Every shopper wants to find a bargain; it’s one of the thrills when we go looking to buy things. Finding what we want at a lower price than we planned on spending – that’s always a bit exciting. And this holds true for the stock markets, too. It’s the allure behind value stocks.

According to Bank of America, the value stock segment, typically priced lower than their underlying strengths would suggest, has badly lagged the growth stocks so far this year. The bank’s research equity and quant strategist Savita Subramanian describes value stocks as ‘neglected and trading at very low multiples,’ and points out several sectors, including energy stocks, as a place for value-minded investors to look for opportunities.

Subramanian’s colleague, Bank of America stock analyst Kalei Akamine, has been taking that stance forward and giving a closer look at three value-priced energy stocks. All three are members of the S&P 500 value index, and the BofA view holds that these are value stocks to consider right now.

According to the TipRanks database, the broader Wall Street take on these picks is clear – they are Buy-rated and offer sound, double-digit upside potential. Let’s look into the details and find out just why Bank of America believes they are compelling portfolio choices.

ConocoPhillips (COP)

We’ll start with ConocoPhillips, one of the world’s largest independent oil and gas exploration and production companies. With a market cap of $131 billion, ConocoPhillips oversees a worldwide operation from its Houston, Texas base; the company has activities in North America, Europe, Africa, the Middle East, and the Asia-Pacific region.

Zooming out, we find that ConocoPhillips is deeply involved in the production of most forms of fossil fuel. The company’s ops include all phases of discovery, exploitation, transport, and distribution/marketing of hydrocarbon fuels and other products, including crude oil, natural gas, natural gas liquids, liquified natural gas (LNG), and bitumen, also known as natural asphalt. ConocoPhillips maintained an average daily production last year of 1,826 thousand barrels of oil equivalent, and as of this past Dec 31, claims approximately 6.8 billion barrels of oil equivalent of proved reserves in its land holdings and areas of operation. The company’s largest crude oil and natural gas production region was the ‘Lower 48’ of the US.

For return-minded investors, this company maintains a solid commitment to putting capital back into shareholders’ hands. In 2023, the company returned $11 billion to its shareholders, in fulfillment of its policy to return upwards of 30% of its cash from operations.

In the most recent reported quarter, 1Q24, ConocoPhillips had sales and operating revenues that came to $14.5 billion. This was more than $480 million less than had been expected, and was based on total production for the quarter of 1,902 Mboe/d. The company’s bottom line came to $2.03 per share by non-GAAP measures, in line with expectations.

The oil and gas sector in the US has seen several high-profile mergers and acquisitions over the past year, and BofA analyst Akamine believes this is a net positive for ConocoPhillips. He writes, “We believe that the current M&A cycle has reshaped the competitive landscape in US E&P to the benefit of names with size and growth. With Concho, Pioneer and Hess acquired since the turn of the decade, there is now a vacuum for high quality large cap oil exposure. We think that would continue to push investors into COP, the largest independent E&P by production and market cap…”

Laying out his view of the stock for the long-term, the analyst adds, “In our view, COP’s asset mix and resource depth are the undervalued aspects of the investment case. The depth of the US portfolio has allowed COP to provide peer-leading visibility, with a 10 year plan where target is 4-5% production CAGR. While that sounds modest, there’s a compounding effect that generates significant cash flow growth.”

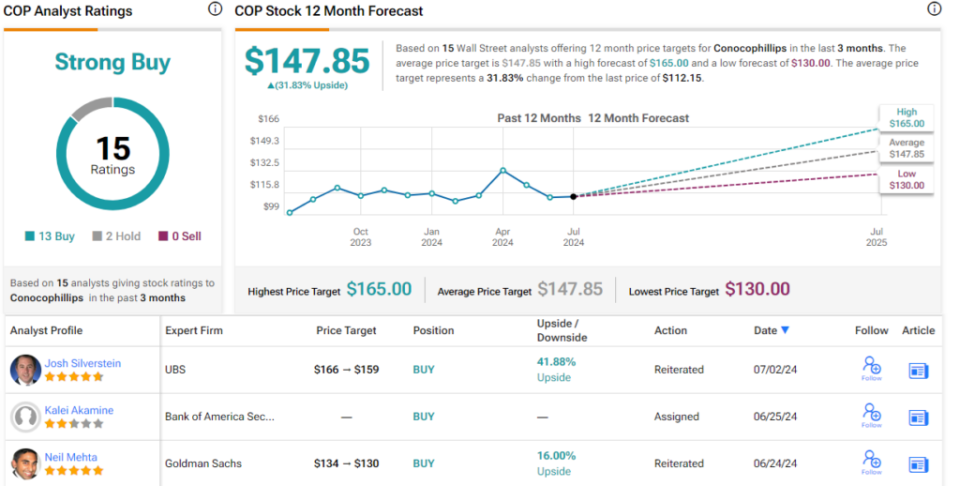

These comments support Akamine’s Buy rating on the shares, and his $147 price target implies a one-year upside of 31%. (To watch Akamine’s track record, click here.)

