(Bloomberg) — Worries that US politicians are taking a harder stance on China and Taiwan sparked a pullback across technology shares, driving S&P 500 futures down 1%.

Most Read from Bloomberg

Nvidia Corp., Advanced Micro Devices Inc., Broadcom Inc. lost more than 3% in pre-market trading. ASML Holding NV tumbled 7.5%, the most since 2022, even after the Dutch company reported strong orders in the second quarter. The dollar weakened and 10-year Treasury yields rose.

The Biden administration is considering using the most severe trade restrictions available if companies including ASML continue to give China access to advanced semiconductor technology, Bloomberg News reported on Wednesday. Meanwhile, an anti-China stance is also at the top of the agenda for Republican nominee Donald Trump. In an interview with Bloomberg Businessweek, the former president questioned whether the US has a duty to defend Taiwan, a major chipmaking hub.

“Regardless of whether it’s a Democrat or Republican victory, there will always be a negative push toward China,” John Taylor, director of global multisector strategies at AllianceBernstein, said in an interview with Bloomberg TV. “One is more brazen and the other is more behind the scenes but the outcome is essentially the same.”

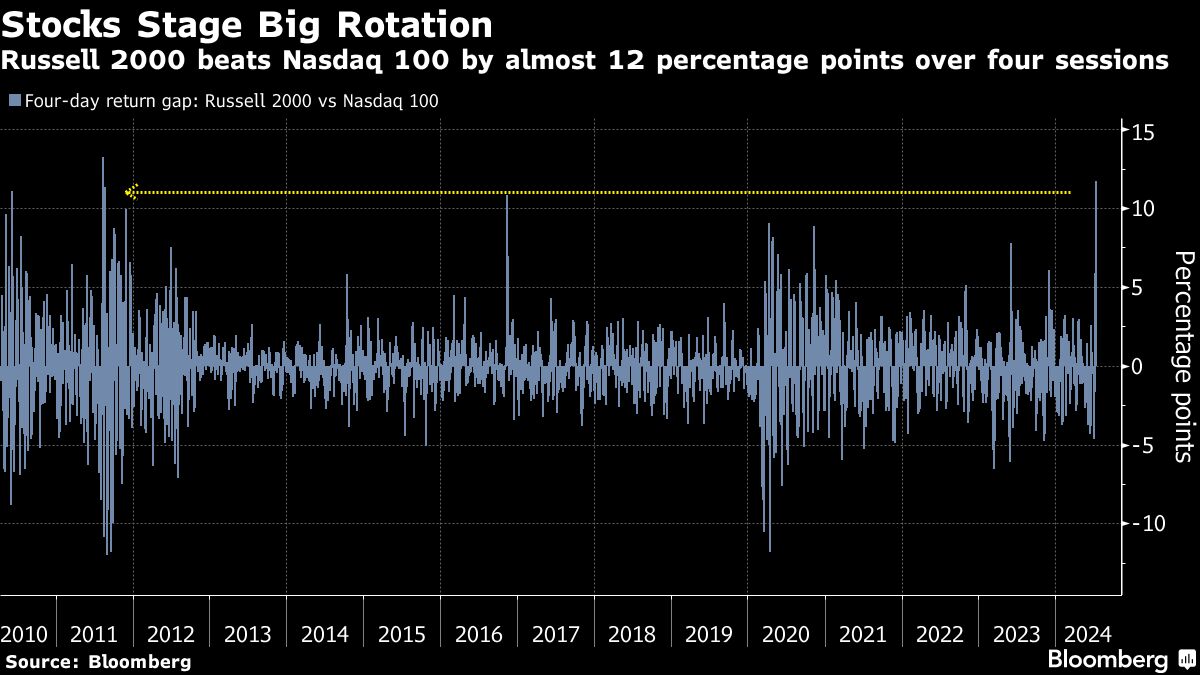

The move in stocks represents a small pullback after a stellar run of gains, fueled by soft inflation data and optimism that the Federal Reserve will cut interest rates. The S&P 500 closed at another all-time high on Tuesday, and in only five days, the Russell 2000 jumped almost 12% — hitting the most-overbought level since 2017.

“We had gotten a little too frothy,” said Tim Graf, head of EMEA macro strategy at State Street Global Markets. “Investors are underweight smalls, hugely overweight large caps and rotating a bit.”

In currencies, the pound topped $1.30 as traders pared bets on an interest-rate cut in August after stickier-than-expected inflation data. The yen rallied 1% against the dollar, reducing the need for Japanese authorities to step into the market again.

In the interview, Trump also said the strength of the dollar has been hurting the competitiveness of US exports and pointing to the weakness of yen and yuan. That’s raised some speculation among strategists that he might adopt policies to reduce the value of the greenback if he takes office.

“The one thing that China and Japan and other Asian currencies are worried about is getting a tariff target on their back,” Mark McCormick, global head of currency and emerging market strategy at TD Bank, said in an interview with Bloomberg TV. “These currencies should be stronger.”

Investors also sifted through earnings reports. Adidas AG gained 5% after raising its annual profit target for the second time in three months. Roche Holding AG jumped on promising early-stage study results for a weight-loss pill.

Key events this week:

-

Eurozone CPI, Wednesday

-

US housing starts, industrial production, Wednesday

-

Fed Beige Book, Wednesday

-

Fed’s Thomas Barkin speaks, Wednesday

-

ECB rate decision, Thursday

-

US initial jobless claims, Philadelphia Fed manufacturing, Conference Board LEI, Thursday

-

Fed’s Mary Daly, Lorie Logan and Michelle Bowman speak, Thursday

-

Fed’s John Williams, Raphael Bostic speak, Friday

Some of the main moves in markets:

Stocks

-

S&P 500 futures fell 1% as of 7:27 a.m. New York time

-

Nasdaq 100 futures fell 1.5%

-

Futures on the Dow Jones Industrial Average fell 0.3%

-

The Stoxx Europe 600 fell 0.8%

-

The MSCI World Index was little changed

Currencies

-

The Bloomberg Dollar Spot Index fell 0.3%

-

The euro rose 0.4% to $1.0941

-

The British pound rose 0.5% to $1.3040

-

The Japanese yen rose 1.1% to 156.59 per dollar

Cryptocurrencies

-

Bitcoin rose 0.5% to $65,023.44

-

Ether rose 0.8% to $3,466.42

Bonds

-

The yield on 10-year Treasuries advanced one basis point to 4.17%

-

Germany’s 10-year yield was little changed at 2.43%

-

Britain’s 10-year yield advanced three basis points to 4.08%

Commodities

This story was produced with the assistance of Bloomberg Automation.

–With assistance from Richard Henderson, Winnie Hsu and Naomi Tajitsu.

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.

EMEA Tribune is not involved in this news article, it is taken from our partners and or from the News Agencies. Copyright and Credit go to the News Agencies, email news@emeatribune.com Follow our WhatsApp verified Channel