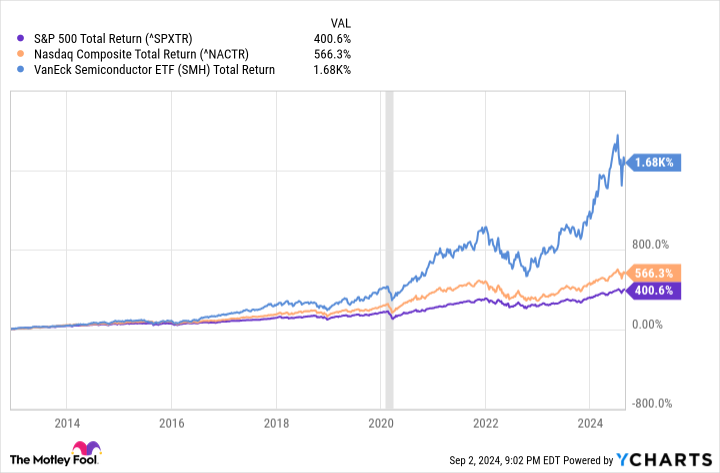

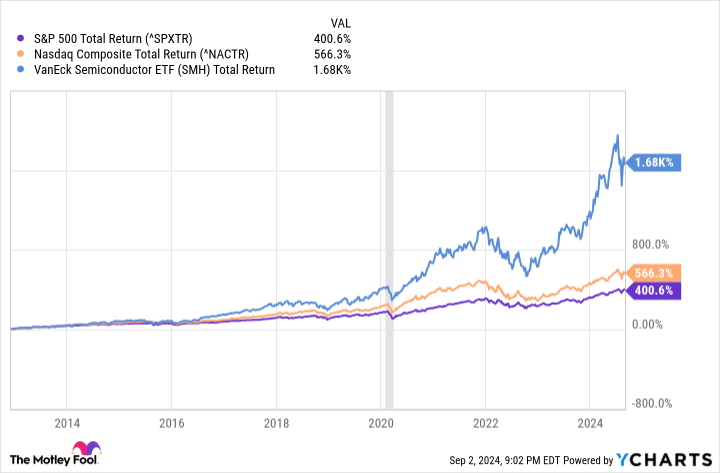

The Nasdaq Composite Index has a terrific long-term track record. During the past decade, for instance, the index rose 566% in value. That return bested the S&P 500‘s rise of 401% in the same period.

The Nasdaq’s long-term performance seems incredible until you compare it to one of my favorite exchange-traded funds (ETFs). During the past decade, this ETF rose in value by nearly 1,700% — roughly triple the return of the Nasdaq.

The best news is that it’s not too late to jump in.

This is one of the best ETFs of all time

Perhaps the best-performing ETF of the past decade has been the VanEck Semiconductor ETF (NASDAQ: SMH). It’s not hard to understand why. As the ETF’s name suggests, this investment vehicle is all-in on semiconductors. There aren’t a ton of stocks that fit this category, meaning it has a concentrated portfolio. More than 70% of the ETF’s portfolio, for example, is invested in just 10 companies.

The ETF’s biggest holding — Nvidia — dominates the portfolio with a weighting of nearly 20%. That’s been a smart decision considering Nvidia’s value has skyrocketed in recent years. The rise of AI has a lot to do with the company’s success, as demand for semiconductors and other critical AI components continues to soar.

The rest of the portfolio can hardly be considered laggards, even if they don’t match Nvidia’s performance. Taiwan Semiconductor, for example, is the No. 2 holding, comprising 13% of the portfolio. Its stock is up more than 80% during the past 12 months. Broadcom, the third-largest holding, commanding about 8% of the portfolio, has seen its shares rise by 87% during the same period.

All of this is to say that the VanEck Semiconductor ETF has found itself in the right place at the right time. Its portfolio is mandated to invest in semiconductor stocks. And those stocks have proven to be some of the best investments in recent memory.

But don’t think the run is over. There are two reasons new investors should still consider this high-performance ETF.

There could be more upside to go

The many reasons semiconductor stocks have performed so well in recent years won’t abate anytime soon.

Semiconductor demand worldwide is growing by more than 15% annually. Many industry forecasts project this rapid growth rate will continue. Fortune Business Insights, for example, anticipates semiconductor demand growing by 14.9% per year through 2032. Its research highlights three primary areas of growth: artificial intelligence, machine learning, and the Internet of Things.

“These technologies assist and enhance memory chip processing time to process large amounts of data in no time,” Fortune stresses. “Moreover, the potentially rising demand for faster and more advanced memory chips in data center applications is expected to drive the market growth over the forecast timeline.”

The great thing about this ETF is that if you invest in a fund comprising multiple stocks, you don’t need to try to predict a single winner. Historically, the chip wars have generated many cycles of winners and losers. Nvidia leads the pack today, but it’s anyone’s guess what will happen in the future.

With the VanEck Semiconductor ETF, no guessing is required. Its portfolio does weight certain semiconductor stocks more than others, but in general, the holdings are diversified across every major competitor, end user type, and geography.

Believe in the rise of AI? These are the stocks you want to bet on, and the VanEck Semiconductor ETF has proven its ability to wisely allocate capital within the sector.

Should you invest $1,000 in VanEck ETF Trust – VanEck Semiconductor ETF right now?

Before you buy stock in VanEck ETF Trust – VanEck Semiconductor ETF, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and VanEck ETF Trust – VanEck Semiconductor ETF wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $650,810!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 3, 2024

Ryan Vanzo has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Nvidia and Taiwan Semiconductor Manufacturing. The Motley Fool recommends Broadcom. The Motley Fool has a disclosure policy.

Forget the Nasdaq — Buy This Magnificent ETF Instead was originally published by The Motley Fool

EMEA Tribune is not involved in this news article, it is taken from our partners and or from the News Agencies. Copyright and Credit go to the News Agencies, email news@emeatribune.com Follow our WhatsApp verified Channel