-

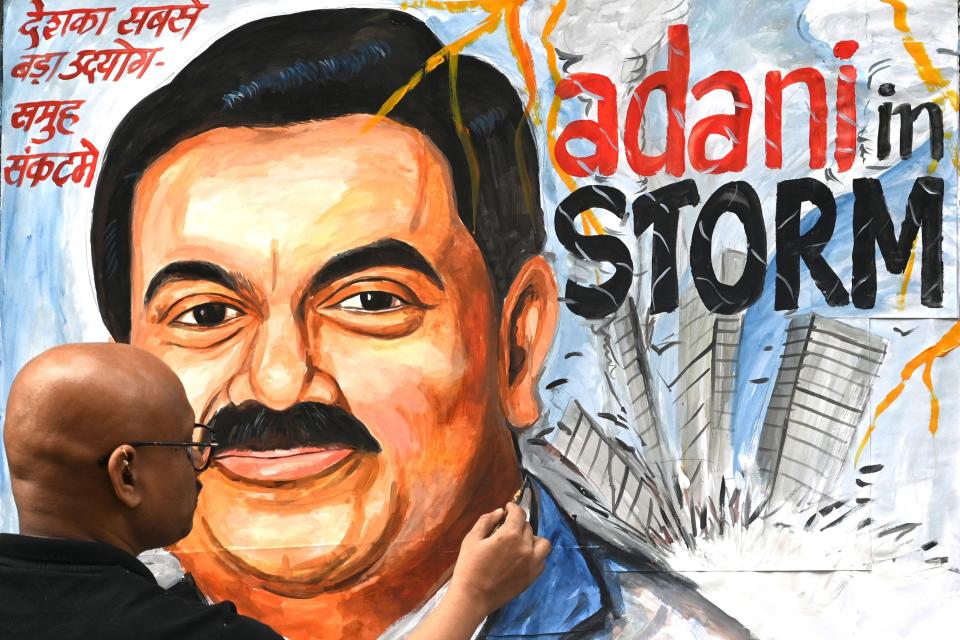

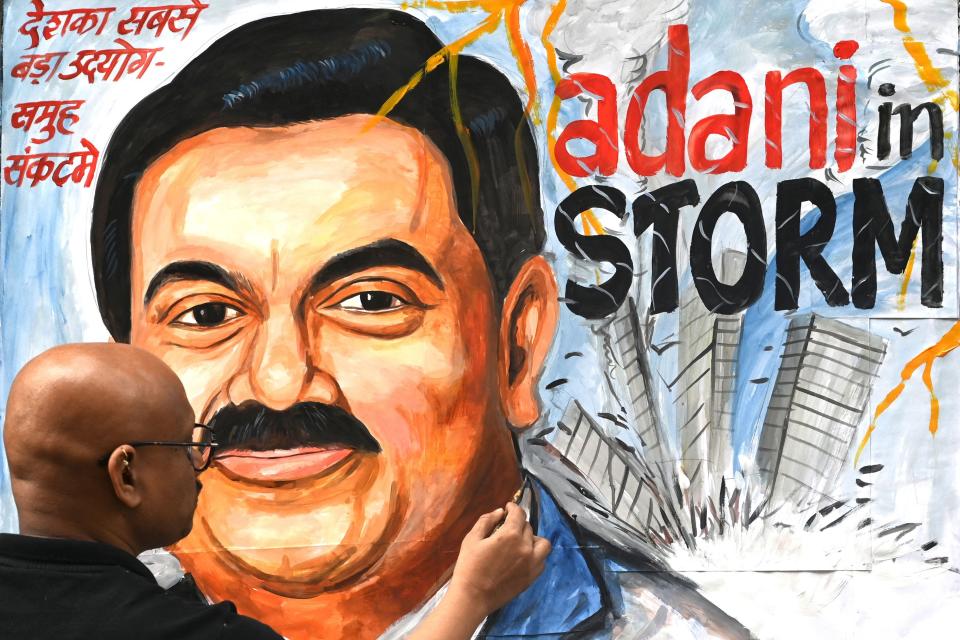

Activist short-seller Hindenburg Research wiped out $153 billion in market value from Adani Group.

