Just when investors thought shares of Apple (NASDAQ: AAPL) might have run out of momentum, the company’s developer conference, where it unveiled an avalanche of upcoming products and features using artificial intelligence (AI), supercharged the stock and sent it to new highs.

Apple is arguably one of the most obvious AI stocks because generative AI perfectly fits the core experience of using iOS products. The million-dollar question is just how much upside remains in the stock for prospective investors today. Is Apple a buy? Here is what you need to know.

AI is a genuine game changer for Apple

It’s fair to say that AI is a big deal for Apple. The company recently unveiled numerous AI features it will build into its software. Some examples include custom emojis, integrating ChatGPT into Siri, and its in-house AI tech, Apple Intelligence. The influx of new technology could dramatically improve the user experience on iOS devices, which Apple was already known for.

After years of limited functionality, I cannot wait for a better version of Siri. It doesn’t seem like a stretch that others feel the same. A better experience with iOS devices likely means an even stickier Apple ecosystem. In other words, AI seems likely to enhance Apple’s core business of selling iOS devices and services rather than harm it.

But can AI solve Apple’s growth woes?

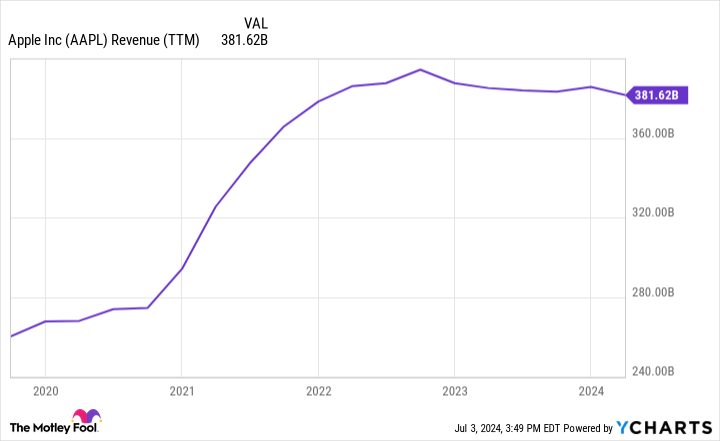

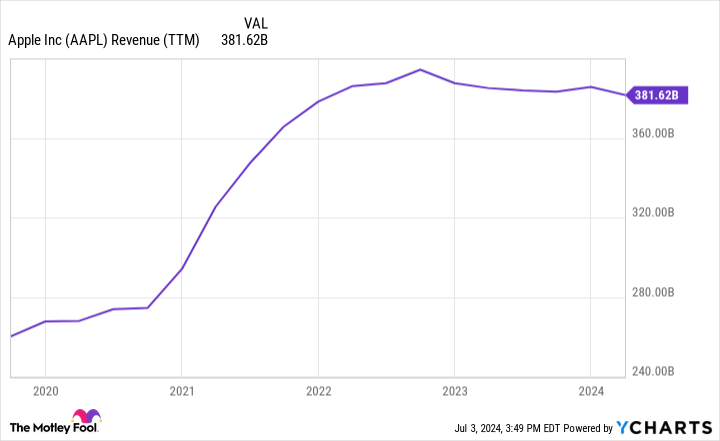

AI’s impact on Apple will determine whether it can get sales growth moving in the right direction again. As you can see below, Apple’s revenue has peaked and begun declining in recent years. New iterations of the iPhone are released annually, and the year-to-year changes aren’t as pronounced as a decade ago. The product has matured. Incremental camera, screen, and processor updates only go so far.

Combine that with Apple’s famously good build quality, and users no longer rush to upgrade their phones. An estimated 61% of iPhone owners wait at least two years to upgrade.

Getting more iPhone users to upgrade could revive revenue growth, and AI could be the catalyst. It’s not a bold statement to say that AI features are the most significant iPhone breakthrough since the first 5G phone, which sparked Apple’s last growth spurt. Naturally, only Apple’s newest phones, the iPhone 15 generation, will be compatible with AI. Time will tell if consumers are excited enough to splurge on new devices.

Is Apple a buy?

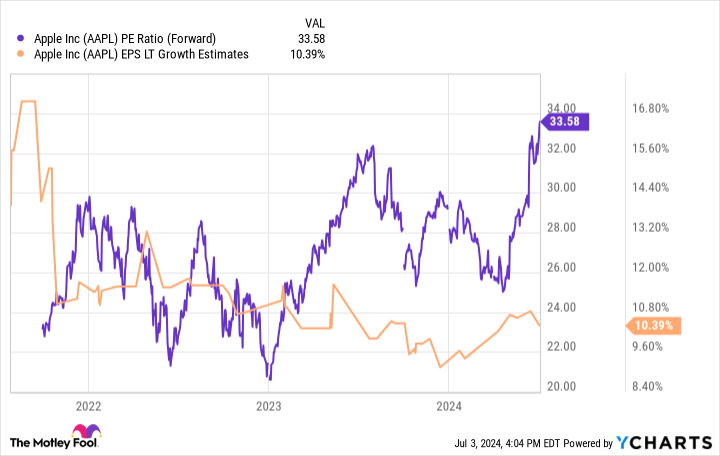

If the share price is any indication, Wall Street is confident AI will help Apple grow again. Shares have rocketed to all-time highs since Apple unveiled its AI plans. But here’s the problem: The stock now trades at a forward P/E over 33, its highest valuation in recent memory.

Investors can equate a stock’s valuation to expectations. The stock’s average P/E for the past decade is just 21. Such a departure from long-term norms is Wall Street saying loud and clear, “You better deliver the goods!”

AI sounds promising, but this is a lot to ask. Even analysts estimate just 10% annual earnings growth over the long term, which doesn’t seem near enough to justify Apple’s current price. Maybe Apple delivers and then some. It could justify the share price, but what about additional gains for investors who buy today? Or worse, what if AI doesn’t impact Apple’s business the way people hope and shares head to a lower valuation?

The reality is that AI hype has priced Apple stock for perfection. There is far more room for shares to go down than up, and even a best-case scenario doesn’t seem to offer much to get excited about. Apple customers have a lot to look forward to with AI, but investors are best off staying away until the share price makes a lot more sense than it does now.

Should you invest $1,000 in Apple right now?

Before you buy stock in Apple, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Apple wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $771,034!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of July 2, 2024

Justin Pope has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Apple. The Motley Fool has a disclosure policy.

Is Apple a Buy? was originally published by The Motley Fool

EMEA Tribune is not involved in this news article, it is taken from our partners and or from the News Agencies. Copyright and Credit go to the News Agencies, email news@emeatribune.com Follow our WhatsApp verified Channel