Overall, this oil and gas giant gets a Strong Buy consensus rating from the Street, based on 15 recent reviews that include 13 to Buy against just 2 to Hold. The shares are priced at $112.15, and the $147.85 average target price is only marginally more bullish than the BofA take. (See ConocoPhillips’ stock forecast.)

Devon Energy (DVN)

Next up is Devon Energy, an Oklahoma-based independent exploration & production firm. Devon focuses its activities on pulling recoverable energy products from onshore assets located in the Continental US. The company operates in five states – Texas, New Mexico, Oklahoma, Wyoming, and North Dakota – and is active in some of the nation’s richest energy regions, including the Williston Basin, the Delaware Basin, and the Eagle Ford formation.

Devon, a ~$30 billion company, has worked to develop a stable asset portfolio, one that is designed to promote strong future production growth while operating in an environmentally responsible manner. The company generated solid production numbers during the first quarter of this year, registering an average daily output of 319,000 barrels of oil, 165,000 barrels of natural gas liquids, and 1 billion cubic feet of natural gas. In all, this came to 664,000 barrels of oil equivalent per day, beating the previously published guidance figure by 4%.

This production led to total revenues of $3.6 billion, down 5.8% YoY, but in line with the forecasts, while the bottom line EPS figure, at $1.16 by non-GAAP measures, was a nickel above the estimates. The company finished Q1 with $1.15 billion in cash assets on hand, a solid increase from the $887 million reported in 1Q23 – and from the $875 million reported in 4Q23.

Checking in with analyst Akamine, we find the BofA energy expert bullish on Devon – citing that moving forward, the company is primed to outperform. Akamine writes, “Our Buy rating on DVN reflects a recovery story centered around DVN recentering its drilling program to its best assets in the New Mexico Delaware – and seeking to reestablish itself as one of the sector’s leading operators… With ’24 initial guidance set on the back of a challenged quarter in 3Q23, we believe DVN has reset the path to ‘beat and raise.’ At 1Q24 results, DVN raised FY24 oil guidance, crediting strong well performance in the Permian, and appears to have gotten some of that operational momentum back. Through YE24, we expect to see Permian oil stabilize around 212mbd, which could set the stage for strong FY25 guidance.”

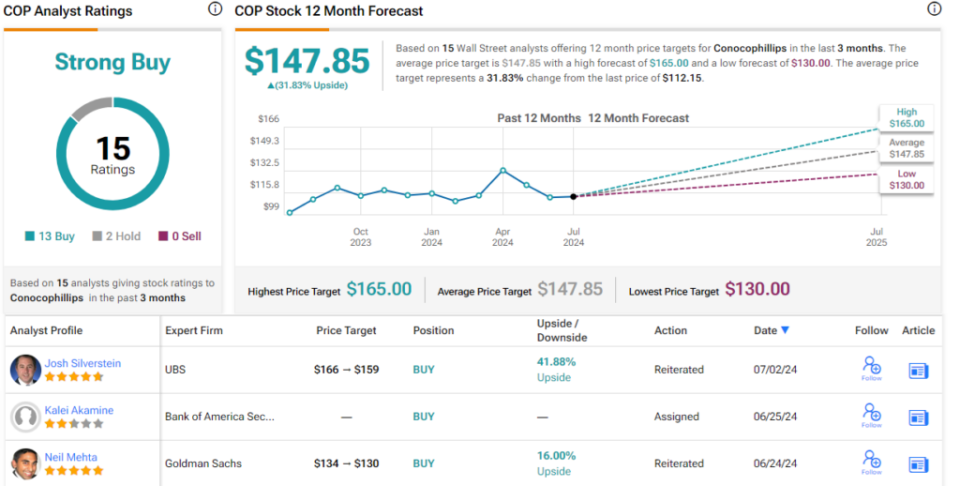

Along with his Buy rating, the analyst puts a $64 price target here, suggesting a 37% upside potential for the next 12 months.

