(Bloomberg) — Japan equities are set to regain some ground after suffering the biggest hit in Monday’s global rout, which wiped out billions across markets from New York to London. US equity futures climbed in early trading.

Most Read from Bloomberg

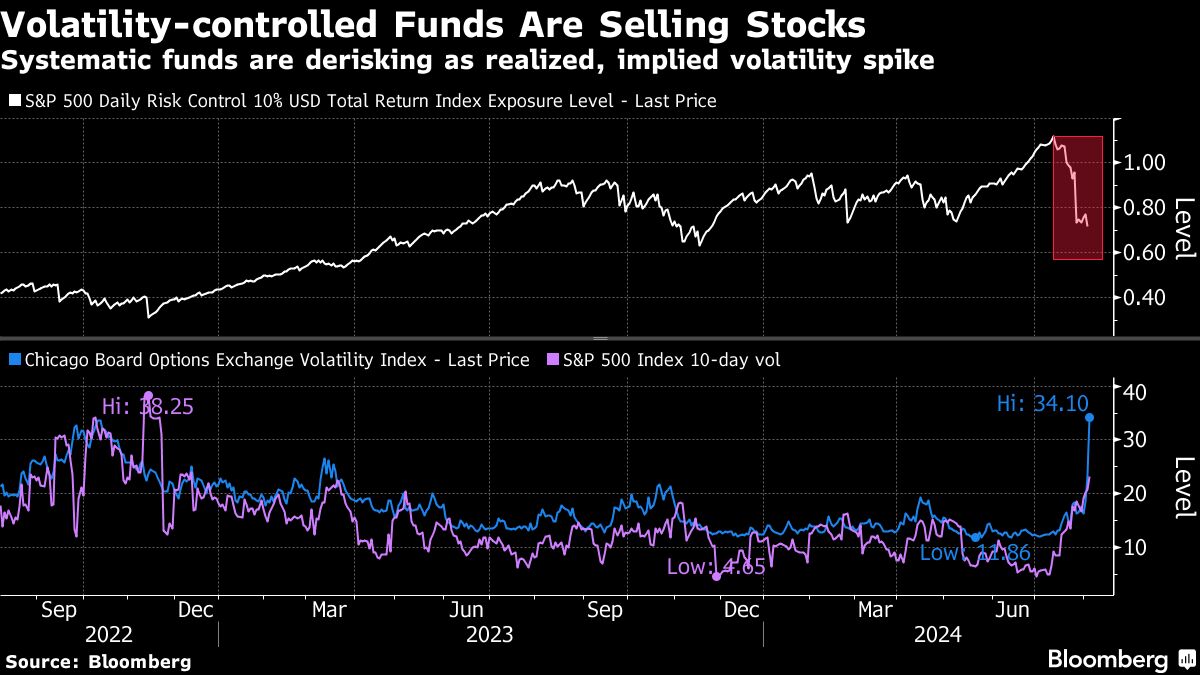

Futures show the Nikkei 225 gaining more than 6% when it reopens Tuesday, following a 12% slump that was the worst one-day decline in yen terms. Hong Kong and Sydney shares look more steady, suggesting traders may be ready to catch their breath following a dramatic day in which Wall Street’s “fear gauge” – the VIX – at one point registered its largest spike in data going back to 1990.

While the S&P 500 pared some of its losses to finish 3% lower Monday, it still suffered the biggest plunge in about two years amid strong trading volume. The tech-heavy Nasdaq 100 saw its worst start to a month since 2008. Still, futures show both those indices may gain when US trading begins later Tuesday.

Specualtion about a looming US recession — mostly seen as premature — wiped out a celebratory mood driven by recent signals from the Federal Reserve about the timing of its first rate cut. The repricing was so sharp that the swap market earlier assigned a 60% chance of an emergency rate reduction by the Fed over the coming week. Those odds subsequently ebbed.

“The economy is not in crisis, at least not yet,” said Callie Cox at Ritholtz Wealth Management. “But it’s fair to say we’re in the danger zone. The Fed is in danger of losing the plot here if they don’t better acknowledge cracks in the job market. Nothing is broken yet, but it’s breaking and the Fed risks slipping behind the curve.”

Treasuries lost some steam after a surge that briefly drove two-year yields — which are sensitive to monetary policy — below those on 10-year bonds. US 10-year yields were little changed at 3.78%. The dollar fell. A gauge of perceived risk in the US corporate credit markets soared, with the turmoil effectively shutting down bond sales on what had been expected to be among the busiest days of the year. Bitcoin sank about 10%.

In Asia, the wave of selling that hit a fever pitch in Japan may subside. On Monday, investors rushed to unwind popular carry trades, powering a 2% jump in the yen and causing the Topix stock index to shed 12% and close the day with the biggest three-day drop in data stretching back to 1959. The rout wiped out $15 billion of SoftBank Group Corp.’s value on Monday.

The Bank of Japan’s monetary policy tightening last week has triggered a wave of criticism after it helped set off a historic plunge in Japanese stocks and contributed to global market turmoil — likely putting any plans for further interest-rate hikes on ice.