-

It recently disclosed that it made just $4 million for its efforts.

-

Detailed below is the war of words that’s taken place over the past 18 months.

Nate Anderson, the chief mind behind activist short-seller Hindenburg Research, has had an eventful past 18 months.

In January 2023, he accused the Indian conglomerate owned by Gautam Adani — one of the world’s richest people — of fraud, subsequently wiping out $153 billion in market value from its associated companies. This led Indian regulators to his doorstep and forced him into defensive mode. A war of words has persisted ever since.

A year and a half later, the battle continues. And based on new information released by Hindenburg, one might wonder whether it was all worth it.

The firm — which describes itself as specializing in “forensic financial research” — recently disclosed that it’s made just $4 million from its considerable efforts. Compared to the nine figures of market value it helped erase, and the $80 billion wiped from Adani’s personal fortune, that’s a drop in the bucket.

Detailed below is the considerable back-and-forth that’s taken place since Hindenburg’s initial shot across the bow of Adani Group. The tale that follows highlights the lengths a global conglomerate — and the regulatory body with a vested interest in keeping it afloat — will go to defend itself. It also shows the resolute nature of Anderson as he continues fighting back.

The initial report

Hindenburg accused Indian business magnate Gautam Adani in 2023 of pulling off the “largest con in corporate history.” It was the result of a two-year-long investigation, which found a number of financial and accounting irregularities in Adani’s empire, the firm said in its 106-page report.

“Indian conglomerate Adani Group has engaged in a brazen stock manipulation and accounting fraud scheme over the course of decades,” the report said. “We believe the Adani Group has been able to operate a large, flagrant fraud in broad daylight in large part because investors, journalists, citizens and even politicians have been afraid to speak out for fear of reprisal,” it later added.

Hindenburg identified at least 38 shell companies closely related to Adani Group, which it said appeared to engage in stock manipulation and money laundering. It cited “numerous examples”of those companies funneling money through private companies owned by Adani, before cash was set to Adani’s listed public companies.

The short-seller’s investigation also found Adani’s private and public companies to have “numerous” undisclosed transactions with other parties, the researchers found, which violates regulatory laws in India.

The “labyrinthian network of shells appears to serve several functions, including shuffling losses into private entities to boost reported earnings, and surreptitiously moving money to prop up entities in the group,” Hindenburg said.

Adani Group was also affiliated with a number of funds that displayed “flagrant irregularities,” the research firm said, such as being offshore entities, having concealed ownership information, and having portfolios being “almost exclusively” invested in Adani’s firms.

One such fund, Elara, controlled another fund that was around 99% concentrated in Adani shares. That suggested to the researchers it was “obvious Adani controls the shares,” the report said.

Hindenburg attached a list of 88 questions for Adani to answer, which included inquiries into the billionaire’s close contacts, Adani Group executives, and investigations into the company by regulators.

“If Gautam Adani embraces transparency, as he claims, they should be easy questions to answer,” the report said.

The response

Nursing deep stock losses, Adani Group hit back with its own 413-page response, calling Hindenburg’s original report “nothing but a lie.”

“We are shocked and deeply disturbed to read the report published by the ‘Madoffs of Manhattan,'” the reply said, referring to Hindenburg.

“The document is a malicious combination of selective misinformation and concealed facts relating to baseless and discredited allegations to drive an ulterior motive,” it added.

The firm disclosed information on its accounting practices and professional relationships, while disputing many of the claims in the Hindenburg report.

Transactions that were identified as suspicious by Hindenburg’s team were in compliance with local laws and accounting standards, it said. Offshore companies and funds mentioned in Hindenburg’s report were merely public shareholders in Adani-listed companies, the retort added.

“A listed entity does not have control over who buys/sells/owns the publicly traded shares or how much volume is traded, or the source of funds for such public shareholders nor it is required to have such information for its public shareholders under the laws of India. Hence we cannot comment on trading pattern or behavior of public shareholders,” Adani’s report said.

