(Bloomberg) — Nvidia Corp., the chipmaker at the center of an AI spending boom, delivered good-but-not-great quarterly numbers on Wednesday, drawing a muted response from investors accustomed to blowout results.

Most Read from Bloomberg

Sales will be about $43 billion in the fiscal first quarter, which runs through April, Nvidia said in a statement. Analysts had estimated $42.3 billion on average, with some projections ranging as high as $48 billion.

Listen to the Bloomberg Daybreak Europe podcast on Apple, Spotify or anywhere you listen.

The company also warned that gross profit margins would be tighter than anticipated as it rushes to roll out a new chip design called Blackwell. And there’s the risk of US tariffs weighing on results. After fluctuating between gains and losses, Nvidia shares were down less than 1% in late trading on Wednesday.

The mixed outlook comes at a shaky time for the AI industry. Nvidia shares have dipped this year on concerns that data center operators will slow spending. Chinese startup DeepSeek also has sparked fears that chatbots can be developed on the cheap, potentially reducing the need for Nvidia’s powerful chips for AI.

Though Nvidia executives addressed most of those issues, it’s become harder for the company to produce blockbuster earnings reports.

“Guidance was slightly underwhelming,” Edward Jones analyst Logan Purk said in a report. But early sales of the Blackwell chip should help ease investor concerns after earlier reports of production delays, he said.

The company got $11 billion of revenue from Blackwell in the fourth quarter, something Nvidia described as the “fastest product ramp” in its history. “Demand for Blackwell is amazing,” Chief Executive Officer Jensen Huang said in the statement.

Though the company’s fiscal fourth-quarter sales topped analysts’ estimates, they did so by the smallest margin since February 2023. Earnings, meanwhile, had the narrowest amount of upside since November 2022, according to data compiled by Bloomberg.

The stock had been down 2.2% this year, following stratospheric gains in 2023 and 2024 that turned Nvidia into the world’s most valuable chipmaker.

