(Bloomberg) — Michael Saylor’s unorthodox decision to hold Bitcoin instead of cash on MicroStrategy Inc.’s books has vaulted the once obscure software maker into the upper echelon of the wealthiest corporations when it comes to financial assets.

Most Read from Bloomberg

Listen to the Here’s Why podcast on Apple, Spotify or anywhere you listen.

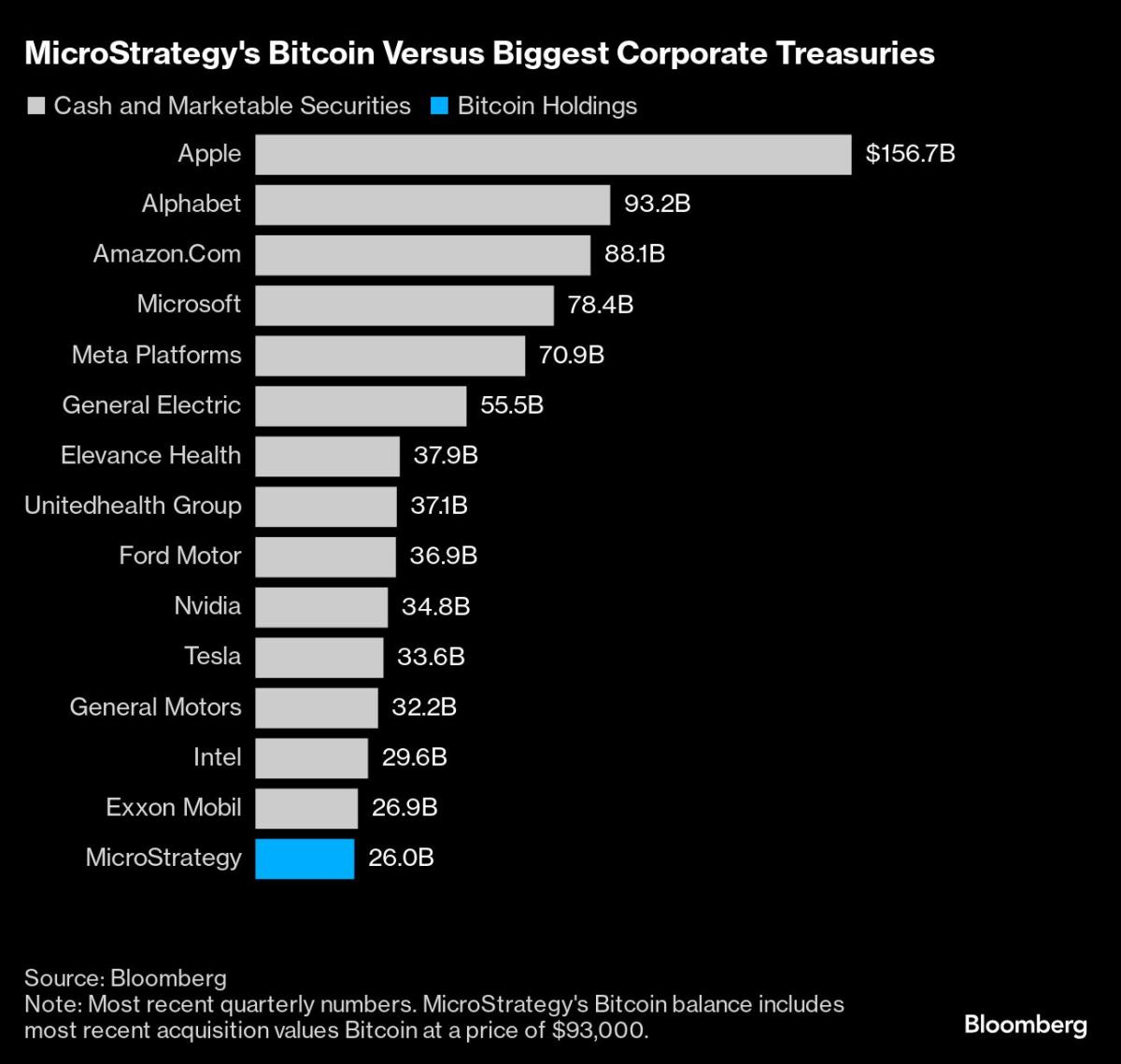

The Tysons Corner, Virginia-based firm’s approximately $26 billion Bitcoin cache is larger than the cash and marketable securities of global market leaders such as International Business Machines Corp., Nike Inc. and Johnson & Johnson, according to data compiled by Bloomberg. Only about a dozen companies, led by Apple Inc. and Alphabet Inc., hold more assets in their corporate treasuries.

Saylor, a co-founder and chairman, decided to invest in Bitcoin in 2020 as a hedge against inflation while MicroStrategy’s revenue growth stagnated. The firm initially used cash from operations to make the purchases, and has shifted to using the proceeds from the issuance and sale of stock, as well as convertible debt sales to leverage its buying power. It has become the largest publicly traded corporate holder of the digital currency.

While the strategy has drawn skepticism from traditional corporate governance observers, it has been embraced by investors as a leveraged way to participate in the Bitcoin rally without having to deal with digital wallets or crypto exchanges. The company’s shares have surged by over 2,500% as the value of Bitcoin has soared around 700% since the middle of 2020, making it the best-performing US major stock during the period. Bitcoin reached a record of almost $93,500 on Wednesday.

“Their balance sheet is primarily a function of the price of Bitcoin,” said Dave Zion, founder of Zion Research Group, a Chadds Ford, Pennsylvania-based firm that focuses on accounting and tax issues. “They’re not in control of the price of Bitcoin, so they’re just going to ride that wave, and it’s a wave that could go up or down.”

Most corporate treasurers use a company’s financial assets to support the business or generate returns, including to pay dividends or to fund share buybacks. Saylor has argued that shareholders benefit from the buy and hold strategy even though the company doesn’t pay a dividend.

MicroStrategy has devised its own performance indicator called Bitcoin yield, which measures the percent change of the ratio between its Bitcoin holdings and its assumed diluted shares outstanding from one period to the next. This yield year-to-date is 26.4%.

“Because we have the volatility, many of the things we do are actually selling the volatility, recycling the proceeds of the volatility back into Bitcoin, and then delivering that to our shareholders in the form of a BTC Yield,” Saylor said on an October conference call with analysts.

Saylor has doubled down on the strategy, saying the company aims to raise $42 billion over the next three years. The firm’s total Bitcoin holdings were acquired for an aggregate purchase price of approximately $11.9 billion — less than half the current value.

This accrual and holding strategy doesn’t have an endgame in sight, according to Mark Palmer, an analyst at Benchmark Co. who has a “buy” rating on the shares.

“Given the way that Bitcoin has moved in 2024 in particular, there’s really no reason why the company would divert from that approach,” he said.

TD Cowen analyst Lance Vitanza also sees the market as accepting of MicroStrategy’s approach as the company continues to be able to tap into sizable capital markets, he wrote in a note to clients on Monday.

“What started as a defensive strategy to protect the value of its reserve assets has become an opportunistic strategy intended to accelerate the creation of shareholder value,” said Vitanza, who also has a “buy” rating on the shares. “This reoccuring value creation deserves to be capitalized.”

–With assistance from Tom Contiliano.

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.

EMEA Tribune is not involved in this news article, it is taken from our partners and or from the News Agencies. Copyright and Credit go to the News Agencies, email news@emeatribune.com Follow our WhatsApp verified Channel