The firm also criticized Hindenburg for its financial stake in releasing the report, calling the firm an “unethical short seller” and guilty of a “flagrant breach of applicable securities and foreign exchange laws.”

“This is rife with conflict of interest and intended only to create a false market in securities to enable Hindenburg, an admitted short seller, to book massive financial gain through wrongful means at the cost of countless investors,” it said.

Hindenburg issued a reply to Adani on the same day, denying any wrongdoing from its original report. They argued that Adani Group’s reply failed to answer most of their questions. The conglomerate also didn’t dispute the existence of certain “suspect” transactions, nor did it explain “their obvious irregularities,” researchers added.

“We also believe that fraud is fraud, even when it’s perpetrated by one of the wealthiest individuals in the world,” Hindenburg Research said in its reply.

Adani Group eventually lawyered up and readied for a fight, though the damage had already been done. In less than a week, Adani, known as the world’s third richest man, saw his personal wealth plummet by $52 billion.

Conflict over Hindenburg’s short-selling arrangement

Indian regulators have raised specific questions about the structure of Hindenburg’s short bet on Adani Group. The Securities and Exchange Board of India — the country’s version of the SEC — sent a notice to Hindenberg in June 2024, raising questions about the nature of the report and the firm’s relationship with Kingdon Capital Management, a New York hedge-fund involved in building a short position against Adani Group.

Hindenburg’s initial report was described to be “misleading” and have contained “inaccurate statements.”

“These misrepresentations built a convenient narrative through selective disclosures, reckless statements, and catchy headlines, in order to mislead readers of the report and cause panic in Adani Group stocks, thereby deflating prices to the maximum extent possible and profit from the same,” the notice read.

Regulators also revealed that Hindenburg had shared its research with Kingdon prior to publication. The two companies had a profit-sharing agreement, the notice says, with Hindenburg set to get 25% of Kingdon’s profits for the short bet.

Kingdon ended up making $22.3 million on the bet, $5.5 million of which is owed Hindenburg. $4.1 million of that had been paid as of the start of June, the document shows.

Hindenburg shrugged off the letter as “nonsense,” and an attempt to ward off whistleblowers who expose corruption among the country’s most powerful people and companies.

“One might think that a securities regulator would be interested in meaningfully pursuing the parties that ran a secret offshore shell empire engaging in billions of dollars of undisclosed related party transactions through public companies while propping up its stocks through undisclosed share ownership via a network of sham investment entities,” Hindenburg said in its reply.

It added: “Instead, SEBI seems more interested in pursuing those who expose such practices.”

A passion for ‘finding scams’

Backlash is nothing new to Anderson, who’s targeted other high-profile financiers and began sniffing out wrongdoers on Wall Street long before he launched Hindenburg Research in 2017.

This decade alone he’s been instrumental in weeding out companies in the electric-vehicle industry. His work on Nikola led to fraud charges against its founder, and he also called out now-defunct Lordstown Motors for hyping up commercial interest in its product.

More recently he took aim at activist investor Carl Icahn and his famed operation, Icahn Enterprises.

“Find[ing] scams” has been a life-long passion, he told the New York Times in a 2021 interview, adding that he had spent hours off-the-clock looking into potential schemes, to the chagrin of some of his former bosses.

“I didn’t plan it this way,” he told the Times. “It was a side hobby that my employers were sometimes annoyed by.”

Fraud-finding is one of his top goals of 2024, he wrote in a post on X in January.

“My 2023 New Years professional resolution is to work with our @HindenburgRes team to expose some of the biggest frauds and financial charlatans in the world,” Anderson wrote. “I am very confident we will achieve this goal.”

Read the original article on Business Insider

EMEA Tribune is not involved in this news article, it is taken from our partners and or from the News Agencies. Copyright and Credit go to the News Agencies, email news@emeatribune.com Follow our WhatsApp verified Channel