(Bloomberg) — The world’s largest stock market lost steam in the final stretch of a stellar year, led by a rout in big tech.

Most Read from Bloomberg

The S&P 500 trimmed this week’s advance and the Nasdaq 100 lost over 1%, with Tesla Inc. and Nvidia Corp. down at least 2.4% on Friday. That’s after a torrid surge that saw the top technology stocks dubbed “Magnificent Seven” accounting for more than half of the US equity benchmark’s performance in 2024.

“It’s fair to say that this recent dip in stocks has taken the euphoria out of individual investors, but it has not dented advisors’ sentiment,” said Tom Essaye at The Sevens Report.

His takeaway is that sentiment is no longer euphoric and markets will start the year with regular investors much more balanced in their outlook — and that would be a “good thing as it reduces air pocket risk”, but advisors have largely ignored the volatility of the last few weeks.

“And if we get bad political news or Fed officials pointing towards a “pause” in rate cuts, that likely will cause more short, sharp drops,” Essaye concluded.

Some of the main moves in markets:

Stocks

-

The S&P 500 fell 0.7% as of 9:57 a.m. New York time

-

The Nasdaq 100 fell 1.3%

-

The Dow Jones Industrial Average fell 0.2%

-

The Stoxx Europe 600 rose 0.6%

-

The MSCI World Index fell 0.4%

Currencies

-

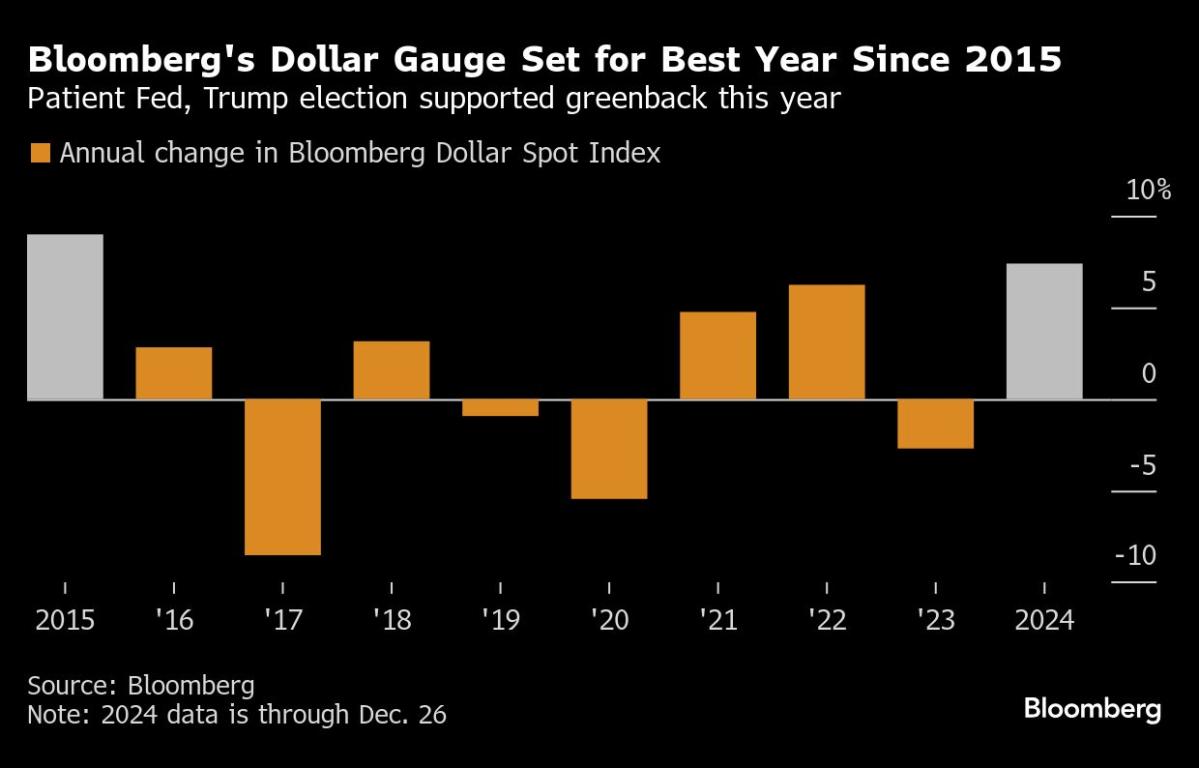

The Bloomberg Dollar Spot Index was little changed

-

The euro was little changed at $1.0427

-

The British pound rose 0.3% to $1.2568

-

The Japanese yen was little changed at 157.87 per dollar

Cryptocurrencies

-

Bitcoin fell 0.2% to $95,491.29

-

Ether rose 0.6% to $3,353.78

Bonds

-

The yield on 10-year Treasuries advanced one basis point to 4.59%

-

Germany’s 10-year yield advanced six basis points to 2.38%

-

Britain’s 10-year yield advanced four basis points to 4.62%

Commodities

-

West Texas Intermediate crude rose 1.2% to $70.47 a barrel

-

Spot gold fell 0.7% to $2,616.24 an ounce

This story was produced with the assistance of Bloomberg Automation.

–With assistance from Robert Brand, Julien Ponthus and Chiranjivi Chakraborty.

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.

EMEA Tribune is not involved in this news article, it is taken from our partners and or from the News Agencies. Copyright and Credit go to the News Agencies, email news@emeatribune.com Follow our WhatsApp verified Channel