On July 19, The Wall Street Journal reported that activist investment firm Elliott Investment Management had purchased a sizeable (but unspecified) stake in coffee giant Starbucks (NASDAQ: SBUX). Over the last five years, Starbucks stock is down almost 16%. This lackluster performance is something that Elliott hopes to help correct.

Investors may wonder what to expect from Elliott next. While there’s no way to be certain what its involvement will look like, investors can look to what it has done in the past with other companies it took stakes in. And one recent success story is image-centric social media platform Pinterest (NYSE: PINS).

In July 2022, Elliott took a 9% stake in Pinterest. At the time, its stock was worth less than $20 per share. Today, it trades at more than $40 per share.

Elliott has been a player in Pinterest’s story, and it shows what investors might expect from its reported investment in Starbucks.

How activist investing can help

There’s a classic business story about Intel and its late CEO, Andy Grove. The company was at the time a leader in memory products, but microprocessors were a budding global opportunity. Grove reportedly asked his management team, “If we got kicked out and the board brought in a new CEO, what do you think he would do?” Grove ultimately repositioned Intel in the microprocessor space because the team concluded that’s what a new CEO would do.

This anecdote highlights how an outside perspective can bring clarity. And activist investors such as Elliott can bring such perspectives to the table.

Typically, these activists publicly propose the changes they’d like to see shortly after they make their investments. And Elliott did publicly comment on Pinterest early on. But the firm appeared content with the company’s direction under then-new CEO Bill Ready. Later that year, Elliott got seats on Pinterest’s board, but again appeared to agree with management’s new vision on how to create shareholder value.

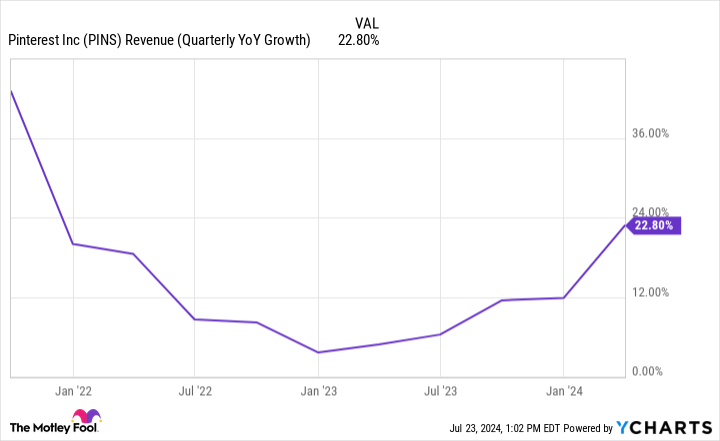

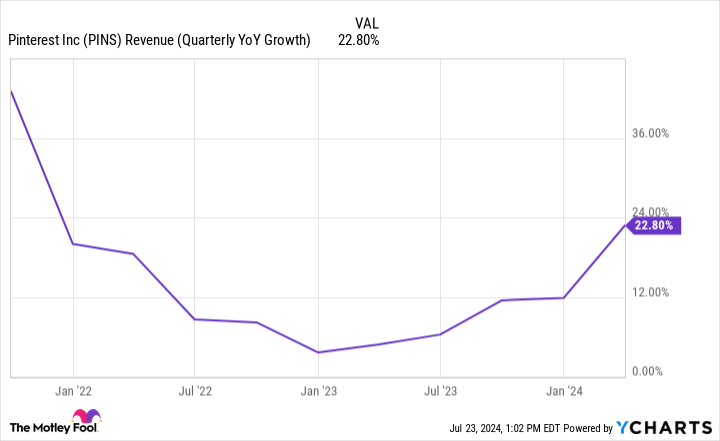

One of the biggest changes that Pinterest made in the last two years was to open up its platform to third-party ads, such as with its partnership with Amazon. This move helped it start to reaccelerate its revenue growth rate in the early part of 2023, which is a big reason the stock has more than doubled.

How this relates to Starbucks

In the session after Starbucks reported its fiscal 2024 second-quarter results on April 30, the stock slumped by nearly 20%. Those results showed slumping sales trends and a step back in profitability. Management blamed value-conscious consumers, but that explanation rang hollow considering that smaller competitor Dutch Bros wasn’t having the same problems.

Starbucks needs to course correct, and an outside perspective might just be what the doctor ordered. This is why Elliott’s position could be material news for investors.

For what it’s worth, former CEO Howard Schultz has already weighed in on the situation, publicly encouraging management to focus on the Starbucks experience. Schultz believes that elevating the experience for both workers and customers will start “reinforcing the company’s premium position,” as opposed to highlighting its value proposition.

Schultz is a good combination of an insider and an outsider. He’s very familiar with the business from his years running it. But he’s also retired, so his view isn’t clouded by daily operations at the moment, which gives him some outsider-like clarity. He seems to disagree with the approach being taken by current management. It’s likely that Elliott also believes a different approach is needed.

Elliott is reportedly communicating with Starbucks’ management behind the scenes. If the two parties can agree on what the best course of action is, things could go smoothly — as they did with Pinterest. But attempted interventions by activist firms don’t always play out that way.

Sometimes companies push back against the input of those outsiders — sometimes to their own detriment. To be clear, the general public still doesn’t know what suggestions Elliott would make or if those would even be any good. But it’s clear some changes need to be made at Starbucks, and this effort could force the issue.

Elliott agreed with Pinterest’s management regarding the changes it made with advertising. And so far, that’s been a good move for that business. Hopefully, his perspective on what would be best for Starbucks will prove similarly accurate. And hopefully, the company will be open to his input.

Should you invest $1,000 in Starbucks right now?

Before you buy stock in Starbucks, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Starbucks wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $692,784!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of July 22, 2024

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Jon Quast has positions in Pinterest and Starbucks. The Motley Fool has positions in and recommends Amazon, Pinterest, and Starbucks. The Motley Fool recommends Intel and recommends the following options: long January 2025 $45 calls on Intel and short August 2024 $35 calls on Intel. The Motley Fool has a disclosure policy.

Pinterest Stock Is Up Over 100% Since an Activist Firm Took a Large Stake. That Same Activist Reportedly Now Has a Large Stake in Starbucks. was originally published by The Motley Fool

EMEA Tribune is not involved in this news article, it is taken from our partners and or from the News Agencies. Copyright and Credit go to the News Agencies, email news@emeatribune.com Follow our WhatsApp verified Channel