(Bloomberg) — Equities in Asia were set to decline as investors began to pullback on the artificial-intelligence frenzy that has powered the bull market this year.

Most Read from Bloomberg

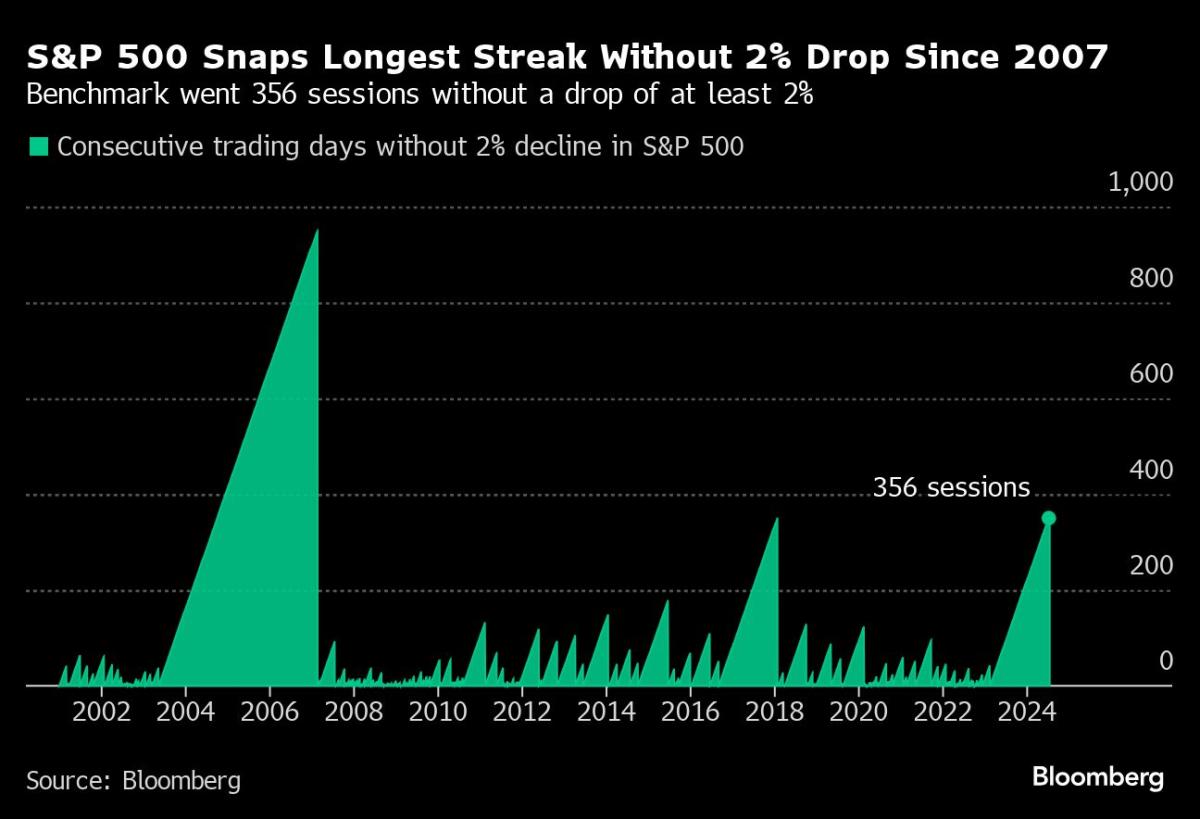

Equity futures in Japan, Australia and Hong Kong all fell. The Nasdaq Golden Dragon China Index, a gauge of US-listed Chinese shares, slid 1.9%. In the US, the S&P 500 slumped 2.3%, its worst showing since December 2022 and one that ended the best stretch without a 2% drop since the start of the global financial crisis.

The tech-heavy Nasdaq 100 fell 3.7% weighed down by its largest constituents. Alphabet Inc. slid 5% after sinking more resources into its drive to outmatch rivals in AI, with spending higher than analysts expected. Tesla Inc.’s profit miss and the Robotaxi delay spurred a 12% stock plunge. Nvidia Corp fell 6.8%.