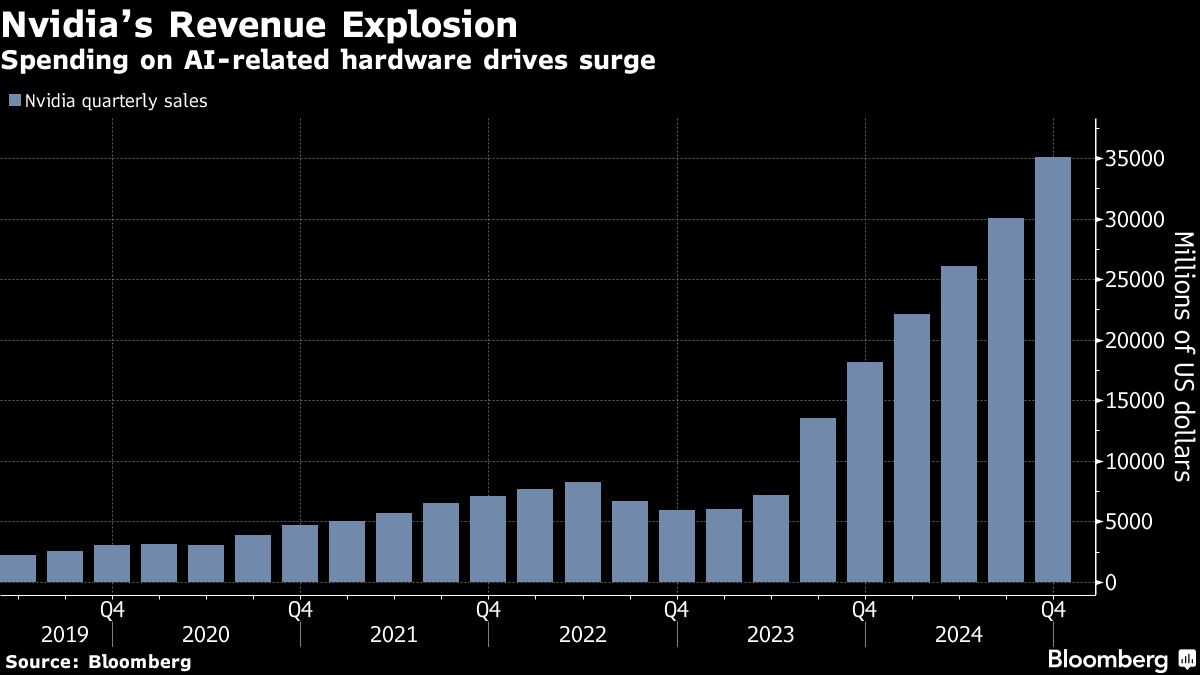

Nvidia has been the biggest beneficiary of a massive surge in AI spending, doubling the size of its revenue the past two years. Many of the largest technology companies are pouring tens of billions of dollars into data center hardware, and Nvidia is the dominant seller of processors that create and run AI software.

Along the way, Nvidia and its CEO have become synonymous with the AI revolution — and the biggest bellwether for how it’s progressing. Huang has spent much of the past two years crisscrossing the world as an evangelist for AI technology and believes it’s still in the early stages of spreading throughout the economy.

Sales in the fourth quarter, which ended Jan. 26, rose to $39.3 billion. That matched estimates, though some projections ranged as high as $42 billion. Underlining just how quickly the company has grown: Its latest quarterly sales were bigger than Nvidia’s annual revenue two years ago, when it totaled $27 billion.

Profit was 89 cents a share, minus certain items. Wall Street was looking for 84 cents.

“We will grow strongly in 2025,” Huang said during a conference call with analysts.

The data center unit, by far Nvidia’s biggest source of revenue, generated sales of $35.6 billion. That beat the average estimate of $34.1 billion. Gaming-related sales — once Nvidia’s core business — amounted to $2.5 billion. Analysts projected $3.02 billion on average. Automotive was $570 million.

The data center division alone now has more revenue than rivals Intel Corp. and Advanced Micro Devices Inc. generate in total, combined.

Nvidia made its name by selling graphics processors, but discovered that the technology also has applications for AI. Its chips help software models during the training process, when they learn to recognize and respond to real-world inputs. Nvidia’s components are also used in systems that then run the software, a stage known as inference, and help power services such as ChatGPT.

Heading into the earnings report, analysts had expressed concern about near-term growth in Nvidia’s biggest business, which serves data center customers. The big question was whether supply constraints and a shift to Blackwell would slow growth. The new technology is more sophisticated, bringing manufacturing challenges.

DeepSeek added to the worries after releasing a powerful AI model that it said required far fewer resources to create. The announcement in late January led to a widespread selloff in AI-related shares. Nvidia shed a staggering $589 billion of capital in one day of trading, a record for the markets.

But key Nvidia customers, such as Microsoft Corp., have maintained their capital expenditure plans, suggesting that the AI spending surge will remain strong.

During the conference call, Huang argued that DeepSeek will stoke interest in a new approach to AI, expanding demand for Nvidia products. The DeepSeek model relies on fine-tuning, so it will require more computing sessions than the “one shot” training of other software, he said. In fact, the approach might require millions of times more computing power than today, he said.

“Future reasoning models can consume much more compute,” Huang said, calling DeepSeek’s model “an excellent innovation.”

Though Blackwell will help handle those computing tasks, the rollout has come at a cost. The expense of getting the product to market has weighed on profit margins, Nvidia said. The savings will come later when the company is able to refine its supply chain, according to Chief Financial Officer Colette Kress. Gross margin, or the percent of revenue remaining after deducting the cost of production, will return to a “mid-70s” percentage by the end of the year.

In the current quarter, that measure will be about 71%, Nvidia said, about a point below the average of analysts’ estimates.

Nvidia has only missed analysts’ estimates on quarterly revenue once in the past five years. And it has exceeded expectations by more than 10% in recent periods, creating a high bar for its performance.

“We think it will be challenging for management to continue to significantly beat expectations for future growth,” Edwards Jones’ Purk said.

Most Read from Bloomberg Businessweek

©2025 Bloomberg L.P.

EMEA Tribune is not involved in this news article, it is taken from our partners and or from the News Agencies. Copyright and Credit go to the News Agencies, email news@emeatribune.com Follow our WhatsApp verified Channel