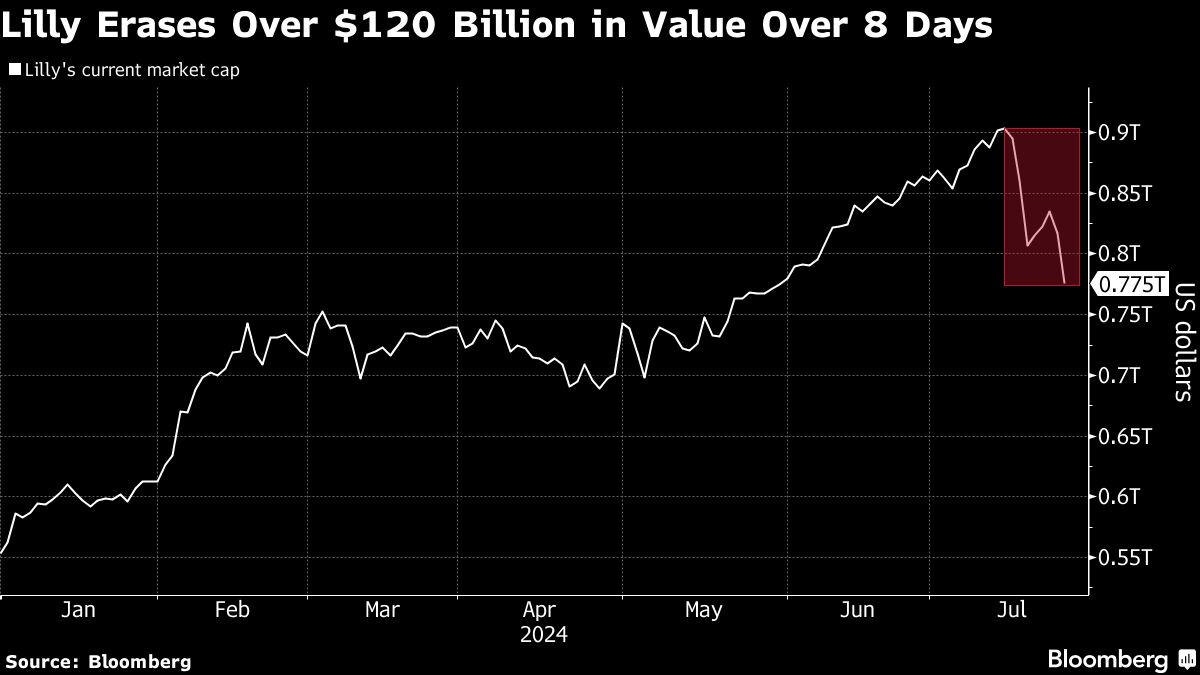

(Bloomberg) — Eli Lilly & Co. is down more than $120 billion in market value and its status as the poster child of the weight-loss drug frenzy is under threat with at least two rivals posting encouraging developments for their obesity treatments.

Most Read from Bloomberg

The company’s shares fell as much as 6.2% on Thursday, hitting the lowest intraday level since May. They’re down 14% over the past eight trading sessions, their worst eight-day stretch since 2020.

New obesity drug updates from Viking Therapeutics and Roche Holding AG over the past week have triggered the selloff in Lilly’s shares. The rout signals that investors see a potential end to the dominance of Lilly and Novo Nordisk A/S in the obesity market — that’s poised to reach $130 billion by 2030 — as competitors inch closer to having viable drugs.

“The assumption is that this is not a duopoly forever,” said Jared Holz, a health-care specialist at Mizuho. “I would expect these kind of pretty violent reactions on the back of competitive trials to lessen over time.”

Viking is advancing its weight-loss shot into a late-stage trial and is exploring a monthly dosage, the company said late Wednesday. It also said it’s moving the oral version of the drug into a mid-stage trial, starting in the fourth quarter. Viking’s stock jumped as much as 39% Thursday, the best performance since February.

Meanwhile, Roche is planning to accelerate the development of its obesity drug following promising results from its experimental weight-loss pill last week, the company said.

Lilly probably has “two years of good growth, but I just think they’re gonna hit a wall at some point sooner rather than later,” said Jeff Jonas, a portfolio manager at Gabelli Funds.

Mizuho’s Holz also see the current market rotation — where traders are moving out of outperforming megacaps — as another important driver of Lilly’s rout. Lilly’s stock has now fallen below $800 billion in market value, though it still remains up about 40% this year. The shares could rebound after its second-quarter earnings report, scheduled for Aug. 8, if it stays around this lower level, he added.

NOTE: Lilly’s Climb Has Morgan Stanley Asking $1 Trillion Question

“If all of the signs point to a very strong fundamental picture, then I think the stock will recover,” Holz said.

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.

EMEA Tribune is not involved in this news article, it is taken from our partners and or from the News Agencies. Copyright and Credit go to the News Agencies, email news@emeatribune.com Follow our WhatsApp verified Channel