Rivian Automotive (NASDAQ: RIVN) recently released its second-quarter earnings update, and there were no real surprises. But it’s likely we are in the calm before the storm for Rivian, and investors should start paying attention.

That’s because the electric vehicle (EV) start-up is getting ready to begin production next year on the R2 SUV, its first new model. The smaller and less expensive R3 will follow. If these new EVs launch successfully, they should be major catalysts for Rivian’s stock. Investors who believe in the Rivian brand, and see the success it has had with its R1 models translating into an expanding customer base, should look at the stock before these catalysts affect the share price.

Rivian found its niche market

Rivian differentiated itself from EV industry leader Tesla from the start. It launched just a pickup truck and a large SUV model as its initial EV consumer offerings. That immersed it in a growing market that didn’t compete with Tesla’s popular Models 3 and Y.

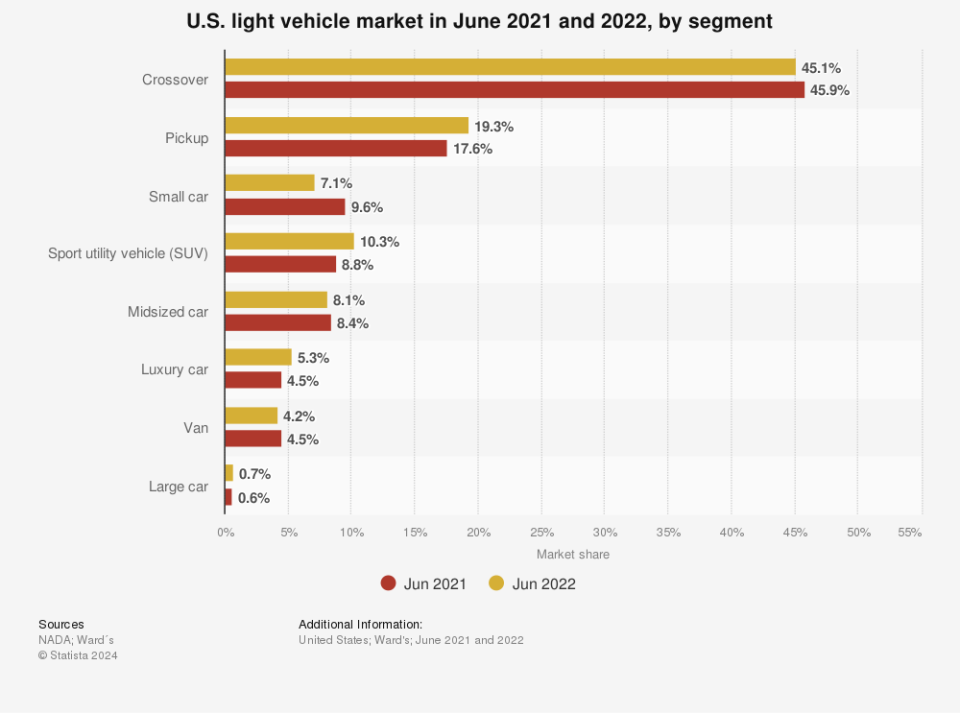

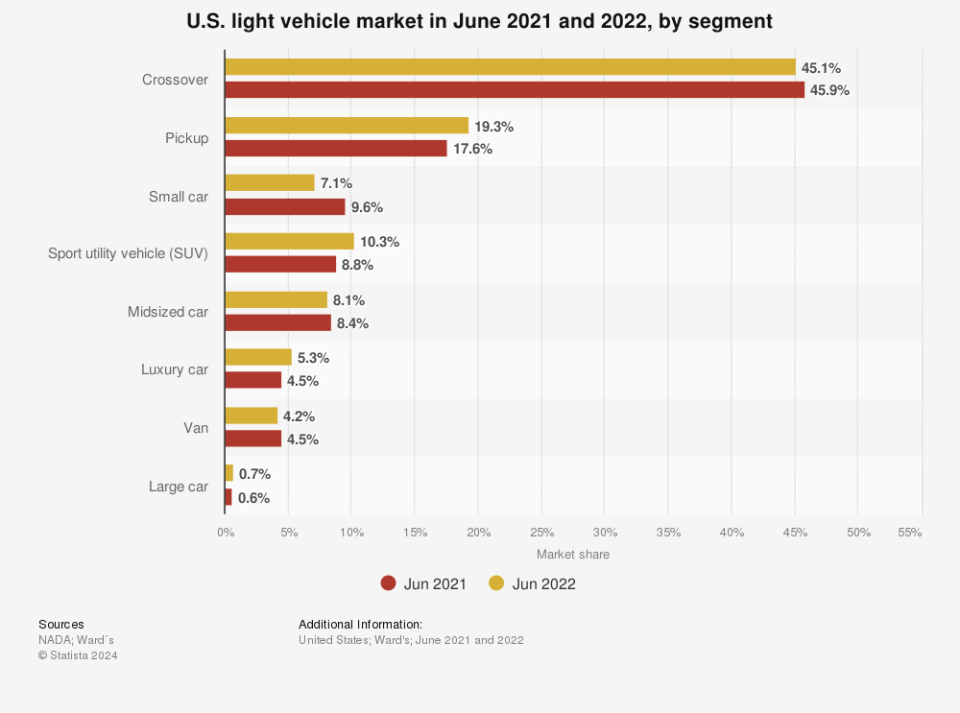

This business plan allowed it to gain share in vehicle markets that haven’t yet been penetrated by other fully electric offerings. At the same time, as shown below, pickup trucks and SUVs have been some of the top-selling light vehicle designs in the U.S. in recent years. And Rivian now has plans to jump into an even bigger consumer market.

Its next-generation R2 SUV will begin production next year, with deliveries scheduled to start in early 2026. That smaller, more affordable model should add to Rivian’s addressable market. It plans to enter the leading crossover segment with its R3 after that.

Those additional models will undoubtedly be catalysts that drive Rivian shares in the coming months. A solid order book for the R2 will likely generate bullish views of the stock. Successful launches and reviews will only bolster those opinions. But positive outcomes aren’t the only possibility. Any perceived lag in demand, or of the vehicles themselves, could drive the stock lower. One way or another, investors should be prepared for volatility in the EV maker’s stock in the near future.

