(Bloomberg) — The buy-everything mania that greeted Donald Trump’s election is cooling in the tried-and-tested world of stocks and corporate credit. Yet on Wall Street’s speculative fringes, the risk-taking frenzy is only getting bigger by the day.

Most Read from Bloomberg

Heavy trading — and big price moves — in everything from crypto to leveraged exchange-traded funds was the story in a week where swings in the S&P 500 and Nasdaq 100 finally started to abate.

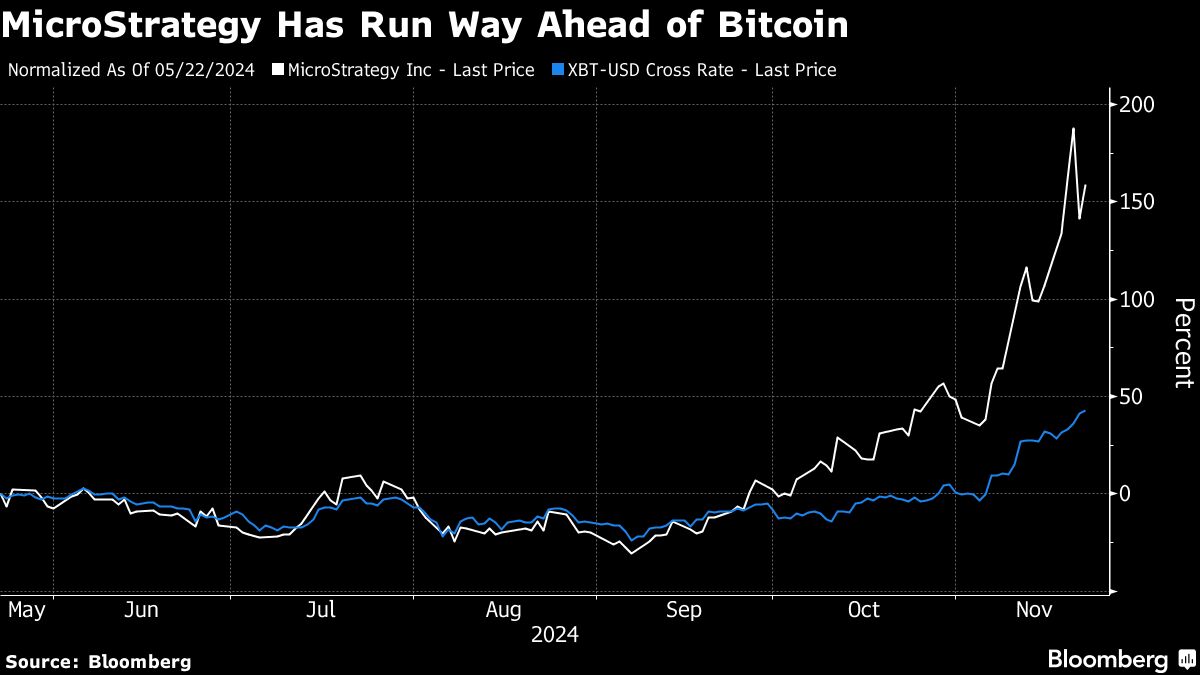

Ground zero for the casino crowd: The $140 billion complex of amped-up exchange-traded funds tracking the likes of Big Tech stocks, Michael Saylor’s Bitcoin proxy MicroStrategy Inc., and more. Gamblers are flocking to vehicles that boost gains and losses across indexes and companies including the Magnificent Seven darlings. Single-name leveraged products have been trading $86 billion this week — a record.

It’s the latest frothy chapter in a marquee year for risky assets, courtesy of the booming economy and Trump’s election pledges — no matter how long the Federal Reserve is taking to cut interest rates.

The gains have fattened brokerage accounts just in time for the holiday shopping season. Yet at this rate, the gambling spirits are running high enough to give market pros pause.

“This euphoria is rampant speculation on par with the 2000 peak,” said Michael O’Rourke, chief market strategist at JonesTrading. “These levels of momentum and turnover are hard to maintain for an extended period of time.”

Gyrations are slowing down in the less-exotic assets. While the S&P 500 gained at a healthy clip — 1.7% this week — it was the smallest move since before election day. Daily changes in 10-year Treasury yields have averaged less than 2 basis points since Nov. 14, compared with more than 7 basis points in the two weeks prior.

No corner of the juiced-up ETF world saw more action this week than funds centered on MicroStrategy, the software firm Saylor has transformed into what amounts to a pure-play bet on Bitcoin. Two leveraged funds based on the company saw a combined $420 million inflow amid a 24% surge for the underlying stock this week.

The popularity of the two funds has led some market-observers to point to a leveraged-loop buying frenzy. It goes like this: Investor demand for the ETFs pushes up the price of MicroStrategy, allowing it to raise more money and further prop up Bitcoin itself. The world’s biggest digital token is up more than 40% in November alone and climbed each day this week to get within a few hundred dollars of $100,000.

Matt Tuttle, chief executive officer at Tuttle Capital Management, which runs one of the funds, says that he bought a flurry of MicroStrategy shares via his leveraged ETF this week. His market-makers have had to buy more shares in order to hedge their positions. “Then look at all the retail investors buying options on MicroStrategy — on and on and on and on,” he said. “It can get pretty crazy.”

Products like these are an increasingly formidable market force unto themselves, with assets reaching $140 billion. Attention has focused on them because of rebalancing mechanics in the futures markets, which some argue tend to amplify moves in the underlying assets.

The impact on market moves is unprecedented, too. Nomura Holdings Inc. estimates that leveraged ETFs bought $2.1 billion of US stocks at the close on Thursday — the highest on record. Trading in these kind of single-name products, which are usually tied to names like Nvidia Corp., Tesla Inc. and MicroStrategy, among others, surged to a record this week, data compiled by Bloomberg Intelligence’s Athanasios Psarofagis show.

“The daily rebalance of levered ETFs, whether amplifying returns of ETFs or single stocks, can exacerbate volatility of the underlying, particularly when there are large daily move,” said Daniel Kirsch, head of options at Piper Sandler.

Of course, leverage — and investor euphoria generally — threatens to hit bulls just as readily as it has aided them in their pursuit of risky assets of late. For now, there are no signs investors are ready to reduce risky assets exposure.

“Allocations to stocks is the highest post GFC, mostly US and mostly tech. We see no sign of them unwinding those positions,” said Marija Veitmane, senior multi-asset strategist at State Street who favors quality tech names.

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.

EMEA Tribune is not involved in this news article, it is taken from our partners and or from the News Agencies. Copyright and Credit go to the News Agencies, email news@emeatribune.com Follow our WhatsApp verified Channel