Most older adults will rely on Social Security to some degree in retirement. A whopping 88% of current retirees depend on their benefits, according to a 2024 poll from Gallup, with 60% of that group saying Social Security is a major income source.

Some retirees even rely on their benefits as their only source of income. Even if you have a robust nest egg, if you end up living a long lifespan, there’s a chance your savings will run out eventually.

The more you can do to maximize your benefits now, the better shape you’ll be in down the road. No matter what your financial situation looks like, there’s one simple strategy that could help the average retiree increase their benefits by more than $700 per month.

The age at which you file could make or break your retirement

Determining what age to begin taking Social Security is one of the most important retirement decisions you’ll ever make.

Your claiming age will directly affect how much you receive each month, and in general, your benefit amount is locked in once you file — save for annual cost-of-living adjustments. In other words, this choice will have a lifelong impact on your finances.

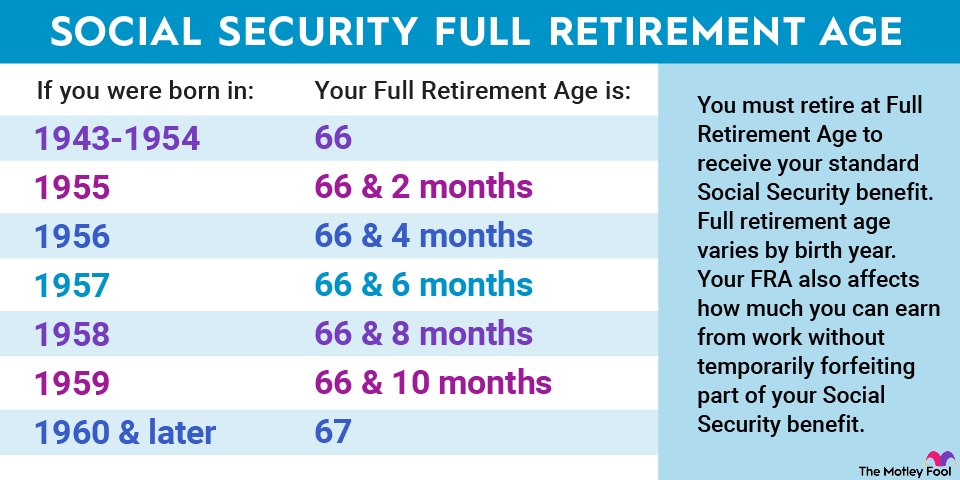

You can begin taking retirement benefits as early as age 62. By waiting until your full retirement age — which is age 67 for everyone born in 1960 or later — you’ll receive 100% of your benefit based on your work history. If you hold off even longer until age 70, you’ll collect your full benefit plus a bonus amount each month.

These adjustments are generally permanent, and they can be significant, too. Claim at age 62, and your benefits will be reduced by up to 30% per month. Wait until age 70, and you’ll collect a bonus of at least 24% per month on top of your full payments.

For the average worker, that adds up to hundreds of dollars per month. According to 2023 data from the Social Security Administration, the average retired worker collects around $1,298 per month in benefits at age 62. At age 70, though, the average benefit is around $2,038 per month — a difference of $740 per month.

Delaying benefits isn’t always the best move

Waiting until age 70 can be a fantastic move if your savings are falling short or you simply want to maximize your retirement income. However, it won’t be the right strategy for everyone, and there are good reasons to consider claiming early, too.

For one, claiming earlier can be smart if you have reason to believe you may not live well into your 70s or beyond. While it’s not the most pleasant topic to think about, if you’re battling health issues, claiming early could give you more time to enjoy your benefits than if you were to delay.

Filing early can also be a strategic decision if your spouse is also entitled to retirement benefits. One of you may choose to claim early to provide some extra income early in retirement, while the other delays to earn larger checks. This approach can help you retire sooner without having to sacrifice as much income.

Deciding when to take Social Security is a highly personal decision that depends on several factors, but if your primary goal is to maximize your income, delaying benefits is one of the best moves you can make. Waiting a few years to file boosts the average retiree’s income by hundreds of dollars per month, which can set you up for a far more comfortable retirement.

The $22,924 Social Security bonus most retirees completely overlook

If you’re like most Americans, you’re a few years (or more) behind on your retirement savings. But a handful of little-known “Social Security secrets” could help ensure a boost in your retirement income. For example: one easy trick could pay you as much as $22,924 more… each year! Once you learn how to maximize your Social Security benefits, we think you could retire confidently with the peace of mind we’re all after. Simply click here to discover how to learn more about these strategies.

View the “Social Security secrets” ›

The Motley Fool has a disclosure policy.

Social Security: The Average Retiree Could Collect $740 More per Month With This Simple Move was originally published by The Motley Fool

EMEA Tribune is not involved in this news article, it is taken from our partners and or from the News Agencies. Copyright and Credit go to the News Agencies, email news@emeatribune.com Follow our WhatsApp verified Channel