If there’s something that can bring Americans together, it’s a good deal.

Home buyers today face an expensive housing market, with record-high home prices and mortgage rates close to 7%. But most people who already own a home are reaping the benefits of having bought or refinanced when mortgage rates were at record lows during the COVID-19 pandemic.

Most Read from MarketWatch

One such homeowner is the presumptive Democratic presidential nominee, Vice President Kamala Harris. Harris and her husband, Doug Emhoff, own a Los Angeles property with a mortgage rate of 2.625%, according to federal disclosures filed at the end of 2021 and first reported by the Wall Street Journal. The couple refinanced their mortgage in 2020, the Journal reported.

Although some of today’s would-be home buyers have put their plans on hold in hopes that mortgage rates will drop significantly, the pandemic-era mortgage rates of 3% were an “anomaly,” Fannie Mae’s chief economist previously told MarketWatch. A more normal rate for the 30-year fixed rate would be 6%, he added, citing historical trends.

“Mortgage rates were historically low during the pandemic, especially late 2020 and early 2021, which is when [Harris] refinanced,” Chen Zhao, economics research lead at the real-estate brokerage firm Redfin RDFN, told MarketWatch.

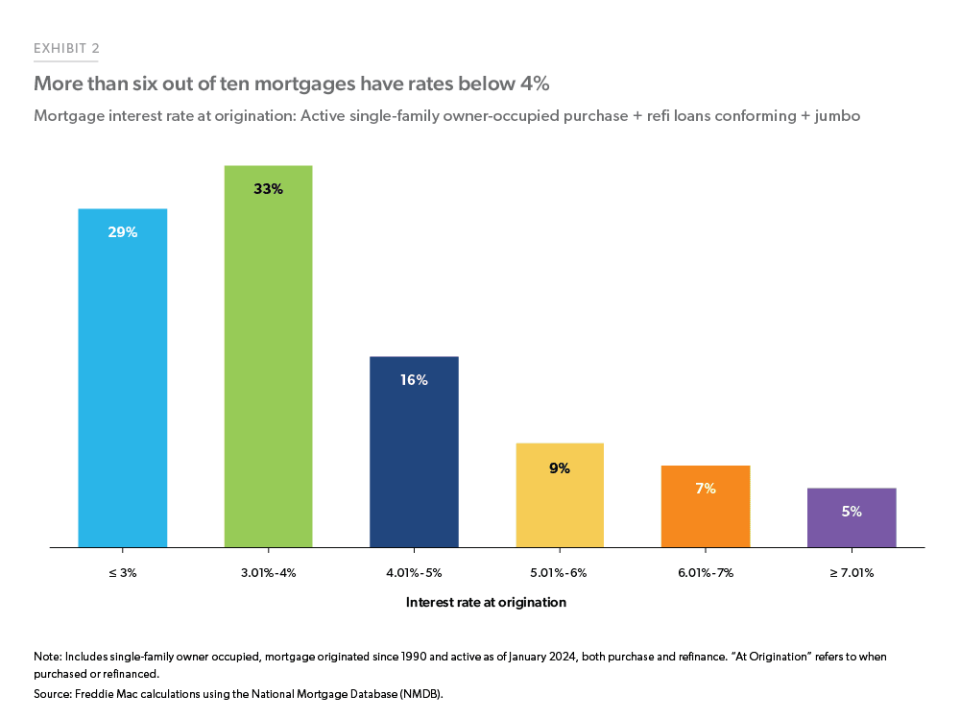

More than six out of 10 mortgages have rates below 4%, which homeowners obtained when buying a house or through refinancing, according to an analysis by Freddie Mac published in May. Nearly 30% of mortgages were originated at a rate of less than 3%. Homeowners who don’t want to lose those low rates may be wary of selling and taking on a higher rate, a phenomenon known as the “lock-in effect,” which is keeping the inventory of existing homes for sale low.

Another homeowner with a mortgage rate under 4% is Sen. J.D. Vance, the Ohio Republican vying to be the next vice president.

Vance, the newly announced running mate of Republican presidential nominee Donald Trump, owns a property with a mortgage rate of 3.875%, according to Senate financial disclosures. He purchased the property in Alexandria, Va., for $1.6 million, according to Mansion Global. He also owns a home in Cincinnati, Ohio, and a townhouse in Washington, D.C., according to Realtor.com.

The Harris and Trump campaigns did not respond to requests for comment from MarketWatch.

Despite having similarly low interest rates, Harris’s and Vance’s mortgages differ in one key aspect: their duration. While Vance opted for a traditional 30-year mortgage, Harris went with an adjustable-rate mortgage with a fixed rate for the first seven years, in 2016 and again when she refinanced in 2020.

Adjustable-rate mortgages were more common in the run-up to the subprime-mortgage crisis, when they made up about a third of all mortgages originated, Redfin’s Zhao said. Today, they make up about 6% of all mortgage applications, according to data from the Mortgage Bankers Association. And a seven-year ARM like the one Harris has is seen as the less popular option, Zhao added, with most people opting for one that is fixed for the first five years.

Harris’s net worth is estimated to be $8 million, according to Forbes, while Trump’s net worth is estimated to be $7.5 billion and Vance’s is estimated to be $10 million.

Harris and Emhoff’s Los Angeles home is worth $5 million, the Wall Street Journal reported. Zhao estimated that after their $2 million 2020 refinancing, the mortgage payment could be roughly $8,000 a month for the first seven years for which the rate was fixed. The fact that the couple went with an ARM instead of a fixed-rate mortgage was an odd choice, the economist added.

“She got that mortgage at a time when there was little advantage to getting an ARM, because the ARM rate was not much lower than the fixed rates,” she said. “So it probably would have been wiser all around to get a fixed-rate loan at that time — but in general, especially for higher-income homeowners, ARMs often do make sense and are underutilized.”

Adjustable-rate vs. fixed-rate mortgages

For the savvy homeowner looking for a deal while mortgage rates average 7%, an ARM might make sense for a couple of reasons, Zhao said.

ARMs have lower rates at the beginning of the loan term: The rate for an adjustable-rate mortgage was 6.33% as of July 12, while the rate for a fixed 30-year mortgage was 6.87%. For house hunters who have a sense of how long they’re going to be in a home, an ARM might be advantageous.

“If you are likely to move in the next five to 10 years, there is no reason to pay the premium for a 30-year fixed-rate mortgage,” Zhao said. And while ARMs get a bad rap due to their association with the subprime-mortgage crisis, they have become much safer due to stricter underwriting standards and limits on how high and how quickly rates can rise, Zhao added.

A 30-year fixed-rate mortgage may make more sense for homeowners looking for stability, as it offers a steady payment over the long term. Borrowers don’t need to worry about mortgage rates rising or falling, so they can budget for other expenses and save in a more predictable manner.

What personal-finance issues would you like to see covered in MarketWatch? We would like to hear from readers about their financial decisions and money-related questions. You can fill out or write to us at . A reporter may be in touch to learn more. MarketWatch will not attribute your answers to you by name without your permission.

Most Read from MarketWatch

EMEA Tribune is not involved in this news article, it is taken from our partners and or from the News Agencies. Copyright and Credit go to the News Agencies, email news@emeatribune.com Follow our WhatsApp verified Channel