Will Rivian’s next EV be a success?

Rivian CEO R.J. Scaringe is already touting the R2’s features and differentiating it from Tesla’s Model Y. He says the R3 will have even more unique features. The R2, which will start at a price of about $45,000, will be “worlds different” than the Model Y, according to Scaringe.

He wants to highlight Rivian’s support of outdoor adventure uses for its vehicles as a key and unique reason to want to own an R2 SUV. Scaringe recently stated: “You can actually take it off-road, you can take it through a river bed, you can do the things you expect from an SUV.”

For its part, the R3 is being promoted as providing the driving excitement of a rally car with an unusually high ground clearance for the crossover vehicle segment.

Investors need to have a plan

If successfully launched, the market should react positively to Rivian’s expanded product offering. Investors who believe in the company and its brand might want to get ahead of these catalysts.

But investors need to acknowledge the high risk and speculation involved, too. One way to hedge that risk is simply to invest an appropriate amount in a growth stock like Rivian. If it’s highly successful, a small allocation is all one needs. If it fails, that small investment is all one would want.

Should you invest $1,000 in Rivian Automotive right now?

Before you buy stock in Rivian Automotive, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Rivian Automotive wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $763,374!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of August 12, 2024

Howard Smith has positions in Rivian Automotive and Tesla. The Motley Fool has positions in and recommends Tesla. The Motley Fool has a disclosure policy.

Prediction: Rivian Stock Will Move on Emerging Catalysts was originally published by The Motley Fool

EMEA Tribune is not involved in this news article, it is taken from our partners and or from the News Agencies. Copyright and Credit go to the News Agencies, email news@emeatribune.com Follow our WhatsApp verified Channel