The pace of price increases over the past year was higher than forecast in September while jobless claims posted an unexpected jump following Hurricane Helene and the Boeing strike, the Labor Department reported Thursday.

The consumer price index, a broad gauge measuring the costs of goods and services across the U.S. economy, increased a seasonally adjusted 0.2% for the month, putting the annual inflation rate at 2.4%. Both readings were 0.1 percentage point above the Dow Jones consensus.

The annual inflation rate was 0.1 percentage point lower than August and is the lowest since February 2021.

Excluding food and energy, core prices increased 0.3% on the month, putting the annual rate at 3.3%. Both core readings also were 0.1 percentage point above forecast.

A separate report Thursday showed weekly jobless claims hitting a 14-month high, indicating potential softness in the labor market despite the big jump in nonfarm payrolls in September. However, most of the surge could be tied to the hurricane and strike.

Much of the inflation increase — more than three-quarters of the move higher — came from a 0.4% jump in food prices and a 0.2% gain in shelter costs, the Bureau of Labor Statistics said in the release. That offset a 1.9% fall in energy prices.

Other items contributing to the gain included a 0.3% increase in used vehicle costs and a 0.2% rise in new vehicles. Medical care services were up 0.7% and apparel prices surged 1.1%.

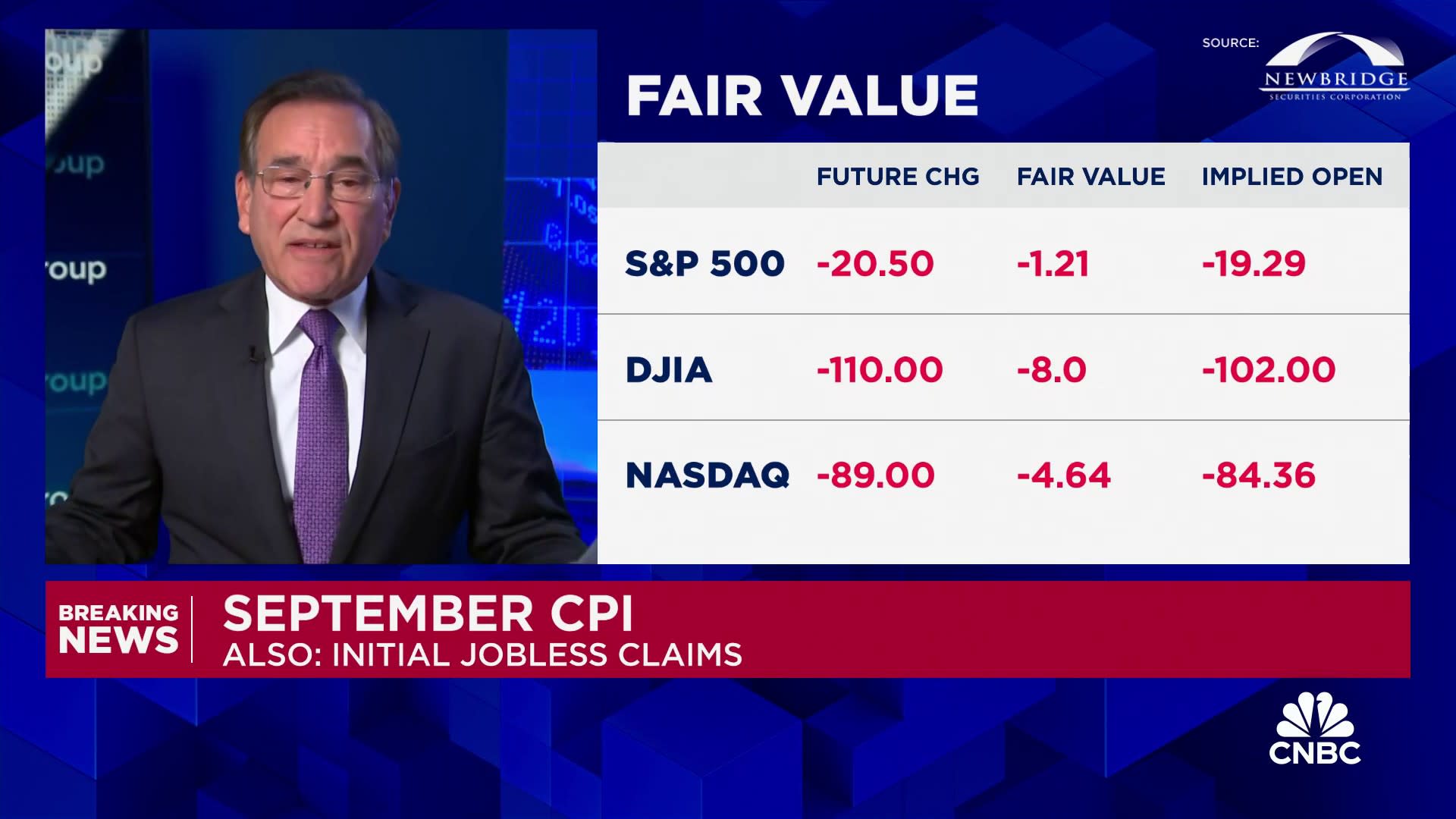

Stock market futures moved lower following the report while Treasury yields were mixed.

The release comes as the Federal Reserve has begun to lower benchmark interest rates. After a half percentage point reduction in September, the central bank is expected to continue cutting, though the pace and degree remain in question.

Fed officials have become more confident that inflation is easing back toward their 2% goal while expressing some concern over the state of the labor market.

“The overall trend is what’s important, not the day to day fluctuations,” Chicago Fed President Austan Goolsbee said said in an interview on CNBC’s “Squawk on the Street” following the release. “The overall trend over 12, 18 months is clearly that inflation has come down a lot, and the job market has cooled to a level which is around where we think full employment is.”