The US stock plunge is vindicating some prominent bears, who are doubling down with warnings about risks from an economic slowdown. JPMorgan Chase & Co.’s Mislav Matejka said equities are set to stay under pressure from weaker business activity, a drop in bond yields and a deteriorating earnings outlook. Morgan Stanley’s Michael Wilson warned of “unfavorable” risk-reward.

“This doesn’t look like a ‘recovery’ backdrop that was hoped for,” Matejka wrote. “We stay cautious on equities, expecting the phase of ‘bad is bad’ to arrive,” he added.

Market veteran Ed Yardeni said that the current equity selloff bears some similarity to the 1987 crash, when the economy averted a downturn despite investor fears at the time.

“This is very reminiscent, so far, of 1987,” Yardeni said on Bloomberg Television. “We had a crash in the stock market — that basically all occurred in one day — and the implication was that we were in, or about to fall into, recession. And that didn’t happen at all. It had really more to do with the internals of the market.”

After a very strong first half, the market had become extended on a short-term basis and the bar for positive surprises too high — and a little bit of bad news has gone a long way, according to Keith Lerner at Truist Advisory Services.

“From a stock market perspective, our base case has not changed,” Lerner said. “Our work still suggests the bull market deserves the benefit of the doubt. However, we have been expecting a choppier environment into the back half of July and August given the sharp rebound from April, stretched sentiment, and the fact that we’re entering a seasonally weaker period of the calendar year.”

Moreover, after strong first halves, historically we have seen a typical pullback of 9% at some point, even while markets still tended to end higher by the end of the year.

Notably, over the past 40 years, the S&P 500 has averaged a maximum intra-year pullback of 14%. Despite this, stocks have still shown an average return (not compounded) of 13% and risen in 33 out of 40 of those years, or 83% of the time, Lerner said.

“While always uncomfortable and typically accompanied by bad news, pullbacks are the admission price to the stock market,” Lerner said. “This is what provides the potential for higher longer-term returns relative to most other asset classes.”

Investors should hedge their risk exposure even if they own high quality assets as US stocks extend losses, according to Goldman Sachs Group Inc.’s Tony Pasquariello.

“There are times to go for the gas, and there are times to go for the brake — I’m inclined to ratchet down exposures and roll strikes,” Pasquariello wrote. He added that it’s difficult to think that August will be one of those months where investors should carry a significant portfolio risk.

To Michael Gapen at Bank of America Corp., markets are getting ahead of the Fed again.

“Incoming data have raised concerns that the US economy has hit an ‘air pocket.’ A rate cut in September is now a virtual lock, but we do not think the economy needs aggressive, recession-sized cuts.”

As the selloff in global stocks intensified Monday, JPMorgan Chase & Co.’s trading desk said the rotation out of the technology sector might be “mostly done” and the market is “getting close” to a tactical opportunity to buy the dip.

Elsewhere in the Asian region, Australia’s central bank on Tuesday is expected to hold its cash rate at 4.35% for a sixth straight meeting, economists predict. The nation is poised to stay near the back of the global easing cycle as local inflation — while cooling — remains elevated requiring the Reserve Bank to keep its key interest rate at a 12-year high.

Oil rose from a seven-month low early Tuesday as the halting of production from Libya’s biggest field refocused attention on the Middle East.

Corporate Highlights:

-

Palantir Technologies Inc. raised its annual outlook, citing continuing demand for its artificial-intelligence software.

-

A federal judge on Monday ruled that Google has illegally monopolized the search market, hading the government an epic win in its first major antitrust case against a tech giant in more than two decades.

-

Nvidia Corp.’s upcoming artificial intelligence chips will be delayed due to design flaws, The Information reported, citing two unidentified people who help produce the chip and its server hardware.

-

Dell Technologies Inc. is cutting jobs as part of a reorganization of its sales teams that includes a new group focused on artificial intelligence products and services.

-

Tyson Foods Inc. shares surged, bucking a broad retreat in equity markets, as quarterly earnings beat the highest of analyst estimates on a rebound in chicken profits.

Key events this week:

-

Australia rate decision, Tuesday

-

Eurozone retail sales, Tuesday

-

China trade, forex reserves, Wednesday

-

US consumer credit, Wednesday

-

Germany industrial production, Thursday

-

US initial jobless claims, Thursday

-

Fed’s Thomas Barkin speaks, Thursday

-

China PPI, CPI, Friday

Some of the main moves in markets:

Stocks

-

S&P 500 futures rose 0.9% at 8:08 a.m. in Tokyo; the S&P 500 fell 3%

-

Nikkei 225 futures rose 6.3%

-

Hang Seng futures rose 0.2%

-

S&P/ASX 200 futures fell 0.4%

Currencies

-

The Bloomberg Dollar Spot Index was little changed

-

The euro was little changed against the dollar

-

The Japanese yen fell 0.7% to 145.23 per dollar

Cryptocurrencies

-

Bitcoin rose 0.8% to $54,831.63

-

Ether rose 0.9% to $2,461.61

Bonds

Commodities

This story was produced with the assistance of Bloomberg Automation.

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.

EMEA Tribune is not involved in this news article, it is taken from our partners and or from the News Agencies. Copyright and Credit go to the News Agencies, email news@emeatribune.com Follow our WhatsApp verified Channel