(Bloomberg) — United Arab Emirates-based Gulf Data Hub is weighing the sale of a minority stake to tap into rising global demand for digital infrastructure, according to people familiar with the matter.

Most Read from Bloomberg

The closely-held firm has drawn interest from international private equity firms, the people said, asking not to be named as the information is private. It’s working with JPMorgan Chase & Co. on the deal, according to the people.

Gulf Data Hub, established in 2012, aims to conclude the sale as soon as the third quarter of this year, the people said. It’s hoping to fetch as much as $1 billion for the stake, they said.

No final decisions have been made on the timing and valuation. Representatives for JPMorgan and Gulf Data Hub declined to comment.

The move comes amid a surge in deals activity in the data-center sector, which has drawn interest from infrastructure funds with large pools of capital as well as companies seeking to tap into the booming demand for cloud services.

Key deals include Nokia Oyj’s $2.3 billion bid for Infinera Corp. Meanwhile, GDS Holdings Ltd. is selling a stake in its data-center business outside China to a group of alternative asset managers.

Globally, close to $22 billion has been invested in the sector over the first five months of this year, according to a recent Linklaters report. Combined with last year’s numbers, that reflects “the increasingly critical role that data centers play in supporting the expanding digital economy,” according to the report.

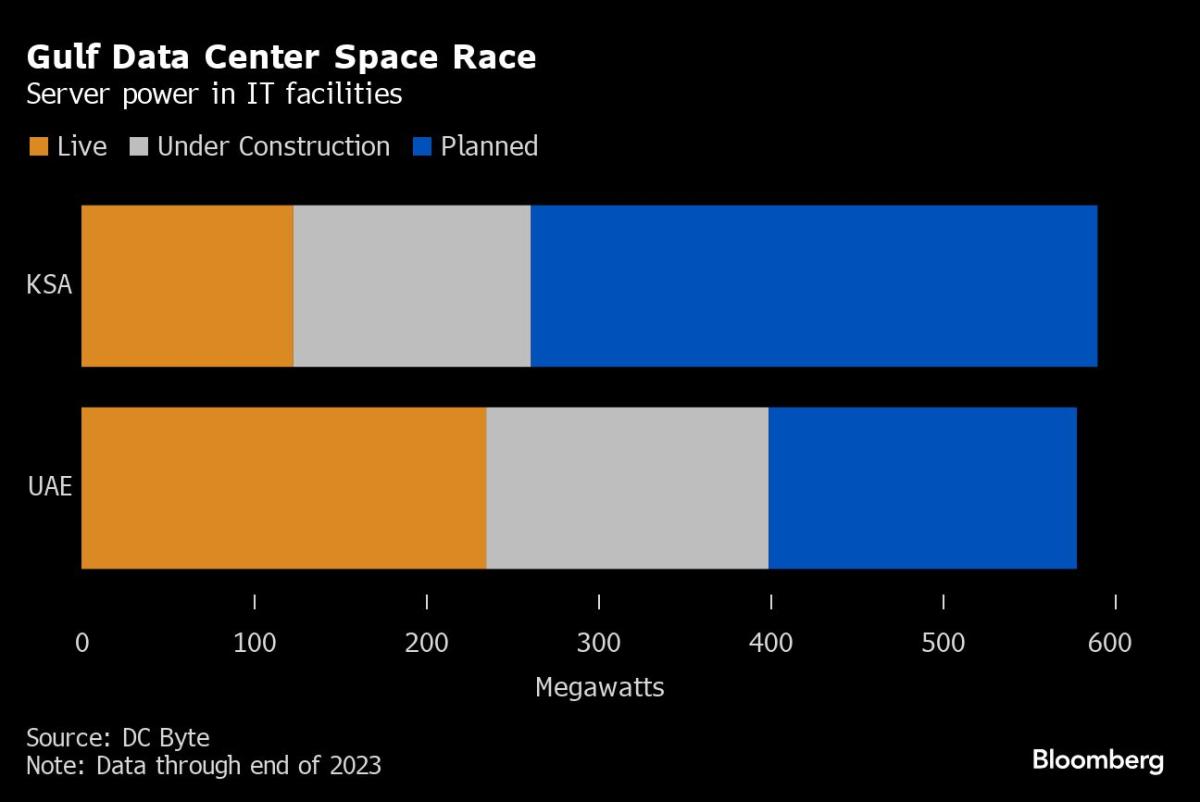

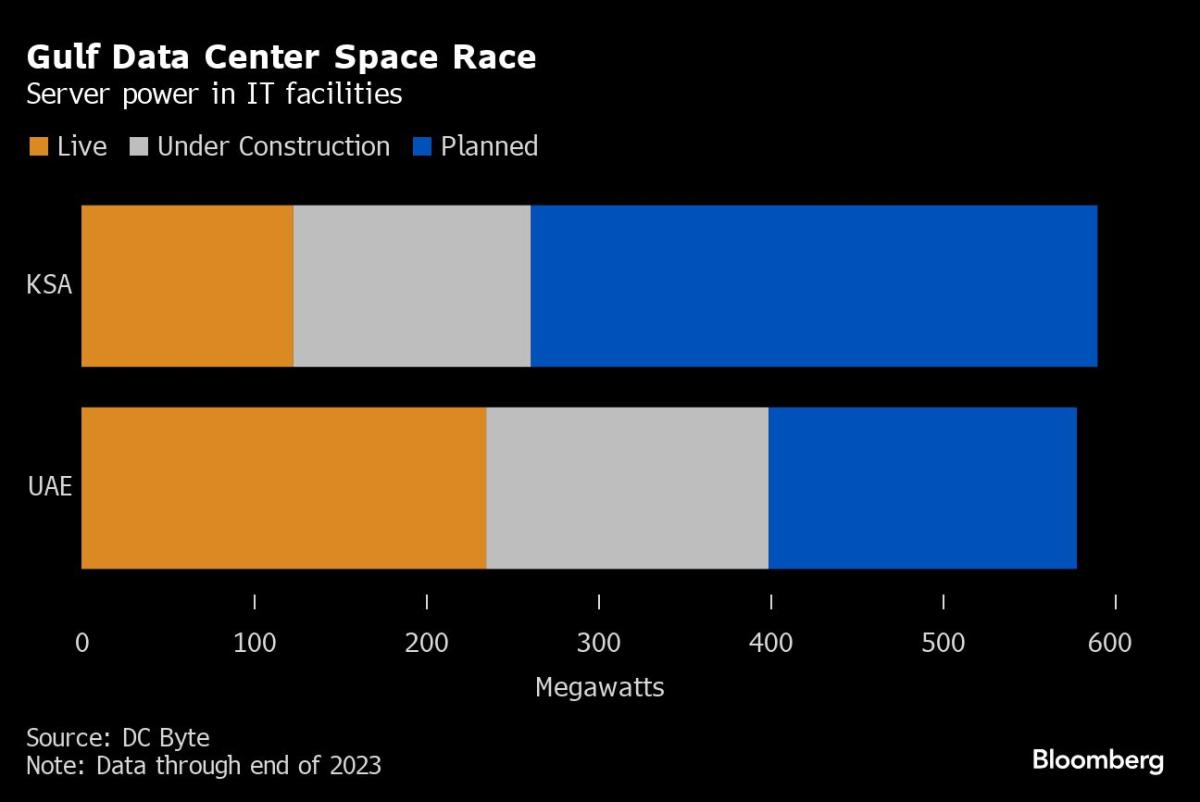

Regionally, the UAE and Saudi Arabia want to become the hub for artificial intelligence, kicking off a race to build expensive data centers to support the technology.

Gulf Data Hub, owned by founder Tarek Al Ashram, operates five data centers and has 15 under construction across the wider Middle East, according to its website. It works with firms including Microsoft Corp. and Oracle Corp.

The company competes against Khazna — owned by G42, the Abu Dhabi technology group chaired by UAE National Security Adviser Sheikh Tahnoon bin Zayed Al Nahyan.

New from Bloomberg: Get the Mideast Money newsletter, a weekly look at the intersection of wealth and power in the region.

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.

EMEA Tribune is not involved in this news article, it is taken from our partners and or from the News Agencies. Copyright and Credit go to the News Agencies, email news@emeatribune.com Follow our WhatsApp verified Channel