Alphabet is one of the world’s largest companies. With a market cap of $2 trillion, there are only a handful of stocks that can compete with its size.

However, there are companies that could grow even larger than Alphabet within the next five years. Here, I’ll cover two that could pull off that feat: Meta Platforms (NASDAQ: META) and Amazon (NASDAQ: AMZN).

1. Meta Platforms

As of this writing, Meta Platforms’ market cap stands at about $1.5 trillion. That trails Alphabet by a little more than $500 billion.

Yet while Meta is only 75% the size of Alphabet, I think it could overtake its rival in the very near future. Here’s why.

First, Meta is enormous. The company can claim nearly 3.3 billion daily active users (DAUs) across its platforms, which include Facebook and Instagram. That means more than a third of the global population uses Meta’s platform regularly.

Accordingly, given the size of its user base, the company reaps an enormous windfall in terms of ad revenue. In its most recently reported quarter, Meta tallied $38.3 billion in ad revenue. That works out to about $425 million per day.

True, Alphabet makes even more in ad revenue right now, but it’s facing some challenges in its key category of internet search. That’s to say nothing of the recent federal antitrust ruling that labeled the company a monopoly.

In short, Meta’s bread and butter is ad revenue, and it’s an area that is not only highly lucrative — Meta’s operating margin is a stout 38% — it’s growing like a weed. The company’s overall revenue grew by 22% in its most recent quarter, despite its size.

In other words, Meta has plenty of gas in the tank to catch Alphabet by 2029 — if not sooner.

2. Amazon

If Meta still has a sizable gap to overtake Alphabet, Amazon has only a tiny crack. As of this writing, Amazon’s market cap of $1.9 trillion trails Alphabet’s market cap by about $100 billion, or roughly 5%.

Indeed, during the past 10 years, these two companies have traded places several times, with Alphabet holding a steady lead from 2014-2018. Amazon edged ahead from 2018-2022, only to see Alphabet retake the lead in recent years.

However, I think Amazon will not only retake the lead, but move significantly ahead of Alphabet during the next five years. The main reason why is that Amazon is starting to hit its stride under Chief Executive Officer Andy Jassy, who took over from Jeff Bezos in 2021.

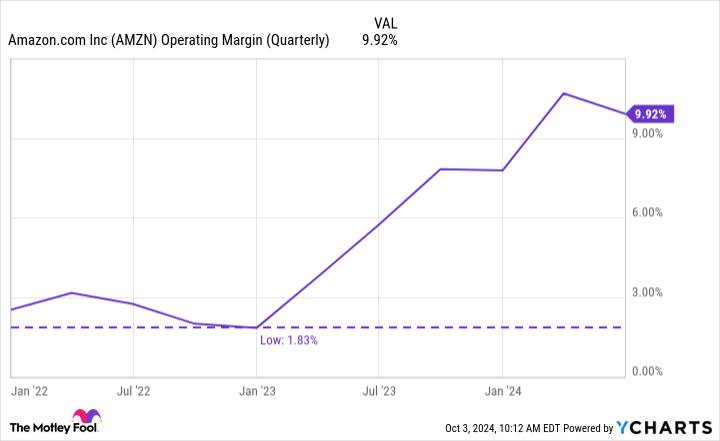

Three years into the job, Jassy is putting his own mark on Amazon, starting with the company’s increased efficiency. As of its most recently reported quarter, Amazon’s operating margin climbed to almost 10%. That’s up significantly from its recent low of 1.8%, hit about one year after Jassy took over from Bezos.

Two companies to watch

Both Amazon and Meta Platforms are gaining ground on Alphabet’s giant market cap. While I believe all three stocks remain solid long-term buy-and-hold candidates, investors may want to focus on Amazon and Meta, as those companies appear better positioned than Alphabet over the next few years.

Should you invest $1,000 in Meta Platforms right now?

Before you buy stock in Meta Platforms, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Meta Platforms wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $765,523!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 30, 2024

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Randi Zuckerberg, a former director of market development and spokeswoman for Facebook and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Fool’s board of directors. Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. Jake Lerch has positions in Alphabet and Amazon. The Motley Fool has positions in and recommends Alphabet, Amazon, and Meta Platforms. The Motley Fool has a disclosure policy.

Prediction: 2 Stocks That Will Be Worth More Than Alphabet 5 Years From Now was originally published by The Motley Fool

EMEA Tribune is not involved in this news article, it is taken from our partners and or from the News Agencies. Copyright and Credit go to the News Agencies, email news@emeatribune.com Follow our WhatsApp verified Channel