While the CPI is not the Fed’s official inflation barometer, it is part of the dashboard central bank policymakers use when making decisions. Several of its components filter directly into the Fed’s key personal consumption expenditures price index.

Though the inflation reading was higher than expected, traders in futures markets increased their bets that the Fed would lower rates by a quarter percentage point at their Nov. 6-7 policy meeting, to about 86%, according to the CME Group’s FedWatch gauge.

Goolsbee said the data is largely in line with Fed expectations and shouldn’t be viewed in isolation as having an outsized influence on policy.

“I just want to caution everybody, let’s settle down when one month numbers come in,” he said. “That’s not what we should be basing the monetary policy on. We should be basing it on the long part.”

In recent days, policymakers have said they see rising risks in the labor market, and another data point Thursday helped buttress that point.

Initial filings for unemployment benefits took an unexpected turn higher, hitting a seasonally adjusted 258,000 for the week ended Oct. 5. That was the highest total since Aug. 5, 2023, a gain of 33,000 from the previous week and well above the forecast for 230,000.

Continuing claims, which run a week behind, rose to 1.861 million, a rise of 42,000.

The jobless claims figures follow the damage from Hurricane Helene, which struck Sept. 26 and impacted a large swath of the Southeast. Florida and North Carolina, two of the hardest-hit states, posted a combined increase of 12,376, according to unadjusted data.

A strike by 33,000 Boeing workers also could be hitting the numbers. Michigan had the largest gain in claims, up 9,490 on the week.

On the inflation side, rising prices across a variety of food categories showed that it is proving sticky.

Egg prices leaped 8.4% higher, putting the 12-month unadjusted gain at 39.6%. Butter was up 2.8% on the month and 7.8% from a year ago.

However, shelter costs, which have held higher than Fed officials anticipated this year, were up 4.9% year over year, a step down that could indicate an easing of broader price pressures ahead. The category makes up more than one-third of the total weighting in calculating the CPI.

EMEA Tribune is not involved in this news article, it is taken from our partners and or from the News Agencies. Copyright and Credit go to the News Agencies, email news@emeatribune.com Follow our WhatsApp verified Channel