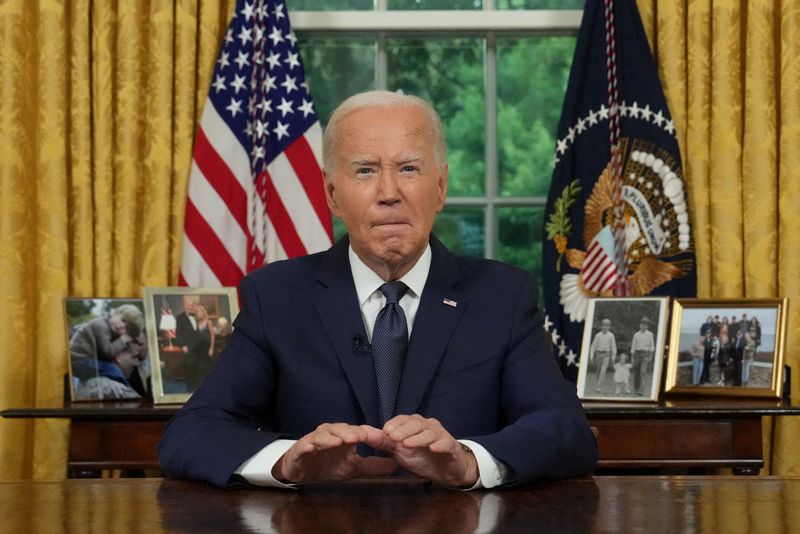

NEW YORK (Reuters) – U.S. President Joe Biden ended his reelection campaign on Sunday after fellow Democrats lost faith in his mental acuity and ability to beat Donald Trump, leaving the presidential race in uncharted territory.

Here are comments from investors:

BRIAN JACOBSEN, CHIEF ECONOMIST, ANNEX WEALTH MANAGEMENT, BROOKFIELD, WI:

“This is a contest once again. If Biden stayed in, the odds would have increasingly tilted not only in favor of Trump winning, but of there being a Republican sweep. Now it’s race again. The Trump-Trade will likely take a breather as investors reassess the odds of the outcome. That means small caps, financials, energy, and crypto could see a little pullback, but Trump still has the edge.”

JACK MCINTYRE, PORTFOLIO MANAGER, GLOBAL FIXED INCOME, BRANDYWINE GLOBAL INVESTMENT MANAGEMENT:

“I think overall this is going to be at least temporarily positive for markets…It’s probably going to be a positive for the bond market, especially given just where we are in the business cycle and more importantly, where we are with growth, inflation.

“I suspect that if this moves us toward getting divided government, that is a positive for the market.”

JAMIE COX, MANAGING PARTNER, HARRIS FINANCIAL GROUP, RICHMOND, VA:

“The question of who is going to be the nominee is going to re-enter investors’ minds in a very big way.”

“Markets are going to be terribly volatile until the Democrat nominee is known. That will likely manifest itself through the dollar, creating volatility in fixed income and equities.”

GINA BOLVIN, PRESIDENT OF BOLVIN WEALTH MANAGEMENT GROUP

“Biden stepping down is a whole new level of political uncertainty. This may be the catalyst for market volatility that is overdue.”

RHONA O’CONNELL, HEAD OF MARKET ANALYSIS – EMEA & ASIA – STONEX, LONDON:

“My instinctive reaction is that everything in the short term remains up in the air, vis-a-vis the Democrat nomination, obviously. But it may well put some brakes on the Trump locomotive.

“As far as risk-off is concerned – tailwinds are stronger for gold, purely on this basis, than headwinds. Some uncertainty been taken away, by definition, as per above.”

“At least it points to a stronger opposition, to which is what every democracy should strive.”

(Reporting by Finance and Markets teams, Compiled by Megan Davies)

EMEA Tribune is not involved in this news article, it is taken from our partners and or from the News Agencies. Copyright and Credit go to the News Agencies, email news@emeatribune.com Follow our WhatsApp verified Channel