This is The Takeaway from today’s Morning Brief, which you can sign up to receive in your inbox every morning along with:

In the first half of 2024, stocks leapfrogged the wall of worry to deliver another solid set of six-month returns, leading the S&P 500 (^GSPC) to a respectable 14.5% gain and the Nasdaq Composite (^IXIC) to an even loftier 18% win.

If history is a guide, stock seasonality still favors the bulls in July. In fact, the Nasdaq has closed green in 10 of the past 11 Julys.

This bullishness extends into full-year results as well.

Looking back to 1928, there have been 29 years when the S&P 500 was up 10% or more at the halfway mark. By year-end, the average gain was 24%.

In each of the prior 12 instances of strong starts to the year going back to 1988, the second half of the year closed positive.

And across all years in the group going back to 1928, the second and third quarters combined were up an average 6.1% (9.6% median) — and were green 76% of the time.

Amid all these bullish results, two October stock market crashes — one in 1929 and one in 1987 — paved the way for the two worst-performing second halves of the year in the set, down 21.7% and 18.7%, respectively.

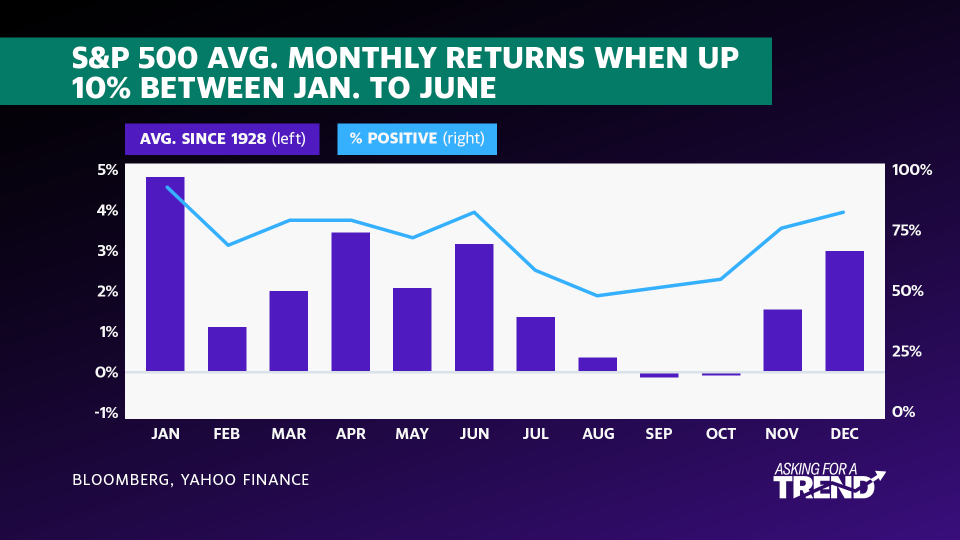

While July sports a respectable 1.4% average return (2.3% median), the percentage of years with positive returns drops to 59% from 83% the month prior.

The monthly seasonal pattern turns from lackluster in August — with a 0.4% average gain and 52% loss rate — to outright negative average returns in September and October (though median results remain positive).

Finally, after three months of roughly sideways tendencies, bullish tailwinds reaccelerate from November into year-end — just in time for the Santa Claus rally.

In general, historical seasonality patterns only account for up to a third of price returns. Big, unexpected catalysts can quickly tip the scales the other direction — so we can only outline tendencies. But it so happens that stock seasonality studies have generally worked well in this bull market, despite the AI moment seeming sui generis.

Separately, BofA studied the first and last 10 trading days of each month going back to 1928 and found that the beginning of July has the highest average of any period (up 1.5% with positive results 69% of the time), another pattern to watch for this month.

Putting it all together, we might expect some more strength in early July before the traditional election market patterns take over.

Click here for the latest stock market news and in-depth analysis, including events that move stocks

Read the latest financial and business news from Yahoo Finance

EMEA Tribune is not involved in this news article, it is taken from our partners and or from the News Agencies. Copyright and Credit go to the News Agencies, email news@emeatribune.com Follow our WhatsApp verified Channel