(Bloomberg) — Sign up for the India Edition newsletter by Menaka Doshi – an insider’s guide to the emerging economic powerhouse, and the billionaires and businesses behind its rise, delivered weekly.

Most Read from Bloomberg

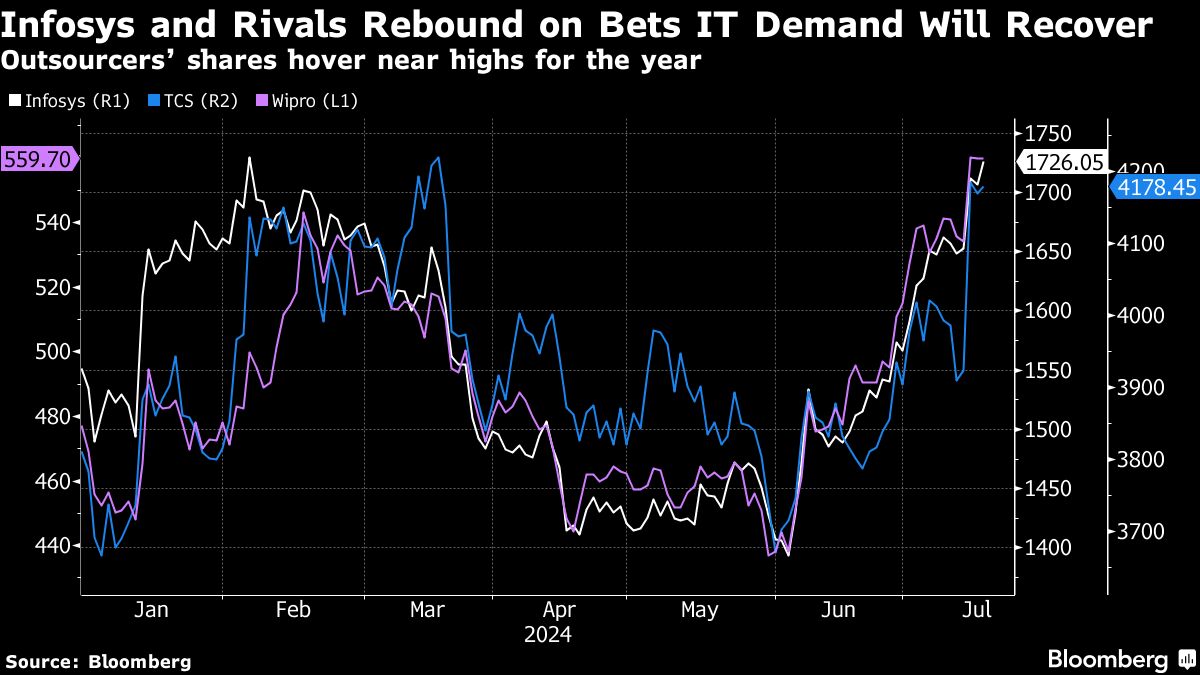

Infosys Ltd. raised its sales forecast for the year in a sign that clients are gradually beginning to boost technology spending, encouraged by a resilient global economy.

Revenue will grow 3% to 4% on a constant currency basis in the fiscal year through March 2025, Infosys said Thursday. That compared with the average analyst estimate of 3.16%. Bangalore-based Infosys had previously given a sales guidance of 1% to 3%. For the first fiscal quarter through June, Infosys’ net income rose to 63.7 billion rupees ($761 million). Analysts expected 62.48 billion rupees on average. Revenue rose 3.7% to 393.2 billion rupees.

“We had a strong performance in Q1 on volumes as well as financial services in the US,” Chief Executive Officer Salil Parekh told a news conference. “Second, we had a very strong performance on large deals in Q1, which gives us more visibility into this financial year.” Infosys also completed the acquisition of in-tech GmbH, a German automotive engineering research and development services provider, which helped in the guidance, he said.

The company said its large deal wins were at a record with a total contract value of $4.1 billion.

India’s $250 billion software services industry, led by Tata Consultancy Services Ltd. and Infosys, is betting that falling interest rates and slowing inflation will spur technology spending. Traders are betting the US Federal Reserve will begin cutting rates in September, while the global economy is set to expand 3% in 2024, more than the 2.7% projected earlier this year, according to Bloomberg Economics. Asia’s largest outsourcer TCS last week expressed optimism about a better fiscal year, though it remained cautious about a sustained growth momentum.

Companies such as Infosys are betting big on machine learning, analytics, and cloud computing to boost revenue as global enterprises try to transform legacy businesses to compete with nimble startups. Generative artificial intelligence is also emerging as a new bright spot for outsourcers around the world, though some like TCS say AI will take some time to become a significant revenue stream.

What Bloomberg Intelligence Says

“It appears that client spending has stabilized and not worsened, particularly in the financial services sector, which is a good sign. Headcount declined again in 1Q, but the pace of decline was lower than in previous quarters, and could reverse in 2H.”

– Anurag Rana & Andrew Girard, analysts

Click here for research

Shares in Infosys ended 1.9% higher in Mumbai. The stock has gained 14% this year.

(Updates with CEO comment in the third paragraph.)

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.

EMEA Tribune is not involved in this news article, it is taken from our partners and or from the News Agencies. Copyright and Credit go to the News Agencies, email news@emeatribune.com Follow our WhatsApp verified Channel