“Investors are finally waking up to all that AI spend and realizing it is much more of an expense right now rather than a revenue generator,” said Peter Boockvar at The Boock Report.

The yen extended gains Thursday after rallying more than 1% to the strongest levels against the US currency since May in an advance that reflected an unwind in carry trades.

The move is “potentially squeezing the yen short positions, given yen-funded carry trading has been a popular strategy over the last few years,” Saxo Capital Markets’ head of FX strategy Charu Chanana wrote in a note.

In the bond market, the Treasury curve steepened Wednesday on bets the Federal Reserve is close to cutting rates. The policy-sensitive two-year yield fell six basis points, while the 10-year yield rose three basis points.

Former New York Fed President William Dudley called for lower borrowing costs — preferably at next week’s gathering. For many analysts, such a move would be worrisome as it would indicate officials rushing to avoid a recession. Later Thursday in the US, investors will see further evidence of the health of the economy with US GDP and initial jobless claims data being released.

An index of dollar strength was little changed Wednesday. The Canadian dollar fell as the Bank of Canada cut rates for a second consecutive meeting and signaled further easing was ahead. In the Philippines, the nation’s central bank suspended currency trading for a second day due to Typhoon Gaemi.

Elsewhere in Asia, data set for release includes gross-domestic product for South Korea, Japan services producer prices for June, and Hong Kong trade for June. Meanwhile, Singapore’s central bank will likely maintain tight monetary policy settings.

Big Tech Pullback

After driving the rally in stocks for most of 2024, big tech slammed into a wall. Traders rotated from megacaps to lagging parts of the market, spurred by bets on Fed rate cuts and concern AI still needs to pay off.

“Tech’s problem isn’t just that earnings are less than perfect, but the group is still caught up in the violent rotation trade that kicked off with the June CPI,” said Vital Knowledge’s Adam Crisafulli. “Many assumed the anti-tech rotation would be ephemeral and the fact it’s proving durable is compounding anxiety toward the group and spurring additional selling pressure.”

The drubbing in these stocks has seen some of the air come out of valuations. While that’s something that could argue in favor of dip buying, the earnings season is just getting started. Apple Inc., Microsoft Corp., Amazon.com Inc. and Meta Platforms Inc. are all due to report results next week.

Both the Nasdaq 100 and the S&P 500 benchmarks have breached thresholds that trigger a selling signal for commodity trading advisers, or CTAs, according to models at Goldman Sachs Group Inc.’s trading desk.

If stocks keep falling, those rules-based traders could unwind $32.9 billion of global stocks with $7.9 billion flowing out of the US market, according to an analysis from the bank’s trading desk. Even if the market reverses its slide, CTAs are still poised to sell $902 million of US stocks.

In commodities, oil rose, clawing back from a run of losses, after a government report showed that US crude inventories fell to the lowest since February. Gold was steady early Thursday after a 0.5% drop in the prior session.

Key events this week:

-

Germany IFO business climate, Thursday

-

US GDP, initial jobless claims, durable goods, Thursday

-

US personal income, PCE, consumer sentiment, Friday

Some of the main moves in markets:

Stocks

-

S&P 500 futures rose 0.2% as of 7:29 a.m. Tokyo time

-

Hang Seng futures fell 0.6%

-

S&P/ASX 200 futures fell 0.9%

Currencies

-

The Bloomberg Dollar Spot Index was little changed

-

The euro was little changed at $1.0842

-

The Japanese yen was little changed at 153.74 per dollar

-

The offshore yuan was little changed at 7.2660 per dollar

-

The Australian dollar was unchanged at $0.6581

Cryptocurrencies

-

Bitcoin fell 0.7% to $65,559.1

-

Ether was little changed at $3,375.16

Commodities

This story was produced with the assistance of Bloomberg Automation.

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.

EMEA Tribune is not involved in this news article, it is taken from our partners and or from the News Agencies. Copyright and Credit go to the News Agencies, email news@emeatribune.com Follow our WhatsApp verified Channel