Devon Energy has earned a Moderate Buy rating from the Street’s consensus, based on 20 recommendations that break down to 14 Buys and 7 Holds. The shares are priced at $46.73 with an average price target of $60.80, indicating potential for a one-year gain of 30%. (See Devon’s stock forecast.)

EOG Resources (EOG)

Last on our BofA-backed list is EOG Resources, another of the North American large-cap independent energy companies. EOG, with its market cap of ~$72 billion, is active in the northern and southern Great Plains, as well as the Appalachian Mountain region. The company has productive oil and gas exploration and extraction operations ongoing in the Appalachian Basin, in the Eagle Ford formation, the Midland Basin, and the Permian Basin, and in the Williston, Powder River, and DJ Basins. In addition, the company has an offshore operation in the Columbus Basin, near the island nation of Trinidad & Tobago. EOG is based in Houston, Texas, near the epicenter of the 21st century energy renaissance.

On the production side, EOG beat the midpoint of the 1Q24 guidance on crude oil, natural gas liquids, and natural gas, and saw modest gains from 4Q23. The company’s crude oil production in Q1 came to 487.4 MBbld; natural gas liquids reached 231.7 MBbld, and natural gas output came to 1,858 MMcfd. The company’s total production in the quarter, converted to crude oil equivalent volumes, was reported at 1,028.8 MBoed.

Those production figures underpinned EOG’s quarterly revenue of $6.12 billion. That was up a modest 1.3% year-over-year, but beat the forecast by almost $1.8 billion. The company’s bottom line earnings figure, at $2.82 per share by non-GAAP measures, was 24 cents per share better than had been anticipated.

This company doesn’t just generate solid hydrocarbon production figures; it also generated plenty of cash in 1Q24. EOG’s cash flow from operations was listed as $2.9 billion. After deducting $1.7 billion in capital expenditures, the company reported $1.2 billion in free cash flow.

When we consult one last time with BofA’s analyst Akamine, we find that he likes this company for its combination of long-term staying power and cash generation. The energy analyst says, “EOG’s portfolio supports drilling at the current pace in the Permian Basin for 19 years, twice as long as the peer average. Post COVID, valuations have calibrated around FCF yields, which undervalues longer dated inventory. But as the industry depletes core locations and looks to replenish through expensive M&A, we see EOG increasingly well positioned and deserving of a premium multiple.”

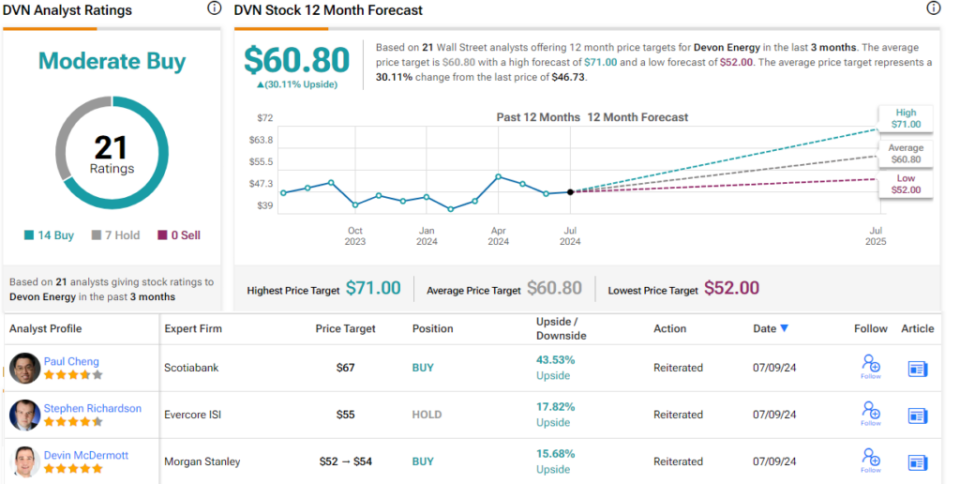

Akamine goes on to rate these shares as a Buy, and he puts a $151 price target here to point toward an upside of 19.5% on the one-year time frame. (To watch Akamine’s track record, click here.)

From the Street as a whole, EOG has a consensus rating of Moderate Buy, based on 22 reviews with a 12 to 10 breakdown favoring the Buys over the Holds. The stock is currently trading for $126.56 and its $149.35 average price target implies a one-year upside potential of 18%. (See EOG’s stock forecast.)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.

EMEA Tribune is not involved in this news article, it is taken from our partners and or from the News Agencies. Copyright and Credit go to the News Agencies, email news@emeatribune.com Follow our WhatsApp verified Channel