The performance of the “Magnificent Seven” has been a bit of a mix bagged this year, with some performing well and others, not so much. This group of high-profile tech companies includes Alphabet, Apple, Amazon, Microsoft, Meta Platforms (NASDAQ: META), Nvidia, and Tesla.

Facebook parent Meta Platforms has been one of the better performers in this clique — the stock is up by a solid 42% since the year started. However, the company is having a rough month — shares are down 6% in the last 30 days. How long will the company keep falling? It’s hard to say, but whatever happens in the short run, Meta Platforms is set to bounce back eventually and deliver excellent results in the long run.

Multiple growth paths

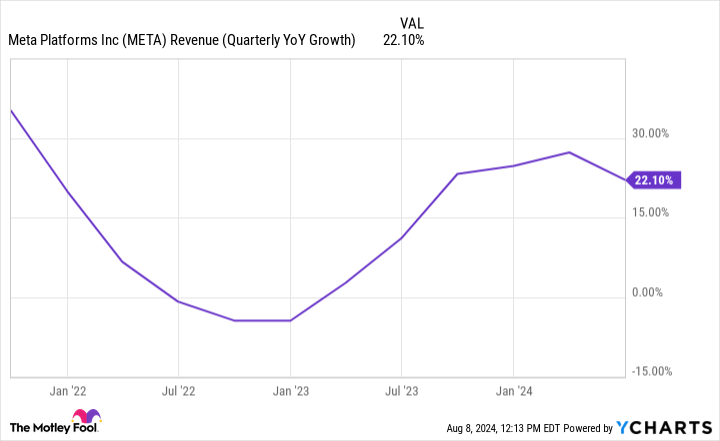

Meta Platforms’ market capitalization is just under $1.3 trillion as of this writing. The company has produced market-beating returns in the past decade. However, the social media specialist still has plenty of growth opportunities. Consider its core business, advertising, where it generates most of its sales. In the second quarter, Meta Platforms’ total revenue was $39.1 billion, up 22% year over year. The company’s advertising revenue was $38.3 billion.

It seems like so long ago that the online advertising market experienced a slump, leading to poor financial results and slow (or nonexistent) year-over-year top-line growth for Meta Platforms. The tech giant, though, has rebounded remarkably since then.

There will be more issues of this kind in the future. Consumers decrease spending and businesses reduce ad budgets when the economy isn’t doing well. However, in the long run, the online advertising market will maintain a solid upward trajectory, according to various projections by analysts.

Meta Platforms has made this business even more productive thanks to artificial intelligence (AI). Its AI-powered algorithm helps the company recommend Reels (short-form videos) that viewers enjoy watching on its platforms, Facebook and Instagram. The result has generally been that viewers spend more time watching Reels — greater engagement among viewers leads to a more attractive platform for advertisers.

Speaking of AI, it represents yet another potential opportunity for the company. Meta Platforms’ Llama, a large language model, is one of the best in the business and serves as the backbone behind its AI-powered assistant, Meta AI. According to the company, Meta AI is on track to becoming the most used AI assistant by year end.

While Meta AI is free, Meta Platforms will eventually find ways to monetize its AI-related efforts. The company is also exploiting other opportunities, from paid messaging on WhatsApp to its ambitious metaverse initiatives.

A wide moat

Meta Platforms isn’t the only company trying to profit from online advertising, AI, or the metaverse. Whatever other major source of revenue it goes after, chances are it will have plenty of competition. The tech giant should still be able to perform well, though, thanks to its competitive advantage.

Consider Meta Platforms’ brands — Facebook and Instagram — which are among the most famous and valuable worldwide, especially among social media companies. Both routinely feature on the list of the most visited websites worldwide.

Next, Meta Platforms benefits from the network effect — the value of its websites and apps increases with use. That’s true for advertisers and consumers. Advertisers see Facebook as a more attractive hub to run ad campaigns, as the platforms have more users. Private users who want to connect with friends and family members have the best shot at it on the most popular websites, and the more popular it becomes, the more attractive it is to that end.

Meta Platforms had 3.27 billion daily active users across its family of websites in June — that’s almost half the population of planet Earth that logs on to one of its apps every single day. This also grants Meta Platforms the opportunity to find ways to monetize its user base. Its initiatives might not always be successful. But it’s much easier for a company with a large existing customer base to sell its users new products than it would be to attract customers unfamiliar with the business.

Meta Platforms’ Threads, an alternative to Twitter that launched about a year ago, already has 200 million monthly active users. Meta Platforms’ vast ecosystem could also help its metaverse and AI ambitions become reality.

Another reason to buy the stock

Meta Platforms is, without a doubt, a terrific growth stock to buy and hold. Earlier this year, the company announced it would initiate a quarterly dividend. It’s too early to say whether Meta Platforms will become an excellent dividend stock, but it can certainly be an additional reason to buy the stock. Over the long run, reinvesting dividends can significantly boost returns. Meta Platforms should perform well, even with the slump it has experienced in the past month. The company’s new dividend sweetens the deal.

Should you invest $1,000 in Meta Platforms right now?

Before you buy stock in Meta Platforms, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Meta Platforms wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $668,029!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of August 12, 2024

Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. Randi Zuckerberg, a former director of market development and spokeswoman for Facebook and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Fool’s board of directors. John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Prosper Junior Bakiny has positions in Amazon and Meta Platforms. The Motley Fool has positions in and recommends Alphabet, Amazon, Apple, Meta Platforms, Microsoft, Nvidia, and Tesla. The Motley Fool recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.

Nasdaq Sell-Off: Buy the Dip on This “Magnificent Seven” Stock Before It Takes Off was originally published by The Motley Fool

EMEA Tribune is not involved in this news article, it is taken from our partners and or from the News Agencies. Copyright and Credit go to the News Agencies, email news@emeatribune.com Follow our WhatsApp verified Channel