Pfizer (PFE) stock has been struggling, but looking among the market’s laggards can yield attractive opportunities. The stock is super cheap, sports a stellar 5.7% dividend yield and has an interesting potential catalyst on deck in the form of a new weight loss drug candidate that it is moving forward on developing. Plus, sell-side analysts believe the stock has potential upside of 17.1% over the next year.

Significantly Cheaper Than the Overall Market

So, how cheap is Pfizer? The stock trades at just 12 times consensus 2024 earnings estimates, slightly less than half the valuation of the broader market, as the S&P 500 trades at 24.2 times earnings.

Pfizer’s stock is down primarily because of the decline in revenue from its COVID business as the pandemic fades into the background, but there are other reasons for optimism, as we’ll discuss later.

Big-Time Dividend

In addition to this attractive valuation, Pfizer also sports a significant dividend yield of 5.7%, which is much higher than you typically see from an established blue-chip stock that isn’t a REIT, financial, energy, or tobacco stock. In fact, Pfizer’s 5.7% yield makes it one of the top-yielding stocks in the S&P 500 right now.

Not only does Pfizer have a high yield, but it has a long and proud history as a dividend stalwart. The company has paid dividends to its shareholders for 34 consecutive years, and it has grown its dividend payout for the past 13 years in a row.

Targeting the Lucrative Weight Loss Drug Market

Cheap stocks with attractive dividend yields can make good investments, but they often need some type of catalyst to send shares meaningfully higher.

Fortunately, Pfizer has one of these up its sleeve. In June, Pfizer’s CEO announced that the company was working on three new weight loss drugs. Now, the company says it is moving forward with the development of a once-daily oral weight-loss drug called danuglipron based on strong pharmacokinetic data. Pfizer will conduct studies to evaluate multiple doses of the drug in the latter half of this year.

It’s important to note that we are still a long way off from this drug being approved and commercialized, but this is still exciting news.

Eli Lilly (LLY) and Novo Nordisk (NVO) have seen their shares skyrocket over the past year-plus, thanks to the success of their respective weight loss drugs, Zepbound and Ozempic, and leaving stocks like Pfizer in the dust in the process. Shares of Eli Lilly and Novo Nordisk are up 107.4% and 80.6%, respectively, over the past year, while Pfizer has slumped to a 20.5% loss.

Furthermore, Eli Lilly and Novo Nordisk trade at 68.3 and 41.4 times 2024 earnings estimates, respectively, while Pfizer trades at just 12 times 2024 estimates, as mentioned above. This isn’t to say that Pfizer should necessarily trade at the same levels as these companies, but if its weight loss drug shows signs of success, there is clearly some room for the stock to rerate.

While there’s no guarantee that Pfizer would be able to unseat the more established offerings from these market leaders, if it can successfully bring its drug to market, there’s a good chance it could appeal to patients who prefer the idea of a once-a-day pill to an injection (which is how Zepbound and Ozempic are administered).

Plus, these weight loss drugs, known as GLP-1 agonists, present a large market opportunity, with some analysts expecting the market to grow to over $100 billion annually by 2030, meaning there could be plenty of room for multiple winners.

There is certainly no guarantee that Pfizer will be successful in this endeavor, but its cheap valuation and nearly 6% dividend yield give investors something to fall back on and some significant downside protection if this catalyst doesn’t materialize. It’s also worth noting that in addition to danuglipron, Pfizer has other experimental weight loss drugs in its pipeline, which could one day become commercially successful. However, it’s too early to say whether this will happen.

Is PFE Stock a Buy, According to Analysts?

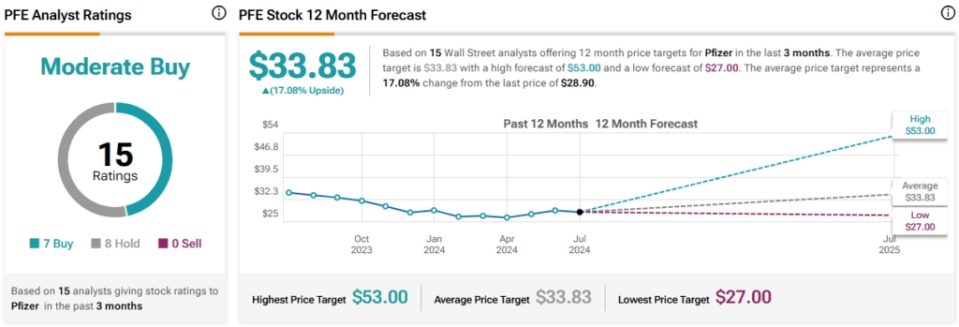

Turning to Wall Street, PFE earns a Moderate Buy consensus rating based on seven Buys, eight Holds, and zero Sell ratings assigned in the past three months. The average PFE stock price target of $33.83 implies 17.1% upside potential from current levels.

Investor Takeaway

Pfizer has been a major laggard over the past year, but I’m bullish on the stock because this decline has created the opportunity to buy shares at a substantial discount to the broader market. Plus, the stock offers a 5.7% yield.

Additionally, while it is still in the early innings and success is far from guaranteed, Pfizer’s progress with its once-daily weight loss drug candidate gives the company an intriguing catalyst that could reignite interest in the stock and drive shares higher.

We’ve seen what weight loss drugs have done for the shares of Pfizer’s fellow pharma giants like Eli Lilly and Novo Nordisk, so even a bit of success in this area could be a boon for shares of Pfizer at these levels.

EMEA Tribune is not involved in this news article, it is taken from our partners and or from the News Agencies. Copyright and Credit go to the News Agencies, email news@emeatribune.com Follow our WhatsApp verified Channel